Back on September 21, we looked at the price of gold and gold mining stocks, and I told you that it might have bottomed.

On September 21 I wrote:

Last week and so far this week, the price of gold has also traded above the 9-12 month cycle moving average. These are both signs that those cycles have bottomed, and are poised to turn up. Gold must now close above the high of the range of the past 4 weeks of 1215 to confirm a tradable upturn in those two cycles. If it does, it could be off to the races.

I suggested a couple of low risk plays to participate in a rally. Both gold itself, and the mining stocks have since had a nice move.

Here’s a brief look at the outlook, and a review of my suggested strategy…

These Gold Fluctuations Are “Normal,” But a Breakout May Be in Store

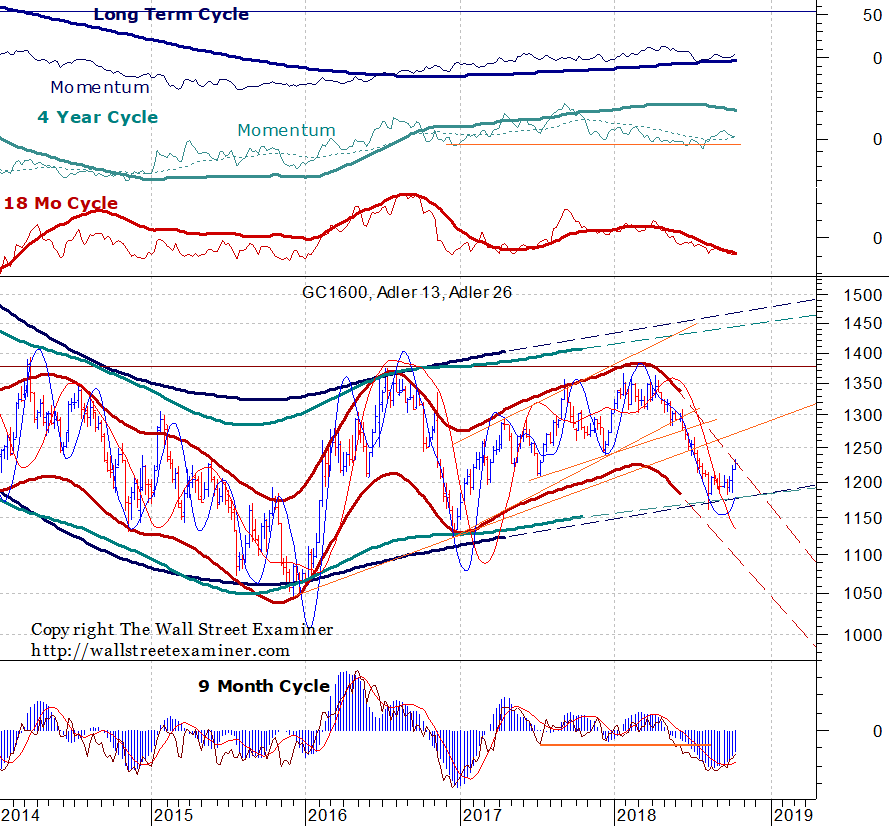

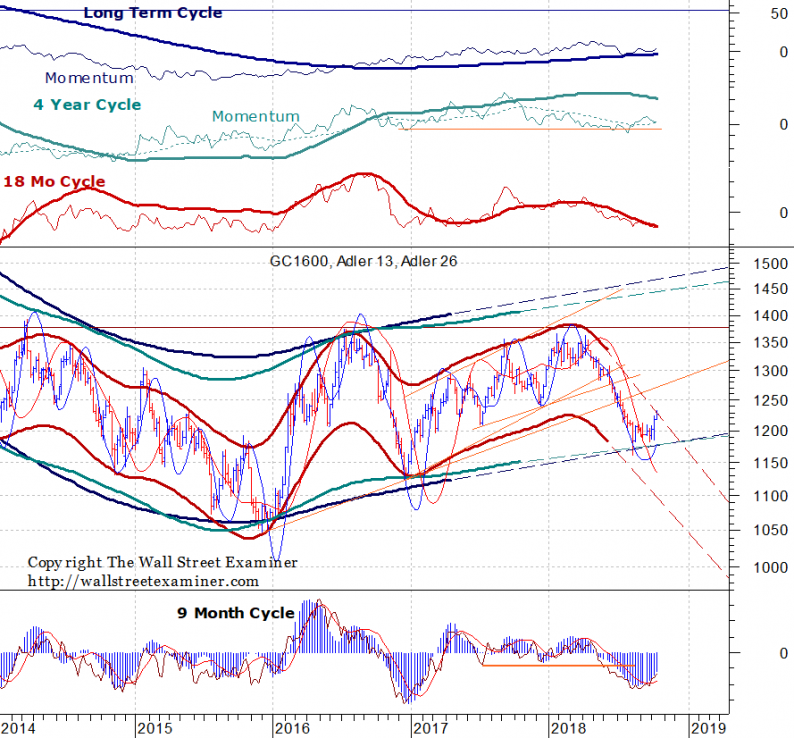

First, let’s look at the weekly chart:

So far, the market has lived up to our expectations.

Last week, gold closed above 1215 and it has slightly extended that breakout on Monday. That’s a signal that we’re in a tradable rally, although I’d like to see it close above 1215 again this week.

A weekly close below that level would be a false breakout. They’re always problematic. We would need to turn a skeptical, risk-averse eye on this rally if that happened.

But if it doesn’t, the upside potential looks really promising.

The red channel and the dotted lines projected from the upper and lower bands represent a nominal 18-month cycle. JM Hurst, the father of cyclical analysis, called cycles “nominal” because they normally vary in duration. For a cycle of this length, several months of the variance in length is quite normal.

Back at the spike low in August, the cycle was 21 months from its previous low. It was overdue for a bottom. Now the price is challenging the upper wave band projection of that cycle. The price needs to end this week above 1240 for a clear breakout. Anything less would be borderline.

Leave A Comment