For two months now, the world has been eyeing the BoJ closely for signs they might be set to follow the Fed and the ECB down the road to policy normalization.

To be sure, Japan is a long way from their inflation target, but as Albert Edwards wrote in January, the deflationary mindset seems to be breaking. Vanquishing the deflationary mindset has the potential to become a self-fulfilling prophecy by pulling forward consumer spending. Maybe Kuroda’s “think happy thoughts” approach wasn’t so stupid after all.

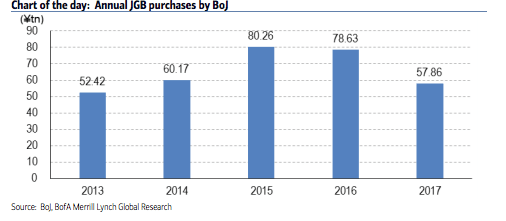

Speculation about a BoJ exit has been fueled lately by the bank’s decision to cut 10-25Y JGB purchases back in early January. That triggered a violent FX reaction. As BofAML reminded everyone later in the month, the BoJ has reduced its JGB purchases under YCC. “Purchases of long-term JGBs were ¥80tn in 2015 and ¥79tn in 2016, but declined to only ¥58tn in 2017,” the bank wrote, in a piece dated January 19. This trend is likely to continue.

Still, the FX move showed just how sensitive the market is to any sign from Kuroda that the BoJ is set to take even the first steps down the road to rolling back accommodation and some media reports have suggested the bank is indeed feeling better about its ever-elusive inflation target. Recall this from a WSJ piece out in January:

The Bank of Japan is optimistic about hitting its 2% inflation target within two years and is considering how best to communicate any possible policy changes, say people familiar with its thinking.

As the central bank prepares for its first policy meeting of 2018 on Monday and Tuesday, insiders see more signs that inflation is on the right track. Core inflation—all prices excluding fresh food—rose 0.9% in November, and corporate leaders have expressed openness toward larger wage increases this spring, when annual talks with labor unions take place.

Earlier this week, the bank cut purchases of super long bonds, raising still more questions about the future of monetary policy even as the move was pretty clearly an attempt to engineer a steeper curve. “The Bank of Japan’s cut in purchase of bonds maturing in over 25 years is probably in response to a recent drop in super-long yields, which were pushed lower by seasonal demand from investors,” Daiwa’s Keiko Onogi said on Wednesday.

Leave A Comment