Photo Credit: Jeffrey Zeldman

The end of first quarter earnings season is slowly approaching and it’s the retail sector’s turn to take center stage. This week, the department stores are on deck, pitting upscale retailer Nordstrom against middle of the road, Macy’s, and discounters like JC Penney and Kohl’s for retail supremacy. Shifting spending habits lately have favored the lower end stores as online retailers have taken the biggest bite from Nordstrom’s and Macy’s. Also reporting this week is retail sales for April, with numbers expected rebound after a sluggish March. After the next two weeks we will have a clearer picture of how consumers are spending their discretionary income.

Macy’s, Inc (M) Consumer Discretionary – Multiline Retail | Reports May 11, Before Market Opens

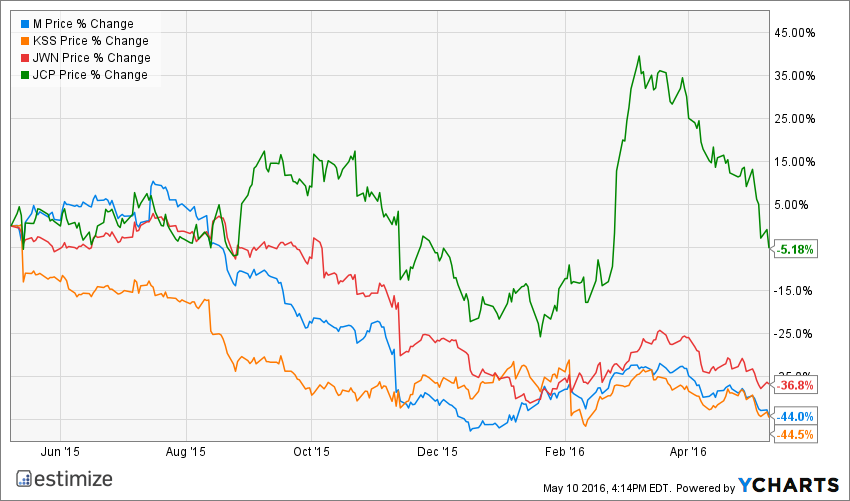

The Estimize consensus is calling for earnings of 37 cents per share on $5.94 billion in revenue, 1 cent higher than Wall Street on the bottom line and $20 million below on the top. Compared to a year earlier, earnings per share are predicted to fall 31% with sales dropping as much as 4%. On average, Macy’s stock is relatively flat during earnings season which is unfortunate because shares are down 44% in the past 12 months.

Kicking things off this week is Macy’s, out with results tomorrow morning. Despite a nice beat last quarter, Macy’s has struggled to drive growth into positive territory. The holiday season, typically Macy’s strongest, featured a total sales decline 5.3% with a 4.8% decline in comparable store sales. The company primarily blamed the abnormally warmer weather, lower tourist spending and an overly cautious consumer for its fourth quarter blunders. Nevertheless, Macy’s has undertaken extensive initiatives to propel sales and profitability. The include expanding its off price business, Macy’s Backstage, implementing a new loyalty rewards program and opening more Bluemercury free-standing beauty stores. The company has also begun to explore a REIT opportunity involving its flagship and mall-based properties. Macy’s Herald Square location alone has been valued over $4 billion and with all its other properties, this number surpasses $20 billion. In the meantime, it will likely be more of the same for Macy’s which continues to lose market share to online and discount retailers.

Leave A Comment