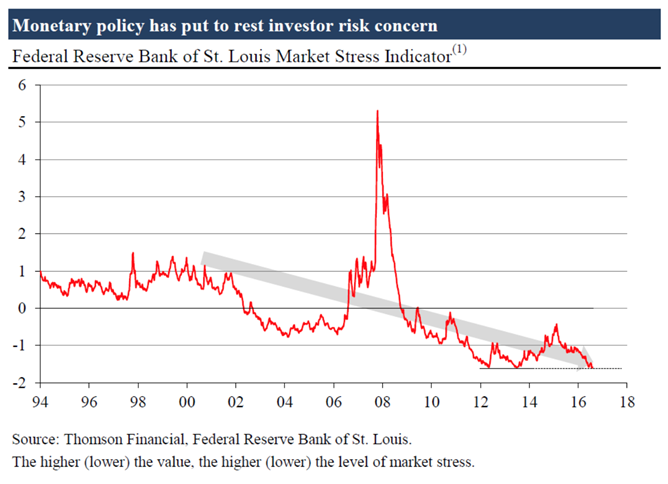

The major economies of the world keep expanding. According to official statistics, output is increasing, unemployment rates are declining, while stock and house prices edge higher. Investor risk aversion, which rose to very high levels in the period of financial market turmoil, has come down considerably, lending a boost to credit transactions and pushing asset prices upwards. It seems that the economic and financial crisis of 2008/2009 has finally been overcome.

Not So Fast

However, there is reason to keep interpreting these developments with a healthy dose of skepticism, don’t get carried away by all the talk about a ‘firming recovery’. The pickup of economic activity is not as ‘healthy’ as it seems: It has been brought about by an unprecedentedly loose monetary policy. Central banks have brought interest rates to extremely low levels and bailed out struggling borrowers by running the electronic printing presses.

By no means less important, central banks have provided financial markets with a ‘safety net’: They have signaled to financial market agents – implicitly or explicitly – that they would come to their rescue, fending off recession and financial market crashes. This has contributed to declining risk premia. For instance, lenders have become less concerned about potential borrower defaults and issue loans at very low-interest rates.

What is more, in stock markets future cash flows are discounted at artificially low-interest rates. This, in turn, increases firms’ present values and thus their stock prices and valuation levels. As firms’ cost of capital decline, new investments are brought on the way – investments that would not have been undertaken had there not been an artificial lowering of interest rates and risk premia caused by monetary policies.

Mainstream economists consider the current situation to be a ‘natural recovery’: Monetary policies, they say, have ‘stimulated’ the economies, having brought them back into growth territory. Most importantly, central banks have prevented recession-depression, which, so the narrative goes, would otherwise have fallen upon us. The visible improvement in economic activity and rising asset prices is referred to as evidence that the monetary policy has been successful.

Leave A Comment