There has been lot’s of analysis lately on what message the recent gyrations in the market are sending.

Is this just a correction in an ongoing, and seemingly never-ending, bull market?

Maybe. Anything is possible.

Or, is the financial market starting to pick up on what we have been warning about for the last several months which is simply higher rates, slowing global growth, and trade wars are going to impact the economy?

The consensus is that with the current spat of strong economic growth, unemployment and jobless claims at record lows, and confidence near record highs, there is simply no way the economy is even close to starting a recession. Furthermore, with economic growth slated to come in at 3.4% for the 3rd-quarter, this is further evidence a recession is “nowhere in sight.”

“Finally, it’s here. The bad news the financial media has been searching for, doggedly, for the last six months. As stocks plunge across the planet, fears of a recession are resurfacing.

We can say this with some confidence: The stock market panic is overblown. And a US recession is not imminent.” – Gwynn Guilford, Quartz

And what is the basis for Gwynn’s vote of confidence?

“American growth is indeed strong. Last quarter, the US economy expanded a whopping 4.2%, in real annualized terms. Unemployment is at 48-year lows. Inflation is in check. Consumer confidence is strong. Wages are rising (if only grudgingly). Investment could be better, for sure. But the fact of the matter is, overall, things are looking pretty good right now.”

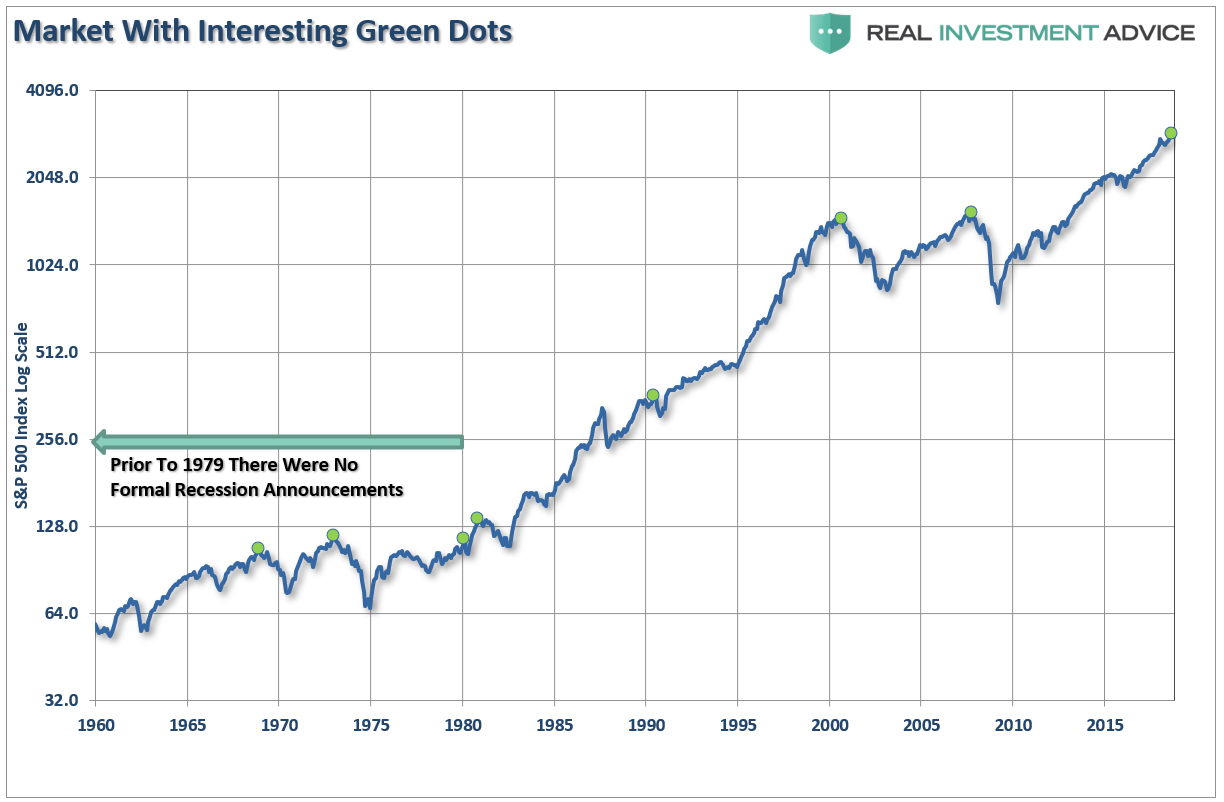

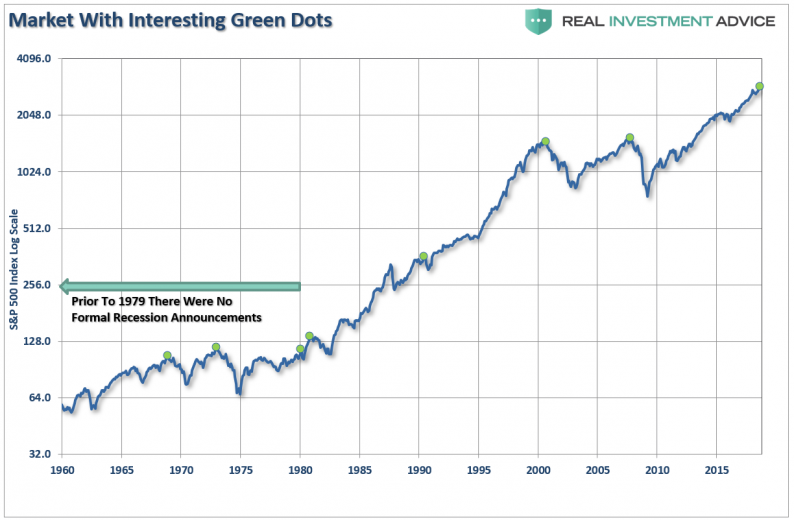

See, nothing to worry about? Obviously, the recent spasms of the market this year are really nothing more than just one of the normal market corrections which happen every now and then. The chart shows the S&P 500 going back to 1960 with some “interesting green dots.” (Cheap trick to get you to keep reading.)

Before we get to those “interesting green dots,” we need to make a point about Gwynn’s assessment of the current economic outlook.

While Gwynn is absolutely correct about the current state of economic growth, the view is also wrong.

The problem with making an assessment about the state of the economy today, based on current data points, is that these numbers are “best guesses” about the economy currently. However, economic data is subject to substantive negative revisions in the future as actual data is collected and adjusted over the next 12-months and 3-years. Consider for a minute that in January 2008 Chairman Bernanke stated:

Leave A Comment