Emotional Reaction To A Red Day

If you have been around the markets for any length of time, the following statements seem rational and logical:

And yet, the emotional reactions to a single red day and a single green day always seem to be extrapolated days, weeks, months, and years into the future.

Psychology Stock market was down today, therefore new lows are on the way. If the market is up tomorrow, new highs must be on the way.

— Chris Ciovacco (@CiovaccoCapital) October 13, 2015

Did Investors Sprint For The Exits On Tuesday?

Trading volume can provide some insight into investor conviction. Would we expect to see high trading volume after a bearish black swan event? Yes, unexpected bad news typically causes a rush for the exits.

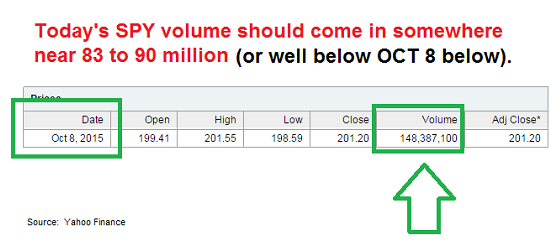

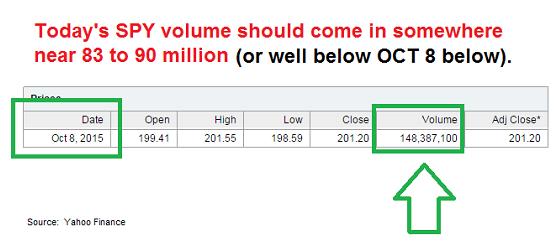

On October 8, the S&P 500 cleared prior resistance levels (a bullish outcome). On Tuesday, October 13, the S&P 500 “gave back” some of the recent gains by dropping 0.63%. Was volume higher on the red day or the green day? Answer: Volume was much lower on the red day. Final volume figures were not available at press time, but it appears as if SPY traded somewhere in the neighborhood of 83 to 90 million shares on Tuesday’s down day, which is roughly 42% lower than SPY volume on the day of last week’s bullish break above prior resistance. Volume may pick up in the coming days, but it was not alarming Tuesday.

Are There Things To Be Concerned About?

Yes, the S&P 500 stalled Tuesday near a logical area of possible resistance, earnings have been just okay, and the Fed continues their seemingly endless talk of this now-fuzzy concept of taking action. Having stated those points, Tuesday’s low volume selloff does not discount the long list of bullish developments described in this week’s video.

Leave A Comment