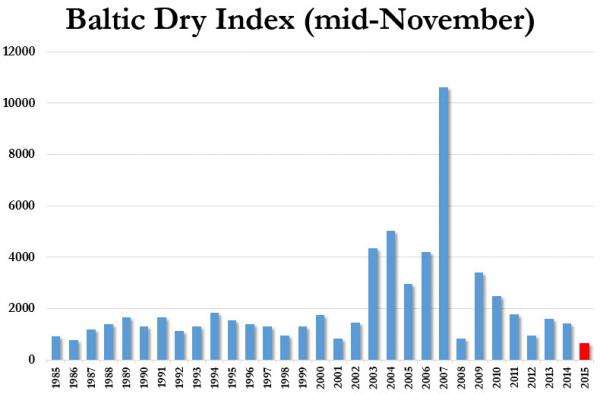

2015 has been an ‘odd’ year. Typically this time of year sees demand picking up amid holiday inventory stacking and measures of global trade such as The Baltic Dry Index rise from mid-summer to Thanksgiving. This year, it has not.

In fact, it has plummeted as the world’s economic engines slow and reality under the covers of global stock markets suggests a massive deflationary wave (following a massive mal-investment boom). At a level of 631, this is the lowest cost for Baltic Dry Freight Index for this time of year in history.. and within a small drop of an all-time historical low.

Hard to ignore something that has never happened before as anything but a total disaster for world trade and economic growth.

* * *

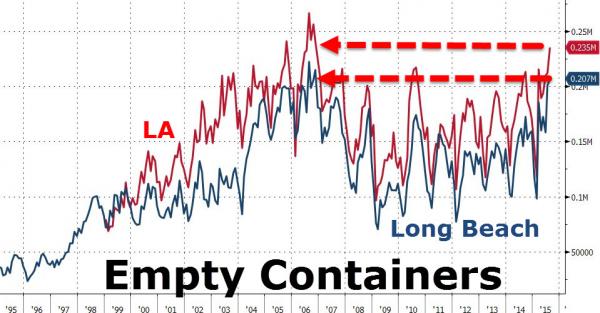

As we concluded previously after exposing the collapse in Ships…

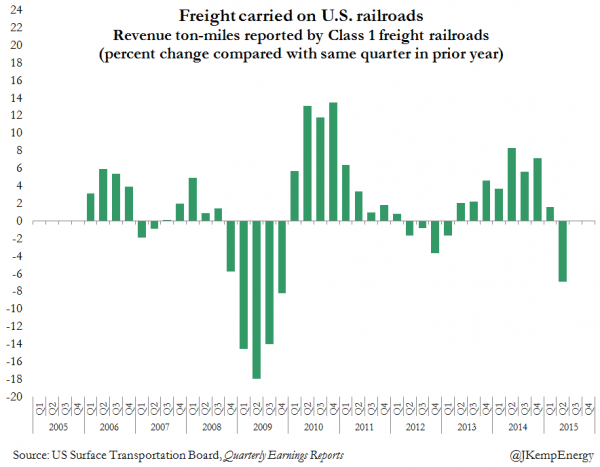

Trains…

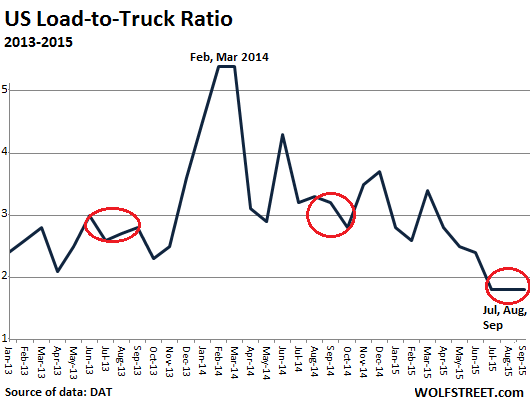

And Trucks…

We have in the past joked that the only thing that could possibly save the world from what is a trade recession is if the central banks can somehow find a way to “print trade” the way they artificially boost asset prices higher to give the impression of a status quo normalcy. Unfortunately, as this is not a real option, and with both global and US trade in freefall, many wonder just how will the world’s central planners mask this most dangerous aspect of the global economic slowdown?

Charts: Bloomberg

Leave A Comment