Stocks are so hot that junk bond managers went into equity markets. Bloomberg’s Lisa Abramowicz explained the conditioning that’s led to this – simply that the performance rankings of corporate debt funds shows that those which are taking the most risk have, not surprisingly, booked the best performance in 2017. While this involved purchasing lower-rated credit instruments, in some cases, it has meant buying more equities.

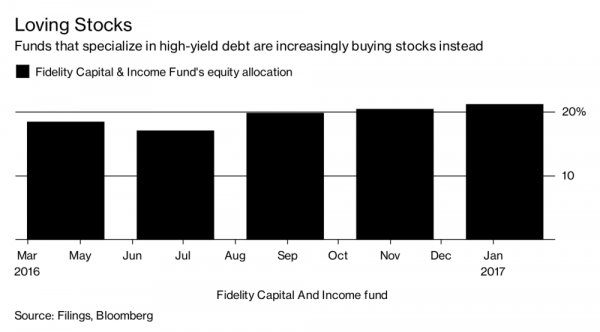

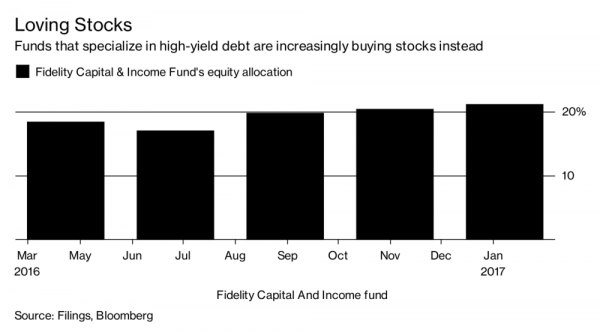

Abramowicz cites two funds, firstly the Fidelity Capital & Income Fund, this year’s top-performer in high yield debt. FC&IF steadily increased its equity exposure to more than 20% earlier this year.

Secondly, the Loomis High Income Fund increased its equity holdings by more than six times between mid-2016 and early 2017, albeit from a low level.

Besides purely ignoring risk for return’s sake, we suspect that active portfolio managers are also responding to the career risk of losing funds to passive investment vehicles. In addition, we suspect some are probably adherents to the synchronized global growth thesis and bonds don’t have the same “juice.”

Abramowicz attributes the behavior to managers seeing less value in risky credit than in equities. As she shows, the incremental yield on junk versus the yield on the S&P 500 has narrowed considerably.

Abromowicz expects this to end badly, which most of us know this to be true. We also know that this behavior is not confined to the wealth management sector.

The lead story on the front page of the Sunday Telegraph’s Money section at the weekend was “Insurer’s risk-taking threatens next crash.” The article cited a warning from the IMF “The International Monetary Fund has issued a stark warning about the potential for a giant shock from the industry amid some serious dangers lurking ‘under the surface’…as they battle to deliver returns against historically low interests rates…’Market risk is rising. The search for yield may have gone too far. There is simply too much money chasing too few yielding assets,’ said Tobias Adrian, IMF’ s financial counselor.”

Leave A Comment