The key economic release this week is the employment report on Friday, which as Janet Yellen noted in her speech on Friday, is the only economic event (together perhaps with the CPI report on April 15), that could potentially derail a now practically guaranteed rate hike.

Following a slew of hawkish Fed commentary throughout last week and reinforced by both Fischer and Yellen on Friday, a March 15th Fed hike looks firmly on the cards and it would seem unlikely that data would cause a change of course. Nevertheless, attention will be squarely on Friday’s jobs report. Consensus expects a strong report, with NFP growth of 190K, average hourly earnings of 0.3% and unemployment ticking down to 4.7%.

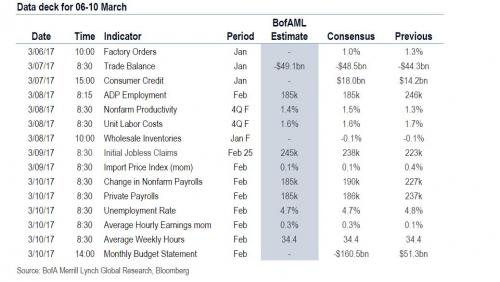

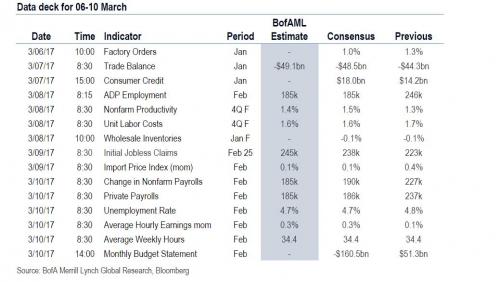

A summary breakdown of key events in the US in the coming week:

In addition to the US jobs report, two G10 Central Bank decisions this week, as the RBA and ECB meet to decide policy. Neither bank is expected to change policy, although more interesting times are likely ahead as both now face rising inflationary pressures which will likely prompt them to turn hawkish in the coming months. There is a more compelling case for the RBA to begin normalizing policy next year, but doubt the RBA will shift guidance this week. Look for moves in Feb and Aug 2018.

The ECB will also be on hold as the current “truce” between hawks and doves holds and is reflected in a dovish tone, with no decision. After the summer, the debate between hawks and doves cannot be avoided however. Keep an eye on the batch of forecasts released by ECB, though few expect revolutionary changes.

Elsewhere, in the UK, the Budget announced on Wednesday is a key release, while we also get trade balance and industrial production. The House of Lords continues their examination of the Brexit Bill. Following the completion of third reading, the bill will return to the Commons for consideration of Lords amendments.

In Japan, main economic releases include trade balance, final GDP, PPI and money supply.

In Canada, the main release will be the labor market report.

In Norway, data this week will be the last main inputs for the Norges Bank meeting on March 16th. Particular focus will be on the regional network survey and inflation.

Detailed breakdown of global events below:

* * *

A daily look at key events:

It looks set to be a quiet start to the week with just the Sentix investor confidence reading for the Euro area due this morning followed by January factory orders and final durable and capital goods revisions in the US this afternoon.

Leave A Comment