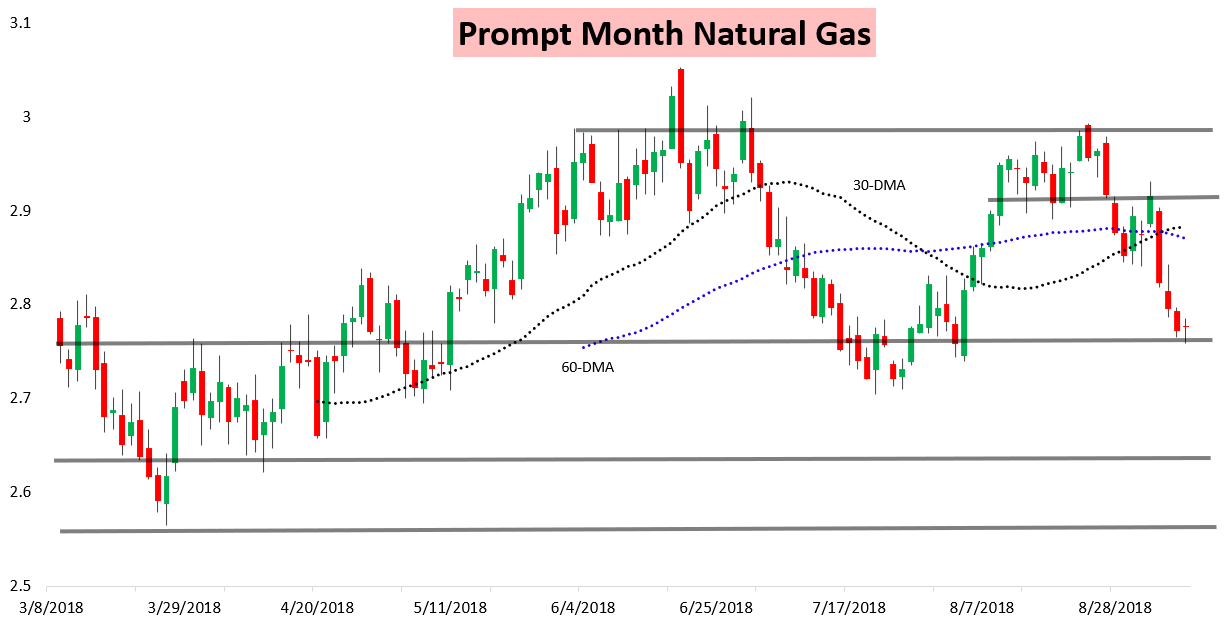

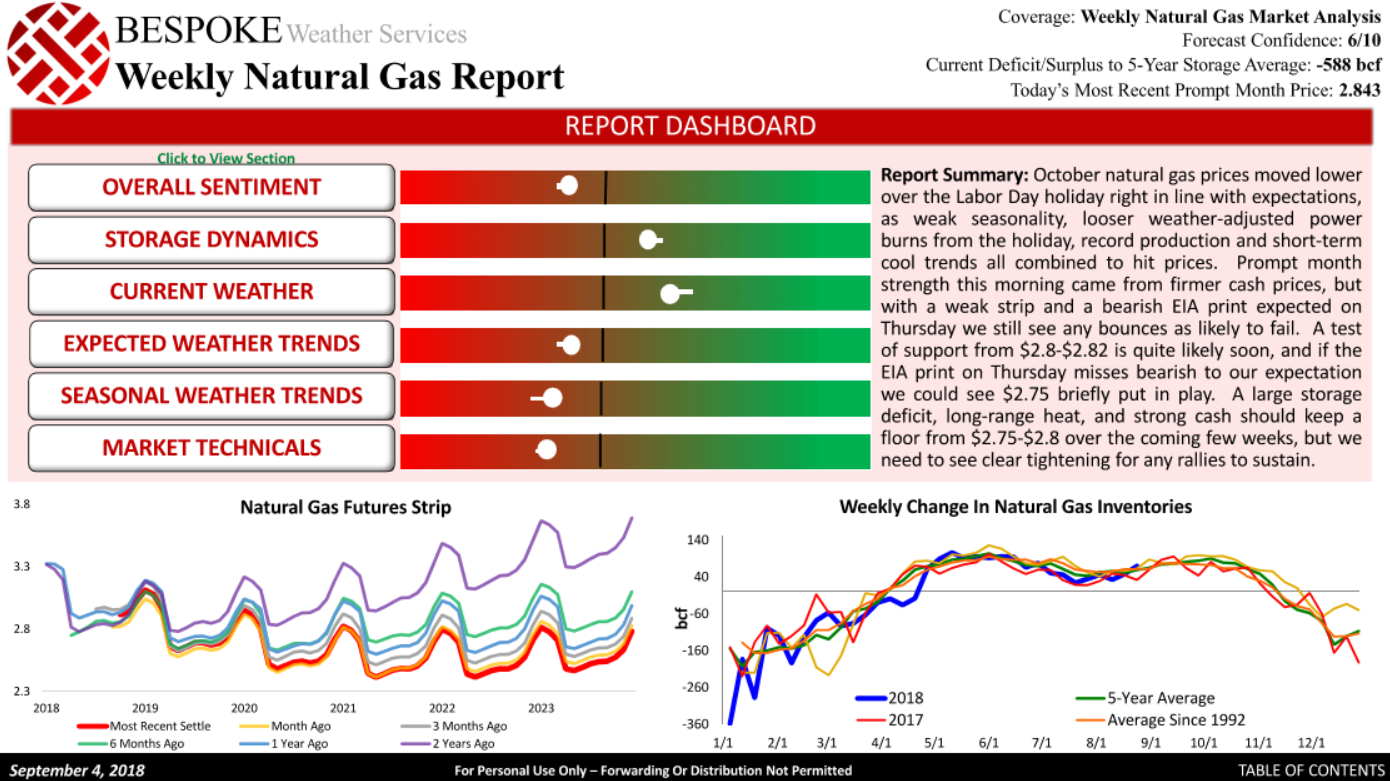

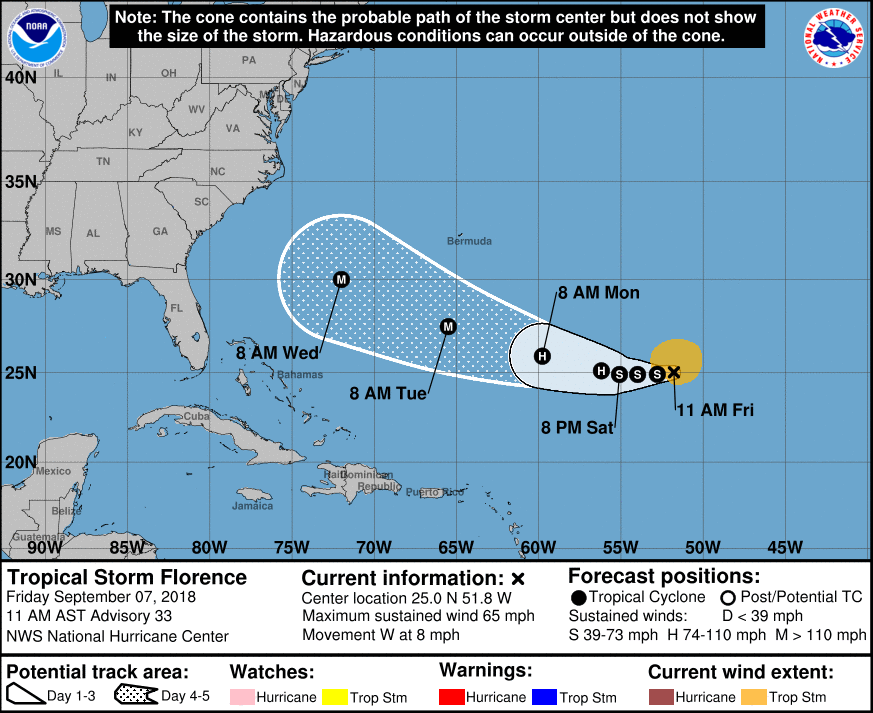

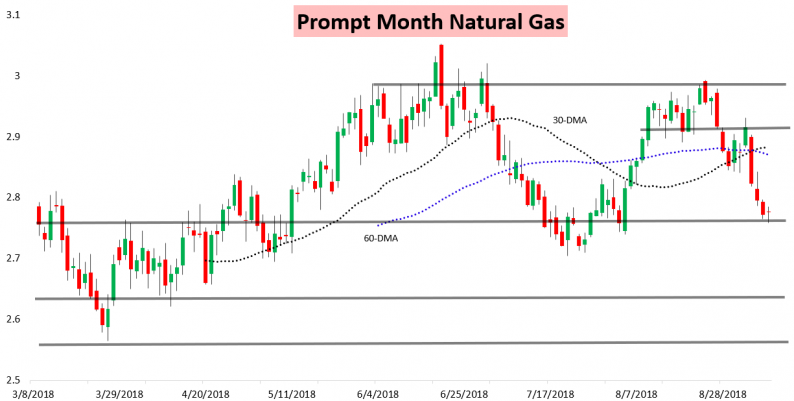

It was a rough week for natural gas bulls, with the October natural gas contract declining just less than 5% on the week.

It was another week where natural gas prices traded very well within our weekly expectations set out in our flagship Natural Gas Weekly Update. Short-term forecasts trended cooler thanks to Tropical Storm Gordon as expected, EIA data came within 1 bcf of our expectation, and a weak winter strip continued to limit any rallies even as we saw a floor from $2.75-$2.8 defended.

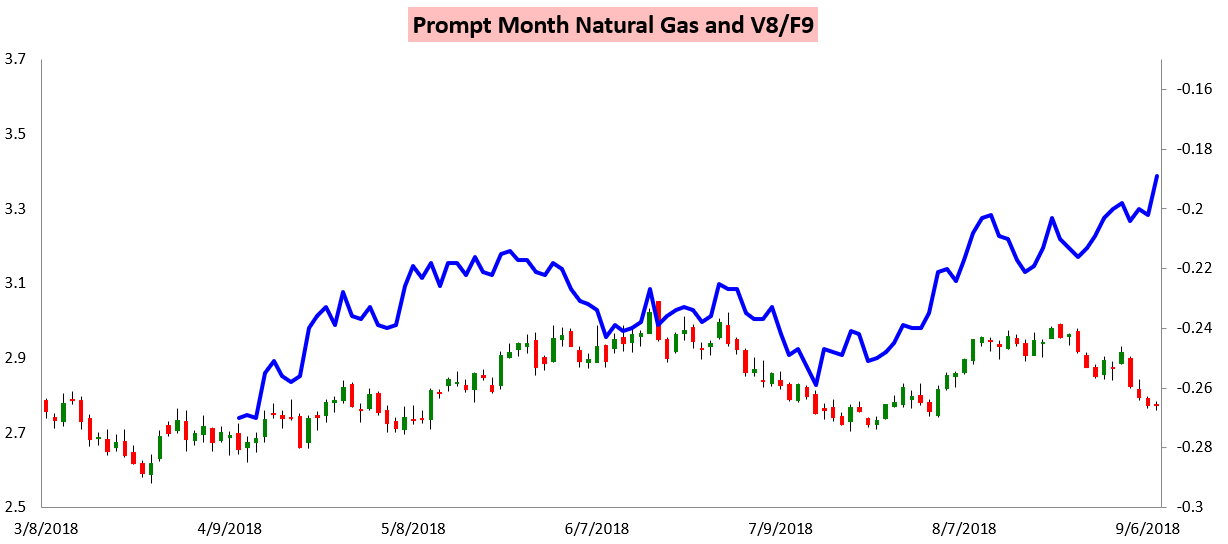

Meanwhile, we have continued to see winter weakness with a new narrow V/F settle on the day.

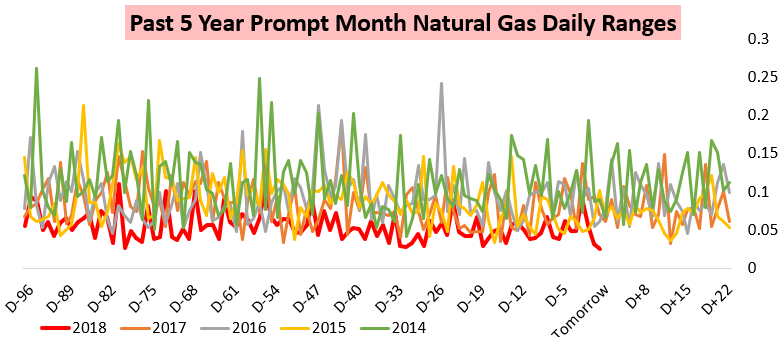

Also, Friday we saw the smallest prompt month trading range of the year for natural gas prices, something we have been saying a lot the past few months. The October contract traded in just a 2.6-cent range after seeing much larger moves earlier in the week.

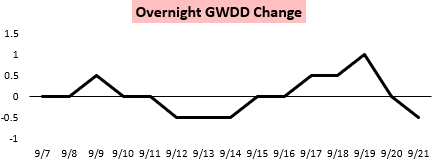

Climate Prediction Center forecasts showed that, indicating slight cooling trends in the 6-10 Day period with decreased confidence in heat but nothing that was all that significant.

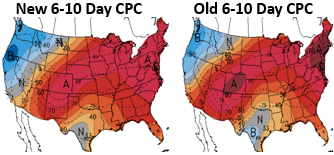

Meanwhile, traders continue to monitor Tropical Storm Florence, as it progresses towards the eastern US. Any landfall is still several days away, and in our Pre-Close Update we broke down any potential impacts from the storm on natural gas prices.

Leave A Comment