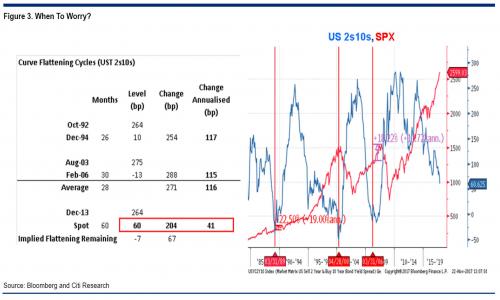

Over the weekend, we presented an analysis by Citi looking at how long after the yield curve inverts do investors have before they should start worrying. As Citi’s Jeremy Hale noted, “sometimes inversion provides a timely signal for the economic cycle a la 2000, where Professor Curve predicted almost the ding-dong high in the SPX. However, the 2006 episode of inversion dished up 7 months of pain for equity bears, with 18% further upside for the SPX. Ditto for the 1989 episode where equities continued to rally 22% into the 1990 recession (Figure 3, RHS). For now, we’re comfortable with the flattening dynamic with regards to other markets but would become increasingly cautious as the curve approaches zero.”

Which leads to the next logical question: how long before the current 60bps or so spread in the 2s10s drops to 0, and then inverts?

Today, in its 2018 Global Strategy Outlook, Morgan Stanley provided its answer: the yield curve will be “completely flat” in roughly 10 months, or by September 2010.

As rates strategist Matthew Hornbach writes, previewing his bear flattening base case “the highlight of our global rates year-ahead outlook is the flattening of the US Treasury curve.” He explains that the bank’s economists project that the Fed will continue to remove policy accommodation gradually by increasing the target rate range at each quarterly press conference meeting until it reaches 2.00-2.25% in September 2018. Meanwhile, as the Fed raises rates gradually, the curve will continue to gradual flatten such that, “in 3Q18, all Treasury yields will be in the lower end of that 2.00-2.25% range.”

According to Hornbach, the forecast for a completely flat curve is based on two key: i) Global central bank balance sheets continuing to grow in 2018; and ii) The Fed continuing to tighten monetary policy both via short-term rates and, increasingly, its balance sheet in an environment of low realized inflation.

Leave A Comment