Happy Holidays! First off, we want to thank you for being a part of our mailing list and blog, and hope you have a restful and enjoyable holiday season.

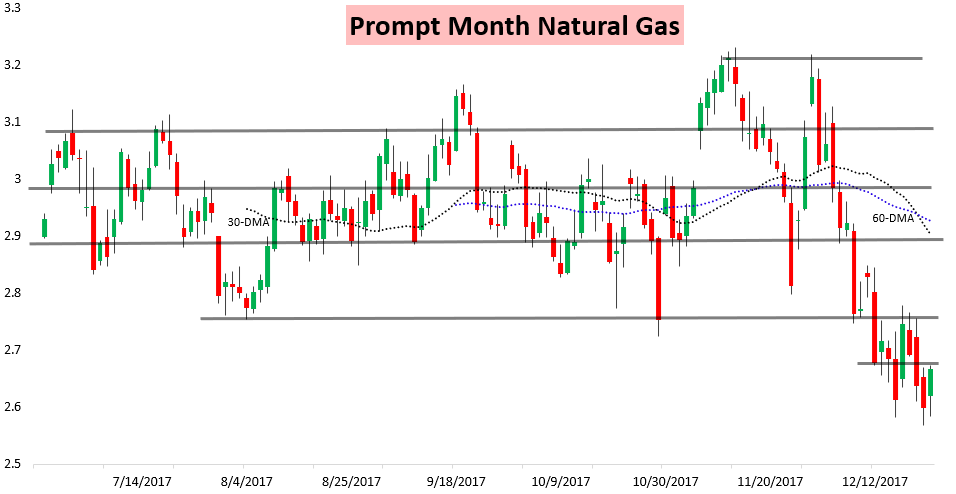

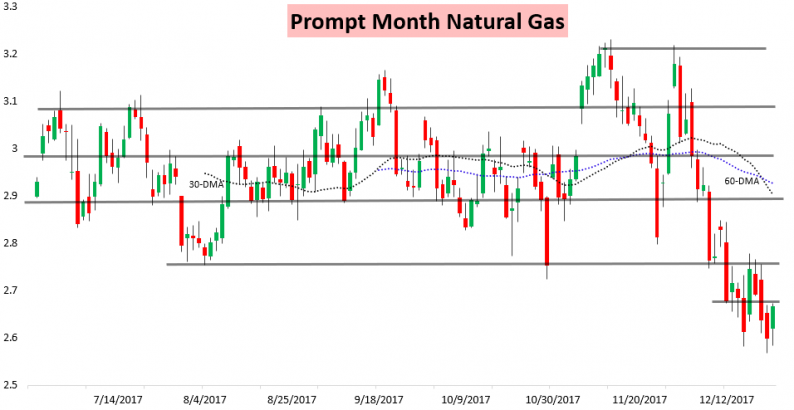

In the natural gas market, volumes were a bit lighter ahead of the holiday season but we actually saw prices rally decently, moving back above the $2.65 level.

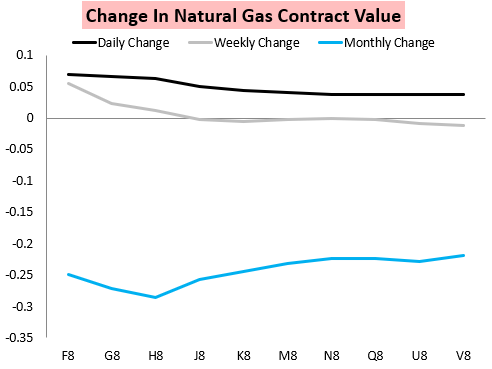

The entire strip got involved in this rally, indicating it was a bit more than just a front-led weather-driven rally. In fact, the front of the strip even ended the week up.

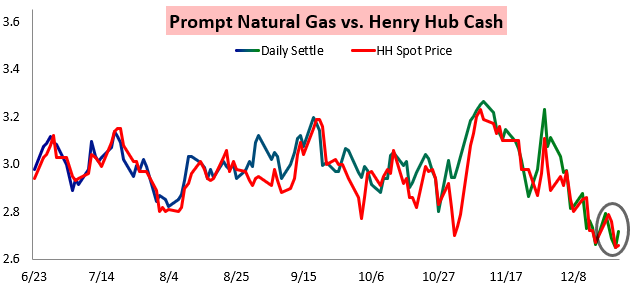

This came as cash prices were relatively stable today, with today’s rally not really seen as cash-led.

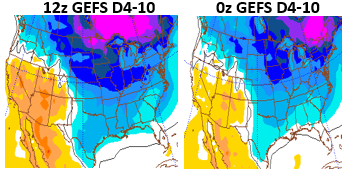

As we head into the holiday weekend traders will closely be watching cold in the medium-term, which trended even a bit stronger on the GFS ensembles this afternoon (courtesy of the Penn State E-Wall).

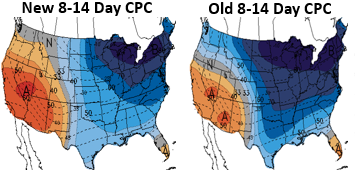

Yet the Climate Prediction Center showed a bit less confidence in cold Days 8-14.

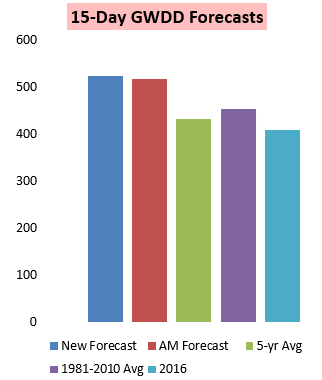

Still, our Afternoon 15-Day Gas Weighted Degree Day (GWDD) forecast for clients slightly increased demand thanks to very strong medium-term cold, and we expect weather-driven natural gas demand to be significantly above average into the first week of January.

Of course, there are questions around just how intense this cold will be and how long it will last. The answers to both of those should help determine weather’s influence in the natural gas market next week, which is something we broke down for clients in our Pre-Close Update, which outlined our forecasts into mid-January and natural gas price action expectations for next week. To give the report a look,

and see how our blended weather and natural gas fundamental/technical analysis can keep you ahead of the next big market move.

Leave A Comment