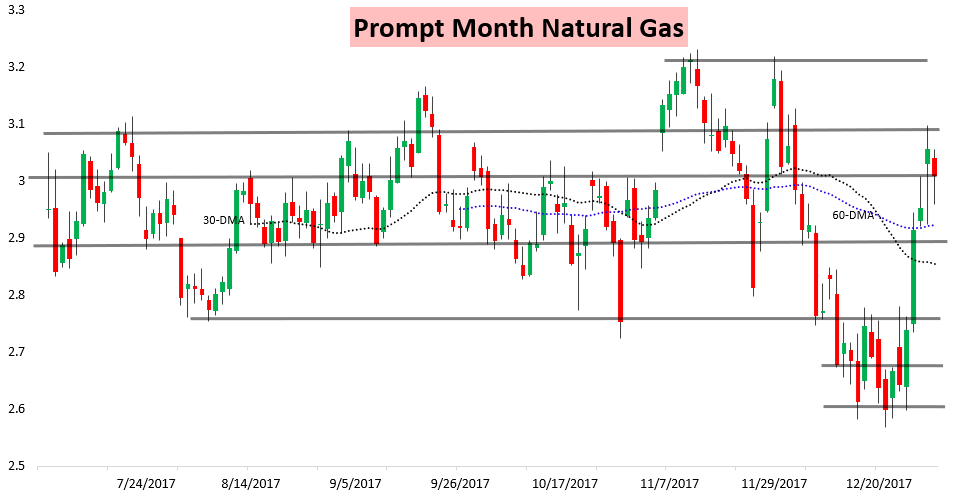

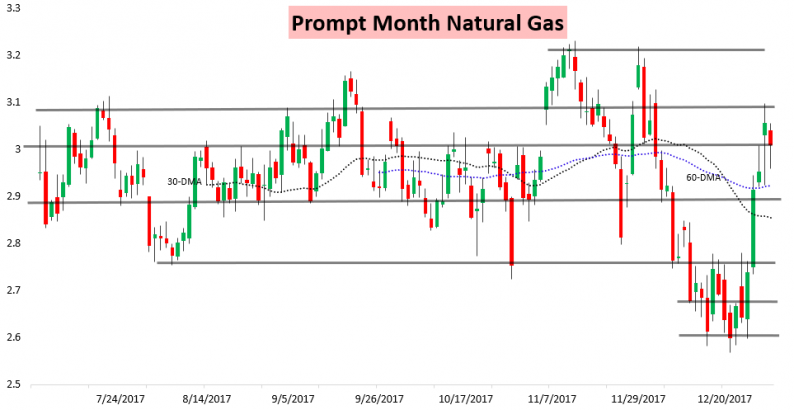

February natural gas prices pulled back around a percent and a half today as traders worried about warm risks in the medium and long-range weather forecasts. Still, buying into the settle helped prices close just above the $3 level.

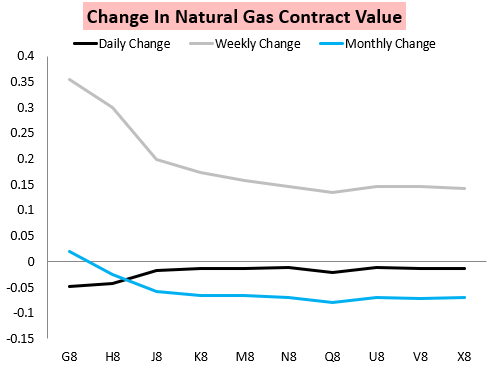

For the first time in awhile, it was the front of the natural gas strip that logged the most losses on the day, though over the past week it is still up by far the most.

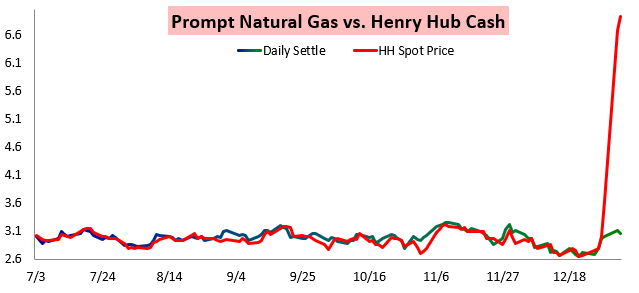

Such weakness came as Henry Hub cash prices rose even more today.

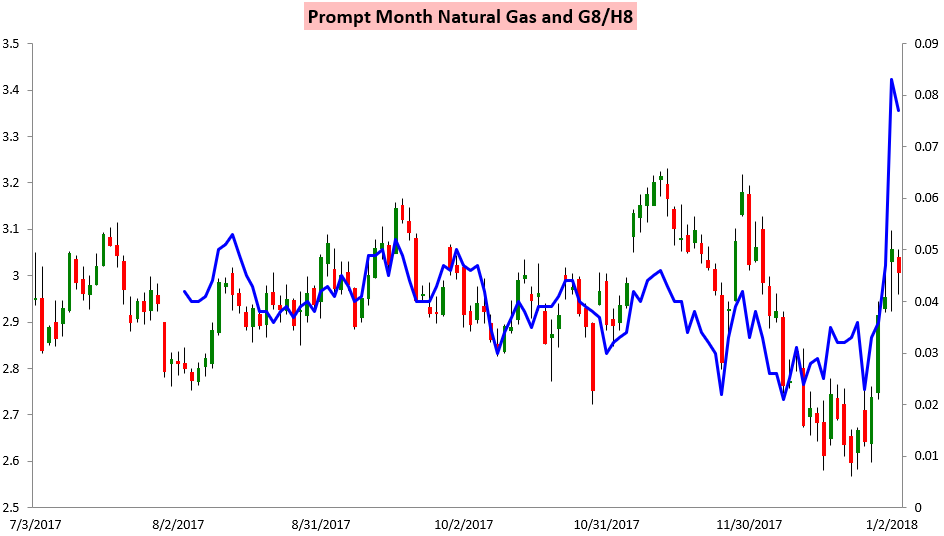

Such cash strength makes it all the more impressive that the February/March G/H contract spread actually ticked back a bit lower today on concerns that heating demand would fall significantly later in January.

These concerns are not unwarranted it would seem, and have been around for awhile. Our Note of the Day last Friday highlighted that model guidance could begin to show some of the warming trends they currently do.

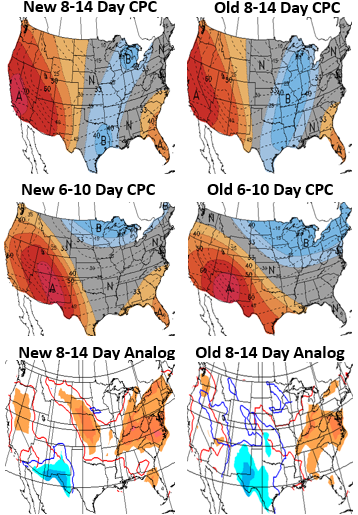

These have continued today with the Climate Prediction Center backing off some of the cold seen in the 6-10 and 8-14 Day forecasts.

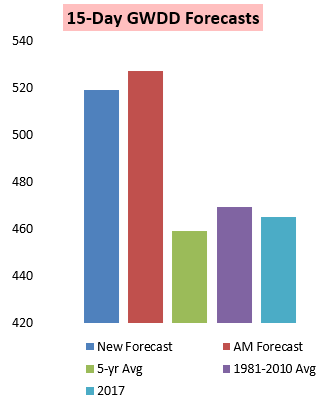

Yet long-range forecasts remain quite volatile, as has frequently been the case this winter. Our afternoon GWDD forecast for clients decently lowered our expectations from this morning.

Still, these have been bouncing around quite a bit over the past week, and we would expect further volatility in the 6-10, 11-15, and 16-21 Day forecasts to drive natural gas prices as traders attempt to determine how much gas will still be in storage by the end of the winter withdrawal season.

Leave A Comment