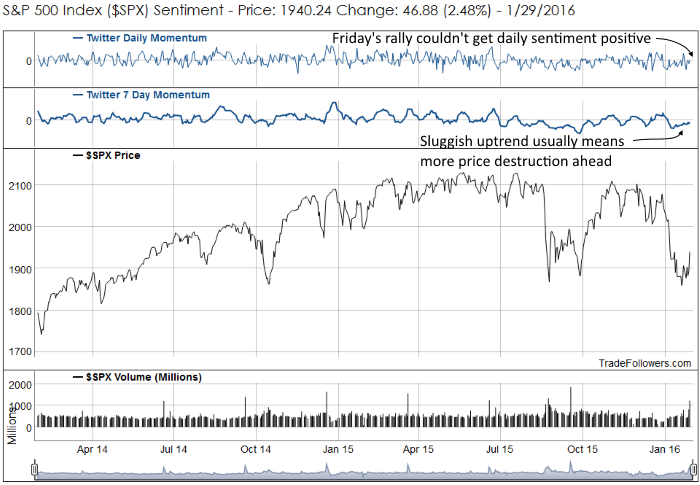

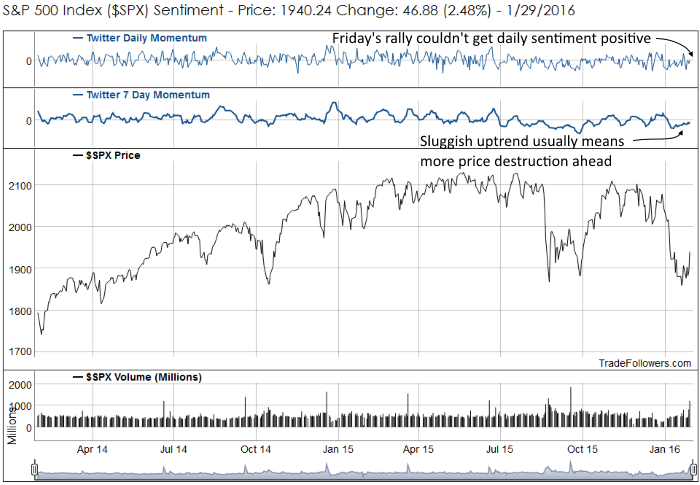

Market participants who tweet just aren’t believing this rally. Even the strong upside move on Friday couldn’t get daily momentum and sentiment above zero. Seven day momentum is acting sluggish and isn’t responding well to upward price moves. When this occurs it generally means more downside is ahead. Since breadth is negative (next chart below) bear market rules now apply. That means we’ll probably see 7 day momentum peak in the +5 to + 10 area with a lot of failures near the zero line (during a bull market it peaks between +15 and +25). That gives this rally a bit more room to run, but be careful if you’re trading on the long side.

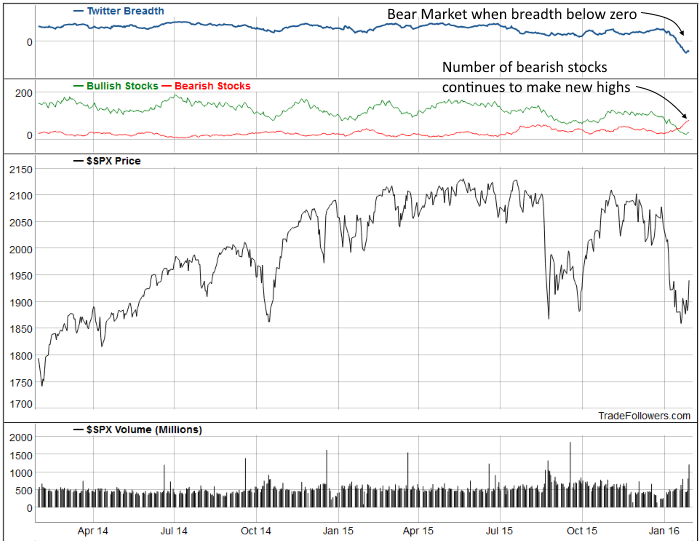

As mentioned above, breadth calculated between bullish and bearish stocks on Twitter is still negative. That means we’re in a bear market and more long term pain is likely ahead. The number of bearish stocks continues to make new highs as investors lose hope in an increasing number of stocks.

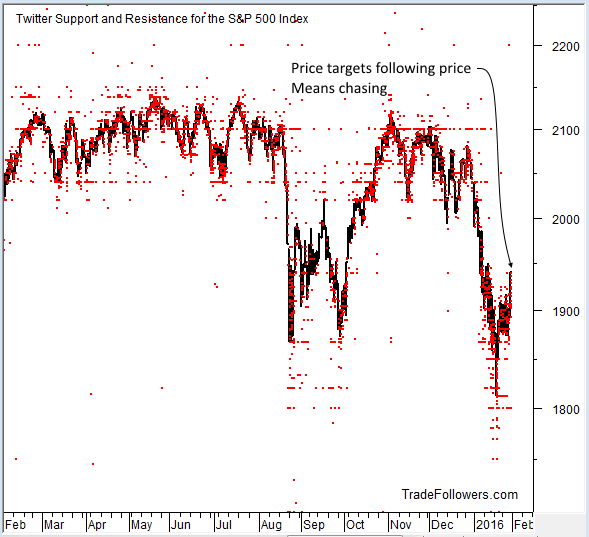

Trader’s price target tweets continue to show the same pattern. Very few tweets above current prices and continued tweets near previous lows. When price tweets follow price it indicates chasing (and little hope). Not a good condition for a solid rally.

Conclusion

It appears that there are very few believers that this rally will be sustained. Daily momentum can’t get above zero, 7 day momentum is sluggish, the count of bearish stocks continues to grow, and no one is tweeting higher prices. Be careful, because these conditions mean a lack of committed buyers, which often results in swift drops that come out of nowhere.

Leave A Comment