If you follow trends in markets, you probably already knew (or at least surmised) that HY ETFs are having observable effects on the junk bond market.

It’s not entirely clear that’s a good thing. As we’ve gone to great pains to explain, an ETF can’t be more liquid than the underlying assets and as Howard Marks wrote with regard to junk bond ETFs, “we know the underlying can become highly illiquid.”

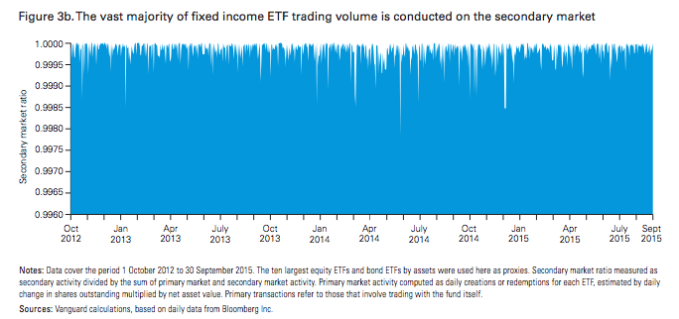

One important think to note about that assessment is that the more trading in the ETF replaces trading in the underlying, the more illiquid the underlying becomes. So when Vanguard says things like “99% of the trading volume [in fixed income ETFs] results in no trading in underlying securities,” that’s actually a bad thing – contrary to how they’re trying to get you think about it.

Well, in addition to everything we’ve already said about the dangers inherent in HY corporate bond ETFs, we wanted to add one more concern.

When you think about replicating a HY bond index (which is presumably what HY ETFs are doing), you’re left to wonder if maybe flows into these vehicles are distorting the market. That is, if the index is skewed towards large capital structures (which is a given), then by definition, flows into the ETFs will begin to influence returns and liquidity in some bonds but not others. Note that this probably isn’t the case for flows into active funds, right? Because the managers aren’t obligated to stick with large capital structures.

Consider that, and then consider the following from Goldman…

Via Goldman

Leave A Comment