While it may surprise many investors, history has shown us that many of the best long-term investments aren’t hyper-growth companies but much more boring dividend growth machines.

For example, in the last 50 years Altria (MO), formerly Philip Morris, has been one of the best performing stocks on a total return basis, rising an incredible 6,648 fold.

Back in 2008, Altria spun off its faster growing international tobacco business into Philip Morris International (PM).

Since then, Philip Morris has increased its dividend for nine consecutive years, rewarding shareholders with 10.7% annualized dividend growth.

While this high-yield stock’s past performance has been remarkable, investing gains are not made by looking in the rearview mirror but instead based on forward cash flow growth.

Let’s take a closer look at Philip Morris International to see what kind of income growth and total returns shareholders can expect going forward and whether or not this dominant tobacco company is an appropriate stock for investors living off dividends in retirement.

Business Description

Philip Morris International is the world’s largest tobacco seller, with its 80,000 employees operating 48 production facilities in 32 countries.

It markets numerous cigarette brands to over 150 million customers in over 180 countries and has a 27.9% global market share (excluding China and the U.S.).

Philip Morris owns the international rights to all of Altria’s most famous brands, including Marlboro, Merit, Parliament, Virginia Slims., L&M, Philip Morris, Bond Street, Chesterfield, Lark, Muratti, Next, and Red & White.

In addition, the company has acquired numerous other foreign cigarette brands, including:

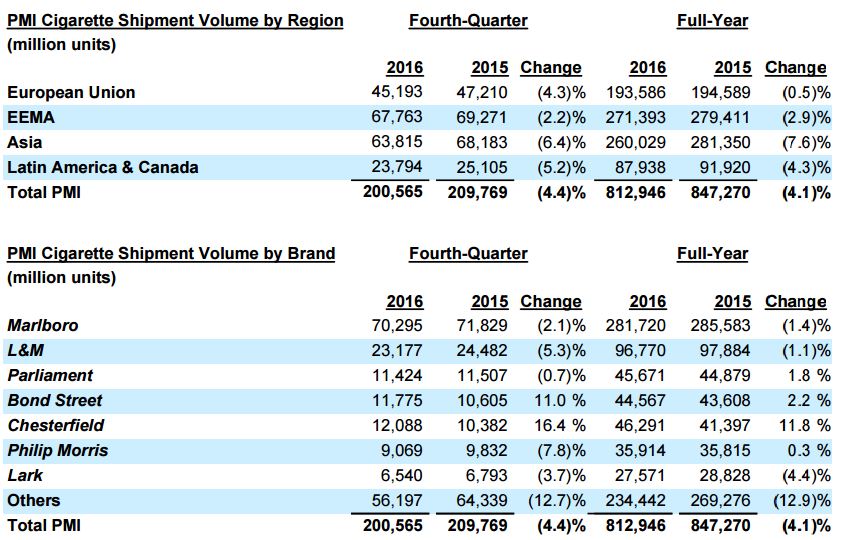

As you can see, Philip Morris International’s sales are pretty evenly diversified with the vast majority of sales coming from Europe and Asia.

However, the EU remains the company’s most profitable region by far, generating over 35% of the company’s total operating income in 2016.

Source: Philip Morris International Earnings Release

Business Analysis

Philip Morris International is an absolute giant in the global tobacco world.

The company is the market leader in seven of the 10 largest OECD countries by industry volume and is the second largest player in another two.

Outside of OECD countries, Philip Morris holds onto the number one market share spot in three of the 10 biggest countries by industry volume and is the number two player in another four.

The company’s dominance is driven by the strength of its brand portfolio. Philip Morris has six of the world’s top 15 cigarette brands, including the world’s number one brand – Marlboro.

As a result, the company enjoys excellent pricing power. Since 2008, Philip Morris’ annual average pricing gain has been 6%, excluding excise taxes.

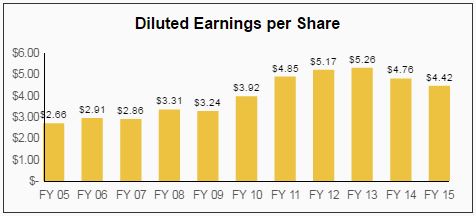

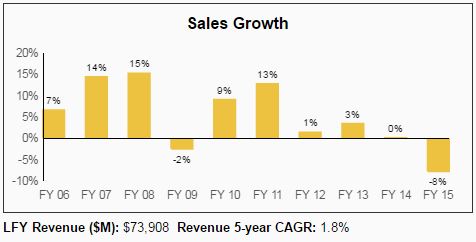

Despite its strengths, Philip Morris International has run into some major growth headwinds in recent years, with sales and earnings grinding to a halt or even turning negative.

Source: Simply Safe Dividends

Source: Simply Safe Dividends

Part of this is due to lower cigarette volumes because smoking is an industry in secular decline.

In fact, Philip Morris reported that its cigarette shipment volume was down 4.1% in 2016 (although roughly 40% of the decline was due to Pakistan and the Philippines, where volume erosion was concentrated in low unit margin brands).

Most of its brands saw flat or negative declines in volumes, as did all regions (although volume in the EU was down just 0.5%). However, it’s important to note that Marlboro gained market share in the EU (+0.2%), Asia ex-China (+0.3%), and Latin America & Canada (+0.6%).

Source: Philip Morris International Earnings Release

One of the reasons for the volume declines is higher government taxes in some of Philip Morris’ largest regions, such as the EU, Russia, and the Philippines (three of the company’s top four markets).

The EU implemented anti-smoking legislation in mid-2014, aiming to reduce tobacco consumption by 2% over the next five years, the equivalent of 2.4 million smokers. The EU has one of the highest excise tax rates on tobacco in the entire world, and roughly 70% of Philip Morris’ revenue from the region goes to the government.

Leave A Comment