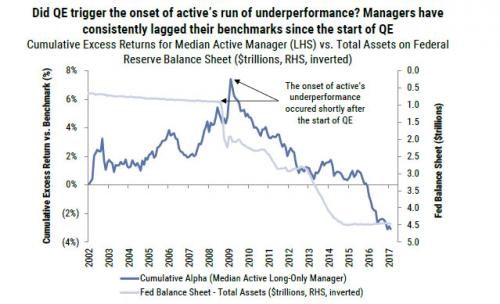

Back in April, we showed that according to a Goldman Sachs report, the current run of chronic active manager underperformance began shortly after the launch of QE in 2009.

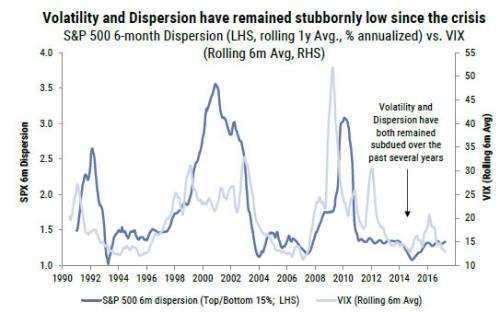

As discussed earlier today by Matt King in his report on “one-way” markets resulting from QE and ETFs, this period has been marked by “stubbornly low volatility and dispersion”, something Goldman first observed four months ago:

Which brings us to what we concluded back in April in we showed that according to a Goldman Sachs report, namely that:

… while hedge funds, especially established ones with significant AUM, find the current status quo relatively comfortable – after all they get to clip their management fees year after year (forget the “performance” upside), extrapolating current trends in central-bank dominated markets would eventually lead to “active” extinction, and the complete domination of ETF-based and other low-cost passive strategies. Furthermore, taken to its thought experiment extreme, a situation in which there is only passive management would guarantee that the next market crash would be truly unprecedented with few hedge funds there to hunt for bargains.

More apropos, we also said that “ironically, the only event that can break this sequence of events would be a market crash, one which finally ends the current pernicious equilibrium and resets the capital markets. For that to happen however, both the Yellen and now Trump put would have to be eliminated. And that, as the past 8 years have shown, is easier said than done. For the sake of hedge funds and their dwindling assets under management, however, they better fund a way and soon.”

Fast forward to today when we are delighted to remark that one of the best strategists on Wall Street has come out with exactly the same conclusion. As reported earlier, late on Friday Citi’s always insightful strategist, Matt King discussed the by Matt King in his report on “one-way” markets “, and why between QE and ETFs, increasingly illiquid markets are not only herding asset managers into precarious positions, but “one-way markets which trend for extended periods very little volatility, but are then vulnerable to abrupt turnarounds.”

Leave A Comment