Image Source: Pexels

Image Source: Pexels Last week was an important one, as the market cap weighted S&P and Nasdaq both broke below their 200 DMAs. It was something I’d been expecting given the underlying internal weakness in the market for quite some time now. What this means is that the bear market rally is over, the bull market has been canceled, and stocks are going lower.

Last week was an important one, as the market cap weighted S&P and Nasdaq both broke below their 200 DMAs. It was something I’d been expecting given the underlying internal weakness in the market for quite some time now. What this means is that the bear market rally is over, the bull market has been canceled, and stocks are going lower.

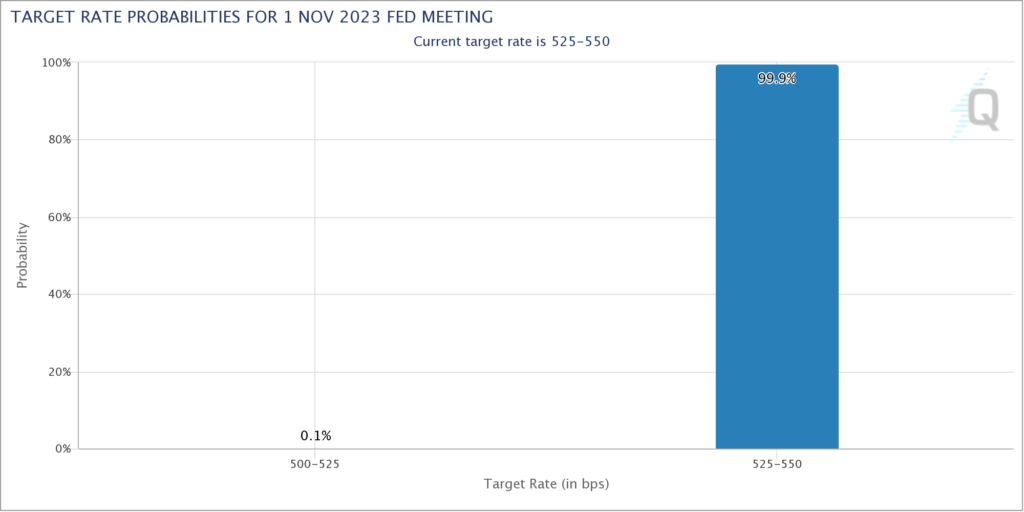

The big events next week are the Fed Decision on Wednesday, Nov. 1 at 2PM EST and Apple (AAPL) earnings on Thursday afternoon. While the Fed is almost certain to make no change to the Fed Funds Rate, investors will focus on Powell’s comments and tone. He maintained his hawkish “higher for longer” narrative when he spoke at The Economic Club of New York two weeks ago. Now it’s time for him to recognize that the market is breaking down and make an adjustment if he wants to have any chance at nailing a soft landing.

The big events next week are the Fed Decision on Wednesday, Nov. 1 at 2PM EST and Apple (AAPL) earnings on Thursday afternoon. While the Fed is almost certain to make no change to the Fed Funds Rate, investors will focus on Powell’s comments and tone. He maintained his hawkish “higher for longer” narrative when he spoke at The Economic Club of New York two weeks ago. Now it’s time for him to recognize that the market is breaking down and make an adjustment if he wants to have any chance at nailing a soft landing. On Thursday afternoon, Apple will reports its numbers for fiscal year 2023 4th quarter. I’ve long argued that Apple has essentially no growth anymore, and it should be repriced as a value stock. If this quarter is a catalyst for that repricing, that may well be the final nail in the coffin for the rally we’ve seen over the last year.

On Thursday afternoon, Apple will reports its numbers for fiscal year 2023 4th quarter. I’ve long argued that Apple has essentially no growth anymore, and it should be repriced as a value stock. If this quarter is a catalyst for that repricing, that may well be the final nail in the coffin for the rally we’ve seen over the last year. Lastly, Barron’s cover for this weekend says it’s “time to buy bonds.” While the magazine cover is usually a contrarian indicator that a narrative is played out and priced in, in this case I believe Barron’s is spot on and ahead of the curve.The breakdown in the market and the potential for a recession next year will be the catalysts for a bottom and sustained rally in beaten-down, long-term bonds. The Long-Term Treasury ETF (TLT) will be a monster in 2024 (I was a year early to discuss this).More By This Author:Market Technicals Heading Into Big Tech EarningsThe Art Of Asshole ManagementRising Rates Are Boiling The Frog, Weak Railroad Volumes, Geopolitical Chaos

Lastly, Barron’s cover for this weekend says it’s “time to buy bonds.” While the magazine cover is usually a contrarian indicator that a narrative is played out and priced in, in this case I believe Barron’s is spot on and ahead of the curve.The breakdown in the market and the potential for a recession next year will be the catalysts for a bottom and sustained rally in beaten-down, long-term bonds. The Long-Term Treasury ETF (TLT) will be a monster in 2024 (I was a year early to discuss this).More By This Author:Market Technicals Heading Into Big Tech EarningsThe Art Of Asshole ManagementRising Rates Are Boiling The Frog, Weak Railroad Volumes, Geopolitical Chaos

Leave A Comment