I see that pundits and even Fed FOMC members are believing the labor market “improvement” will allow the FOMC to raise the zero bound federal funds rate when the Fed meets on December 15 later this year. Improvement??

The October BLS Jobs Report was well over expectations – which seems to me is the proximate cause of all this new belief the Fed will raise rates. I was surprised that the October report was as strong as it was. But the report is seasonally adjusted – and what IF the seasonal factors have changed this year. Basically, one month of data can not be viewed with blinders as there have been a series of disappointing jobs reports beginning in June.

One FOMC member stated this week “… as for the labor market, we’re on pace to add about 2½ million jobs this year …” Not sure this will be true.

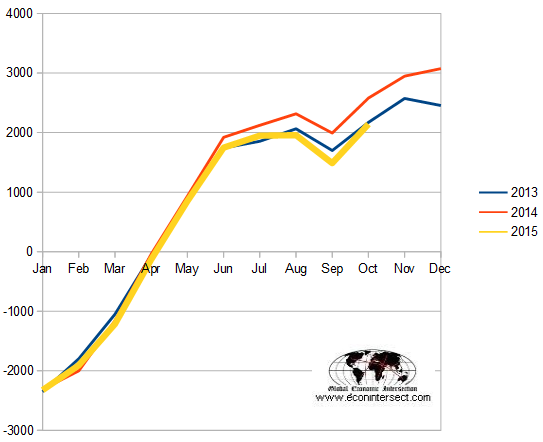

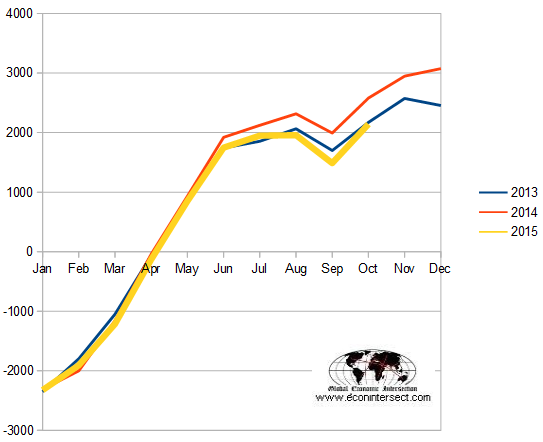

Cumulative Unadjusted Jobs Gains by Year (values times 1000 persons)

It should be obvious from the graph above that jobs growth is slowing. My guess is that the burst of jobs funds has been caused by Christmas and other year end seasonal purchasing starting a month early – and business ramping up to support this early surge. If I am right, November jobs report will be disappointing as this surge normally occurs in November.

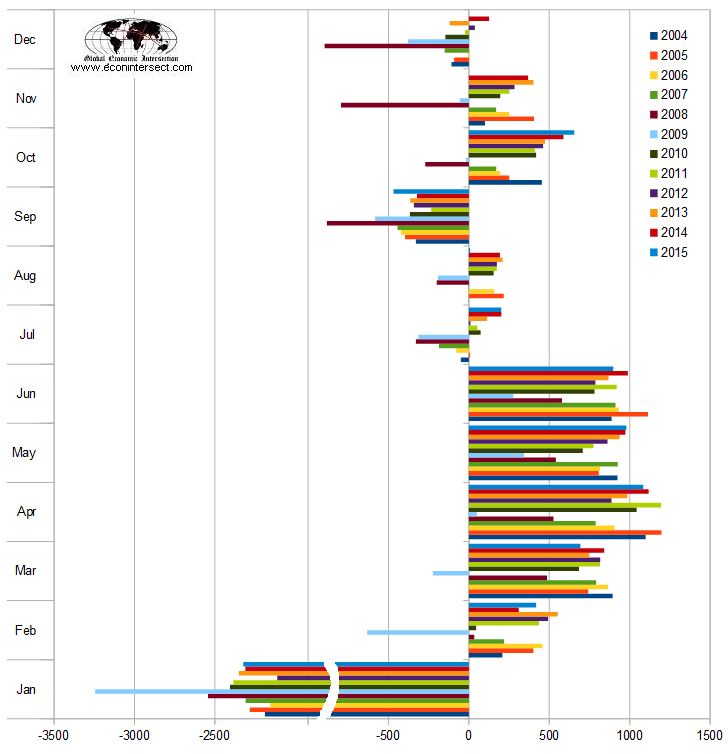

For those folks who like to stare at data (like it do) – the following chart shows the unadjusted gains or losses each month since 2004.

Unadjusted Jobs Gains or Losses by Month

My take from the above graph is that there is little evidence of a strengthening jobs situation. To make any argument, you must exclude data points which do not support your position.

It is hard to understand how the jobs situation is becoming normal. This same October Jobs Report showed the USA labor force participation rate (which measures the share of Americans at least 16 years old who are either employed or actively looking for work) is now at a 38 year low.

Leave A Comment