All Eyes on the Fed

Stocks have been wiggly-waggling along for the last few days. Just like the tail on a happy dog. Investors don’t know what to do…

And everyone is on the edge of his seat in anticipation of whether the Fed will raise interest rates at its policy meeting this week. This must be the most anticipated move by a central bank in all history.

Ms. Yellen, dispensing her imminent rate hike glare

Photo credit: Kevin Lamarque / Reuters

In a few days, Janet Yellen and her central banking cronies will decide whether to begin raising short-term interest rates. Supposedly, the six-year emergency is over. It’s time to help those interest rates up off the floor.

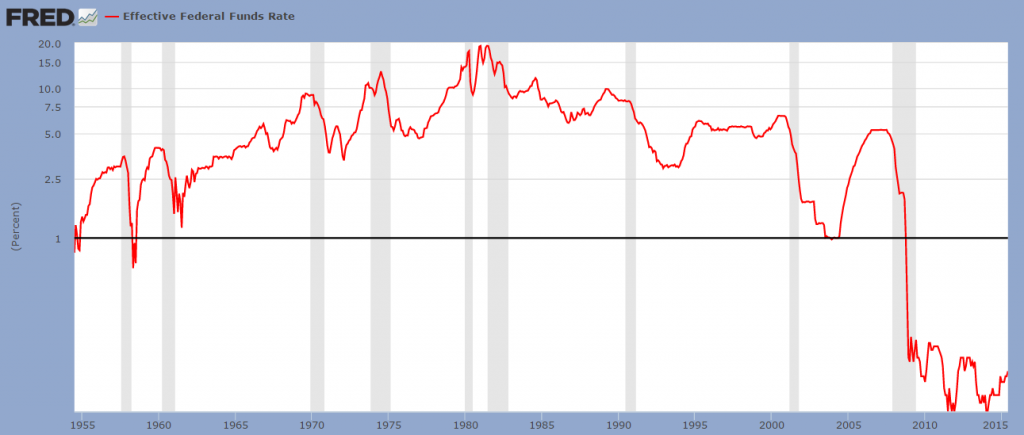

If the Fed does anything at all, it will probably do so little that it won’t make any real difference. Maybe an increase in the federal funds rate of one-quarter of a percentage point! (This rate is the “base” interest rate in the economy. It’s the rate at which banks lend reserves – aka federal funds – to each other, usually overnight.)

But most likely, the Fed will do nothing… because nothing is the safest thing to do. Yellen is well aware that there is always a last straw that breaks the camel’s back. Her main goal as Fed boss is to avoid being the one who puts it there.

Over the last six years, we’ve seen that fiddling with the price of credit does not really improve the economy. Japan taught us this a long time ago. And just as dropping interest rates to the floor doesn’t really help, raising interest rates by a trifling amount won’t hurt much either. That should be a comforting thought.

Effective federal funds rate, log chart (if not for the log scale, the moves over the past six years would look like the EKG of a dead body). Will it be hiked from nothing to almost nothing? . via Saint Louis Federal Reserve Research

But we say this with a bit of caution… Because it is also true that the Fed has put so much effort into backstopping asset prices, it may not be a pretty sight when investors realize that zero interest rates can’t go on forever.

Leave A Comment