The Things that Produce Real Wealth vs. Phantom Wealth

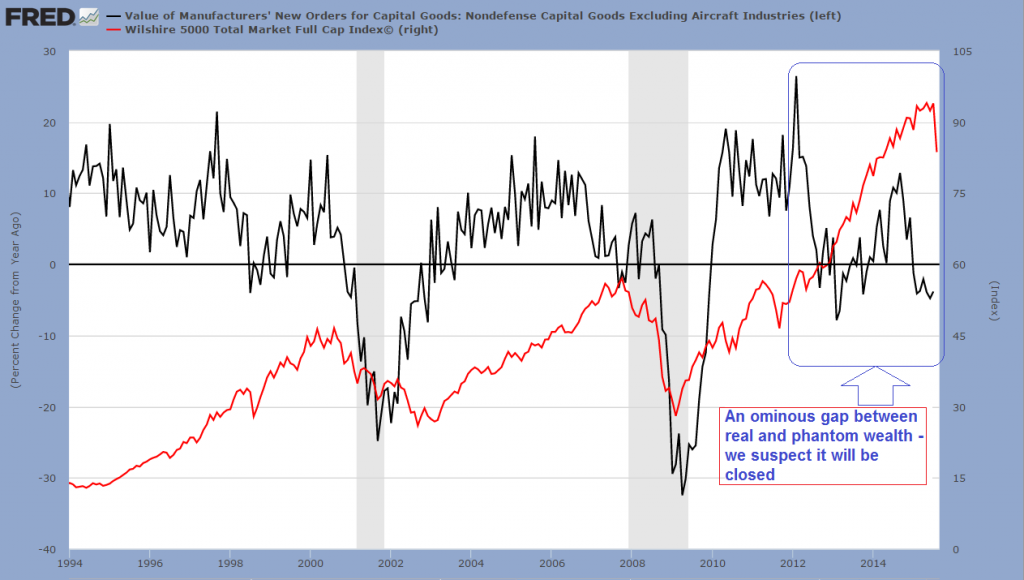

Our friend Michael Pollaro, the keeper of long-term data on the true money supply and author at Forbes as well as occasionally a guest author on this site, recently sent us the following chart of a relationship he keeps a close eye on. It depicts the annual change rate in new orders for non-defense capital goods and compares this series to the Wilshire total market index.

Photo via thedailysheeple.com

Annual change rate in new orders for non-defense capital goods and the Wilshire total market index – click to enlarge.

As you can see, there are slight leads and lags discernible near turning points, but there is no regularity to those that would allow us to make any definitive pronouncements on which trend is likely to lead the other. It is however clear that the two series are often directionally aligned (or to put it more simple: economic expansions and contractions often coincide with rising and falling stock prices).

What is interesting about the current situation is that the stock market is usually supposed to be forward-looking (it isn’t, at least not anymore, but this is still widely assumed – see our previous missive on this topic), but evidently, people are buying fewer of the things that are actually needed for future real wealth generation. Further below you will see that things are a bit more complicated than they look at first glance though – what is at work here is that in some industries, businessmen have just realized that they have malinvested their capital. Anyway, a noticeable gap has opened up between these two series, and it will likely be closed one way or the other. Note by the way the eerie similarity in the recent behavior of new orders and the stock market to what happened near the end of the 1990s stock market mania.

Dangerous Advice

When house prices and stock prices rise and these items are traded back and forth between people at ever higher prices, no new wealth is created (note here that one must differentiate a bit between a general rise in stock prices and moves in individual stocks, which can happen for very good reasons). On the contrary, to the extent that these higher prices prompt misguided investment decisions, they will end up consuming capital and destroying wealth. As a rule, they are merely a symptom of monetary inflation. In fact, the vast bulk of the stock market’s rise over the past century has to be attributed to monetary inflation.

Leave A Comment