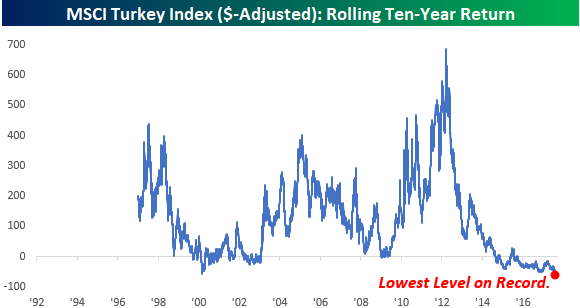

If you’re like us, the constant talk about Turkey is getting about as tedious as the days after Thanksgiving when you are about to have your third or fourth sandwich of the weekend and you’re still up to your eyeballs in leftovers. At the risk of beating a dead horse, though, we found it noteworthy that through last Friday, the MSCI Turkey index (in $-adjusted terms) had clocked in its weakest rolling 10-year return since at least 1997 (data for the index doesn’t begin until 1987). Prior to Friday, the record for the most negative rolling ten-year return in the MSCI Turkey index was a decline of 58.4% through 2/23/01, and Friday’s rolling 10-year return was a decline of 62%.

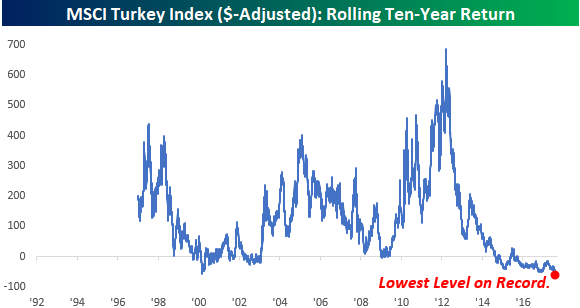

With rolling 10-year returns hitting such an extreme level, you would think that there’s enough ‘blood in the streets’ to warrant dipping a toe in, but if history is a guide, you may be best off taking your time. The chart below shows the performance of the MSCI Turkey index since the start of 2000 through the end of 2003. We have also marked 2/23/01 (the prior trough for rolling 10-year returns) with a red dot. Looking forward from that date, the MSCI Turley index went on to fall an additional 36% before it finally bottomed, and nearly two and a half years later in late July 2003, it was still right around the levels it dipped to in February 2001.

Leave A Comment