Over the course of the last several months, the consequences for Saudi Arabia of deliberately keeping crude prices suppressed in an effort to, i) bankrupt uneconomic producers in the US, and ii) pressure Moscow into giving up Bashar al-Assad have begun to make themselves abundantly clear.

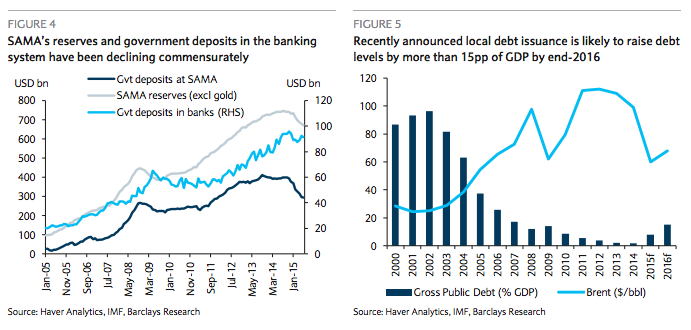

Not only has the kingdom been forced into liquidating its SAMA reserves…

… but the pressure from simultaneously maintaining the riyal peg and preserving the standard of living for everyday Saudis has driven Riyadh back into the debt market in an effort to offset some of the pressure on the country’s vast store of USD-denominated petrodollar assets (see second pane below).

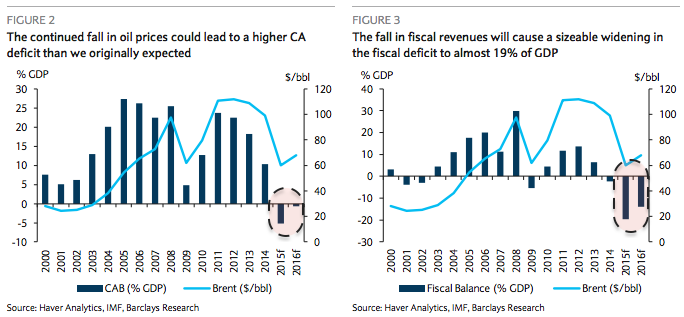

Meanwhile, the war in Yemen is also weighing on the budget and now, the Saudis are staring down a fiscal deficit that amounts to some 20% of GDP and the first current account deficit in years.

All of the above have caused to market to lose faith in Riyadh’s ability to keep the situation under control and now, S&P has downgraded the kingdom to AA- negative citing “lower for longer” crude and the attendant ballooning fiscal deficits.

From S&P:

We expect the Kingdom of Saudi Arabia’s (Saudi Arabia’s) general government fiscal deficit will increase to 16% of GDP in 2015, from 1.5% in 2014, primarily reflecting the sharp drop in oil prices. Hydrocarbons account for about 80% of Saudi Arabia’s fiscal revenues.

Absent a rebound in oil prices, we now expect general government deficits of 10% of GDP in 2016, 8% in 2017, and 5% in 2018, based on planned fiscal consolidation measures.

We are therefore lowering our foreign- and local-currency sovereign credit ratings on Saudi Arabia to ‘A+/A-1’ from ‘AA-/A-1+’.

Standard & Poor’s is converting its issuer credit rating on Saudi Arabia to “unsolicited” following termination by Saudi Arabia of its rating agreement with Standard & Poor’s.

Leave A Comment