“When beggars and shoeshine boys, barbers and beauticians can tell you how to get rich, it is time to remind yourself that there is no more dangerous illusion than the belief that one can get something for nothing.” – Bernard Baruch

“Sell in May and Go Away” – Wall Street Adage

While I’ve never once gotten my shoes shined, I do have my own version of the proverbial shoeshine boy who signals the top: my father-in-law.

He regularly provides a perfect contrary indicator: when he saws it’s time to buy something (like US stocks in 2008 or the US dollar at the start of this year), it’s inevitably time to sell and vice-versa. So you can bet when he started asking me about selling in May this weekend, my contrarian radar perked up.

The historic case for a seasonal headwind for US stocks over the summer months is well-established. According to the Stock Trader’s Almanac, the Dow Jones Industrial Average has generated an average annual return of only 0.3 percent during the six-month stretch from May through October since 1950. In contrast, the Dow has averaged a solid 7.5 percent gain from the months of November through April.

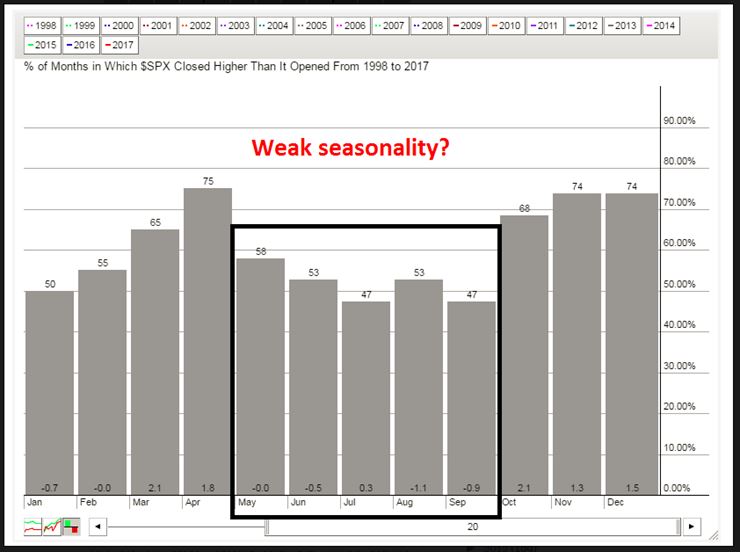

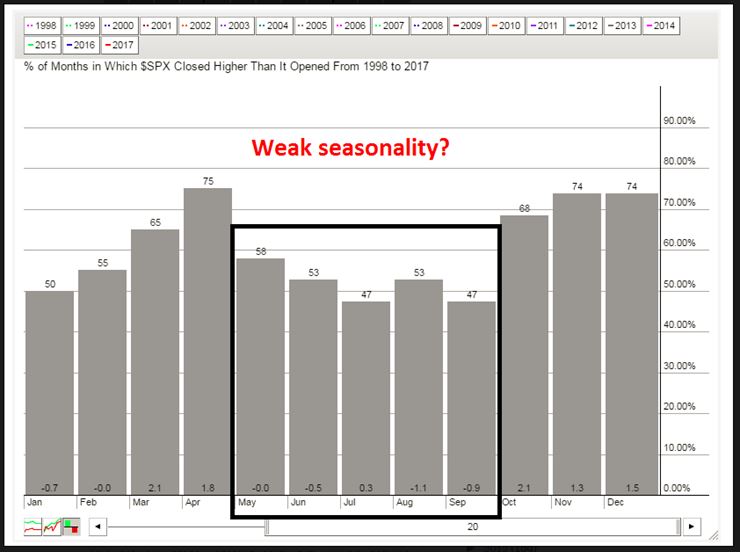

As the chart below shows, the stocks have historically struggled in the May-September period, with the S&P 500 rising only roughly half of those months over the last two decades, compared to closer to 65% of the time for the other seven months:

Source: Humble Student of the Markets

Like all seasonal patterns, the “Sell in May” heuristic doesn’t work all time, but the historical data shows a relatively strong tendency for stocks to struggle over the next 5-6 months. Indeed, This phenomenon is so well known that there’s actually a “Sell in May” ETF!*

From our perspective, the most interesting aspect of this phenomenon is the interaction between the annual “Sell in May” cycle and the well-documented 4-year Presidential Cycle. Recent research suggests that almost the entire underperformance of the May-October period since 1927 took place in the 3rd year of the Presidential cycle! In other years, the summer performance generally matched the other 6 months of the year.

Leave A Comment