Socially responsible investing (SRI). Environmental, Social, and Governance investing (ESG). Impact investing. And so on. These socially responsible investing concepts can be roughly described as portfolio strategies that allocate investment dollars based on ethical, social, sustainability, or other factors. This form of investment has become increasingly popular over the last decade (e.g., see the recent move by the Ritholtz gang into the space). Assets pursuing various flavors of these strategies are now measured in the trillions of dollars and index providers have been busy manufacturing products for this cause.

I respect the intention of those who pursue SRI and related approaches. If an investment approach makes one feel more comfortable with their portfolio and can improve their ability to maintain investment discipline, by all means — go for it. This post won’t debate the psychological benefits of the concept and won’t debate the performance characteristics of these approaches. Indeed, a significant amount of research has already been devoted to determining how these practices impact investment performance. Does investing with a conscience impose a cost on investors via dampened performance or does this form of investing reward investors with better returns? Thus far, the findings on potential cost/benefits appear mixed (see here and here examples of the debate). Notwithstanding, we believe there is a more important concern to be addressed:

Do socially responsible investment policies affect corporate decision-making?

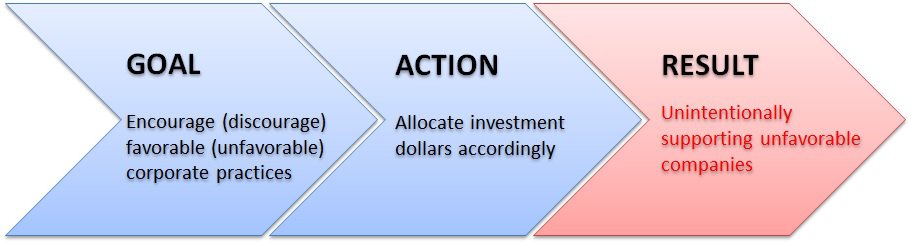

This question is important for a large population of socially responsible investors because the intent of these investment approaches is often to influence corporate behavior (e.g., discourage investment in oil and more investment in solar energy). See the figure below for a visualization of the process of socially responsible investing and the potentially flawed logic that this investment approach will influence corporate behavior.

Figure 1: Flawed Transmission Mechanism

Source: Aaron Brask Capital

I’m going to make a claim that socially responsible investing has little to no impact on corporate behavior, and may in fact make the situation worse! This article discusses the problem and suggests one simple methodology to potentially address the issue.

Socially Responsible Investing Background

Leave A Comment