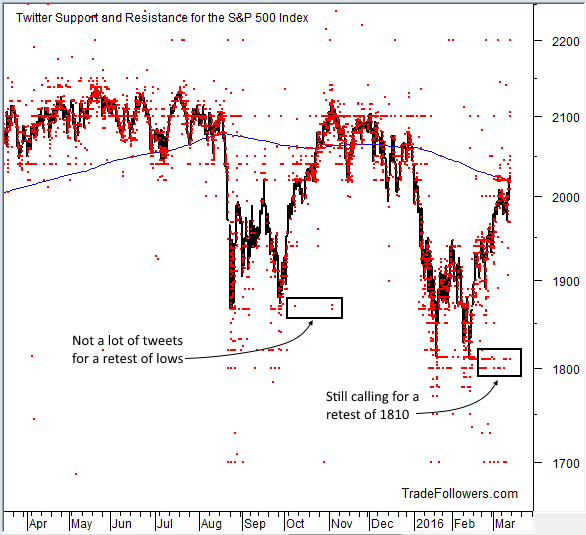

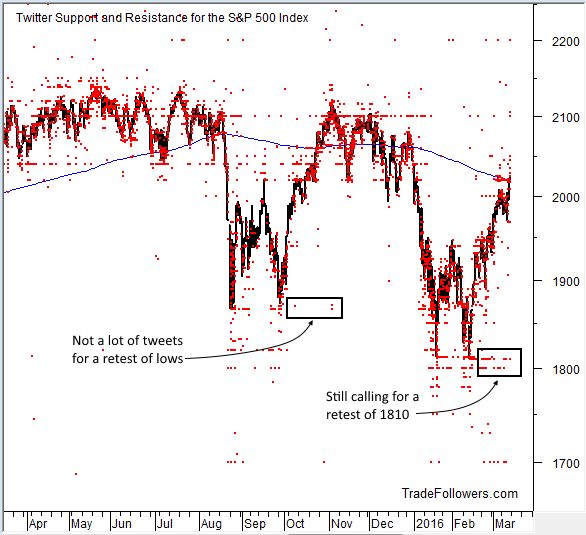

Last week I mentioned that the 200 day moving average for the S&P 500 Index (SPX) was what everyone on Twitter was talking about, and as a result, it should provide resistance. Well, we’re sitting right at that resistance so we should see some profit taking at the least. One thing of note, is that people on Twitter are still calling for a retest of the February lows. This is in contrast to the September 2015 low where traders started looking up. It suggests that fear is still lingering.

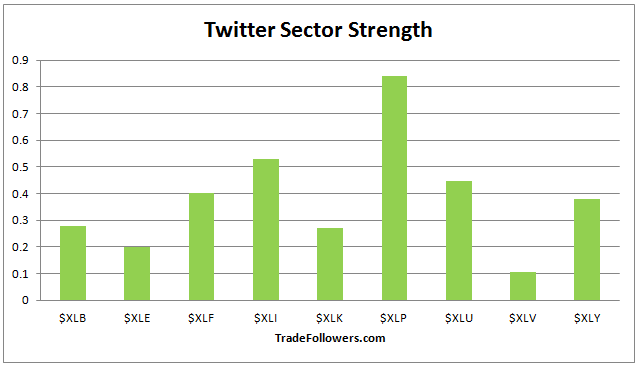

Another sign that we’re close to a short term top comes from sector sentiment. Almost every time in the past when all sectors were positive it marked a short term top. Every sector was positive this past week, so odds favor a decline this coming week. What I’ve observed in the past is that sector sentiment acts as an overbought and oversold indicator. The last oversold signal (all sectors negative) came in mid February, just as the market was bottoming… which was a very good call.

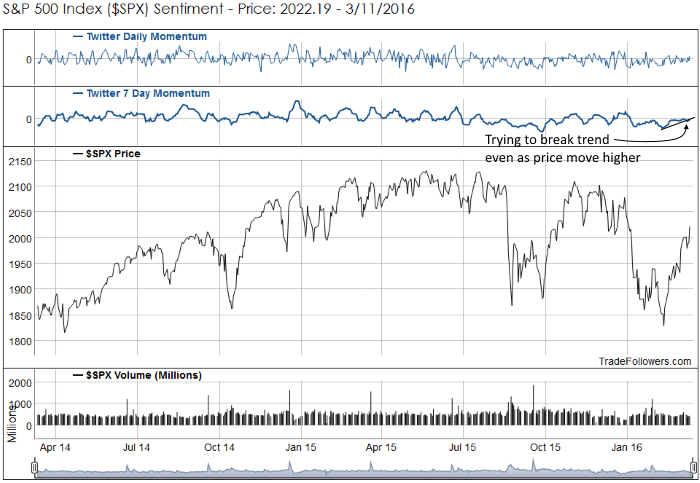

7 Day momentum has turned back down below zero and is starting to break its confirming uptrend line. This also suggests that traders are selling into this rally.

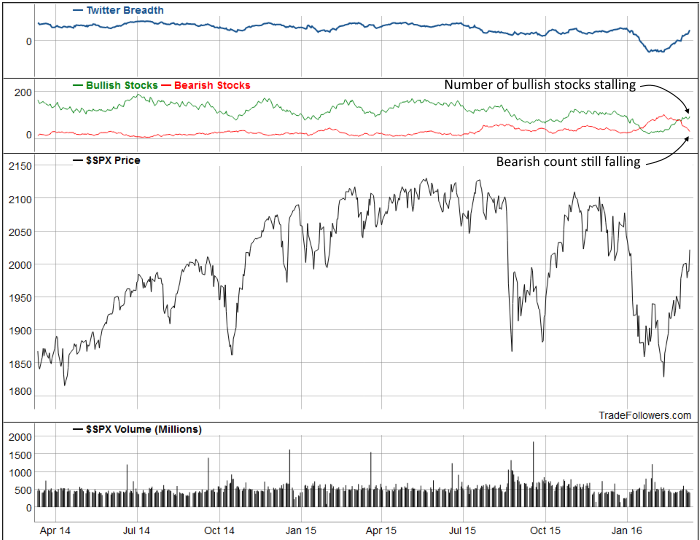

Breadth between bullish and bearish stocks continues to climb due to a fall in the bearish count. The bullish count is starting to stall, which suggests traders are no longer finding new buying opportunities, another small sign that a short term top may be near.

Conclusion

We should be close to a short term top. SPX has reached most traders price target at the 200 dma, sector sentiment is overbought, 7 day momentum is rolling over and breaking trend, and the number of bullish stocks is stalling. Expect some weakness this week.

Leave A Comment