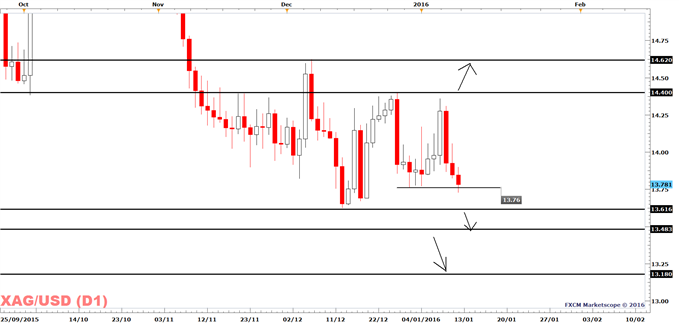

With the breach of the December 30 low of $13.76, and gold prices expected to soften in the coming days ahead, we may see lower silver prices and a breach to the key 2015 low of $13.61. A break to this low will probably encourage more sellers, as a break to this level opens the door for a decline to the August 19 low of $13.48. The reasons for the softer silver prices are mainly a stronger dollar and stock markets clawing back some of last week’s losses. As an example, the S&P 500 is now trading above yesterday’s high. This reduces the need for haven assets such as silver and gold.

From a trading perspective, a break to the 2015 low of $13.61 is the most interesting scenario, as a break to this level will hopefully ensure a valid breakout. A bearish breakout is also in line with the idea that the USD will gain in 2016 as the Fed hikes rates.

If a break does not materialize, then silver prices may reach $14.25 over the next few weeks, but as long as price is capped at $14.40 I will remain bearish (as has been the case since December).

Silver | FXCM: XAG/USD

Created with Marketscope/Trading Station II; prepared by Alejandro Zambrano

Leave A Comment