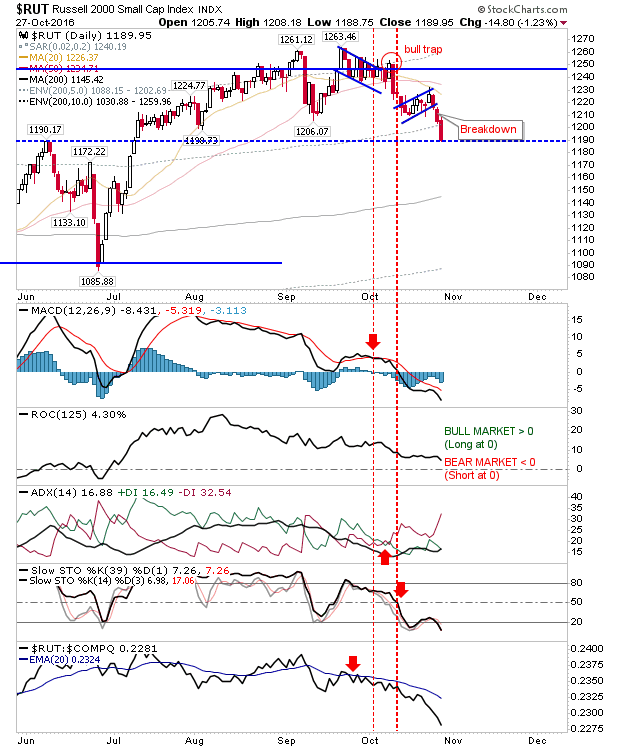

After failing to build a swing low at September’s lows, the Russell 2000 went the other way..fast. The breakdown has moved out of the consolidation which has been in play since July, opening up for a retest of the June swing low at 1,086. Technicals are heavily oversold, so a reaction bounce, potentially from the open, would not be surprising.

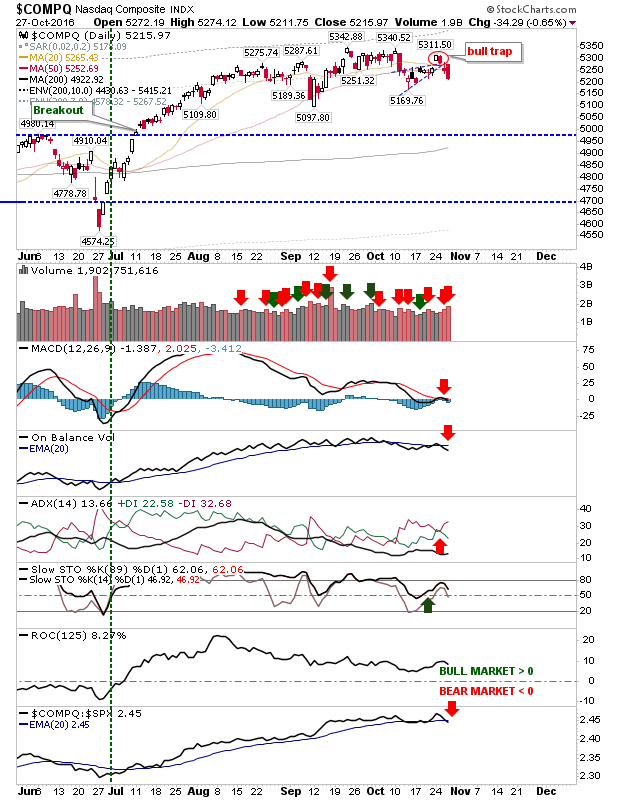

The Nasdaq is felling the pinch. The upside break from the (then) bearish rising wedge had looked to catch shorts on the short, but this has since turned against bulls and now has bears looking to gain an advantage. While yesterday’s losses were well defined and came with ‘sell’ triggers in the MACD and On-Balance-Volume, with a relative swing against the S&P, price action remain inside the August-October consolidation. A loss of 5,097 would be needed to turn summer buyers into sellers.

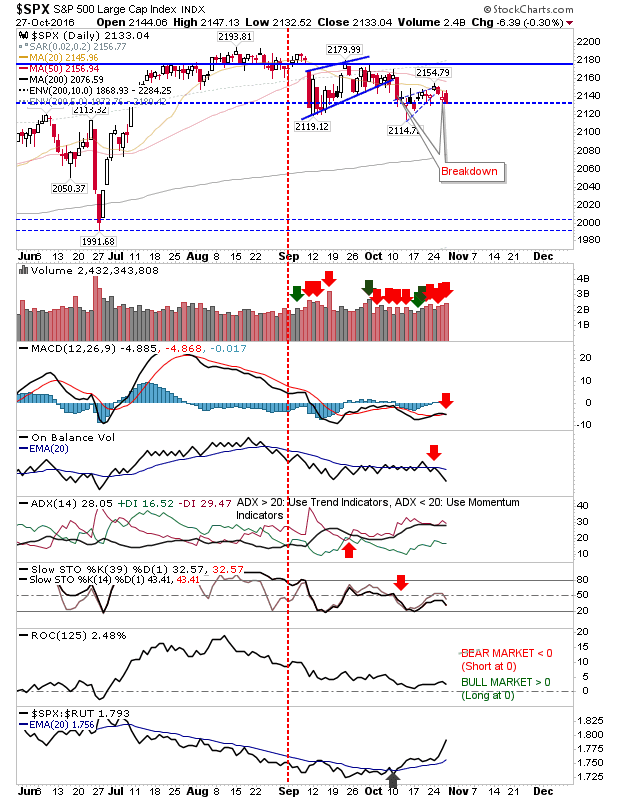

Large Caps had their worst day on Thursday, but it didn’t cause too much real damage (compared to the position of the Russell 2000 and Nasdaq), and relative performance suggest it’s benefiting from a flight-to-safety. The problem is if this safety is not perceived to be so safe anymore…

For Friday, look for some relief buying/profit taking by shorts, but I suspect shorts will again look to attack the rally as the chance for new all-time highs looks to be drifting ever further away. Remember, this is one of the longest running cyclical rallies from March 2009 (the latter, I still consider to be a generational/secular low), so I would like to see a 18-30 month run of weakness to reset the cyclical rally count. February’s losses were almost enough to kick start the process, except there wasn’t enough of a fall from all-time highs to suggest a start of new down trend.

Leave A Comment