New home sales surged in April to 619k SAAR. That was the highest rate, by far, since January 2008 more than eight years ago. It was also the biggest monthly gain in twenty-four years, which either suggests home sales are more than rebounding or casts doubt upon the quality of the data. Economists left no uncertainty as to which way they are leaning:

“Consumers are taking the leap and buying the biggest of big ticket items of their lives and this speaks to confidence. The Federal Reserve can raise rates at their June meeting without fear the economy is going to slow,” said Chris Rupkey, chief economist at MUFG Union Bank in New York.

Though the overall article contained the obligatory credentialed optimism full of such glowing sentiment, it did also include a small cautionary note about the data itself. Admitting both how this one month spike was out of place and that its signal foundation wasn’t actually home sales at all, the implications argue maybe toward more reasonable skepticism.

New home sales increased broadly, with the exception of the Midwest. April’s increase, however, probably exaggerates the housing market strength given that homebuilders confidence has stagnated since rising in January.

New home sales are extremely volatile month-to-month and preliminary figures are subject to large revisions because they are mostly drawn from building permits data.

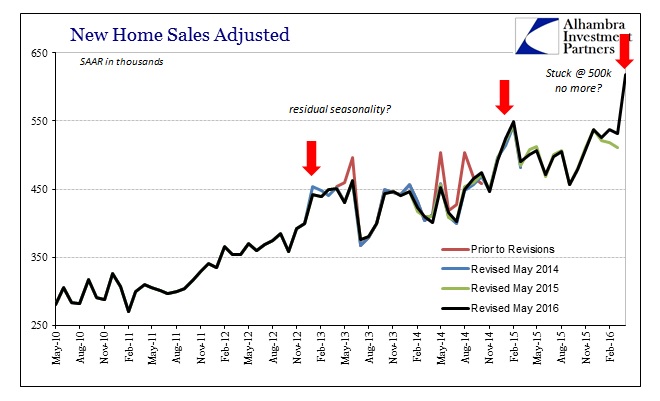

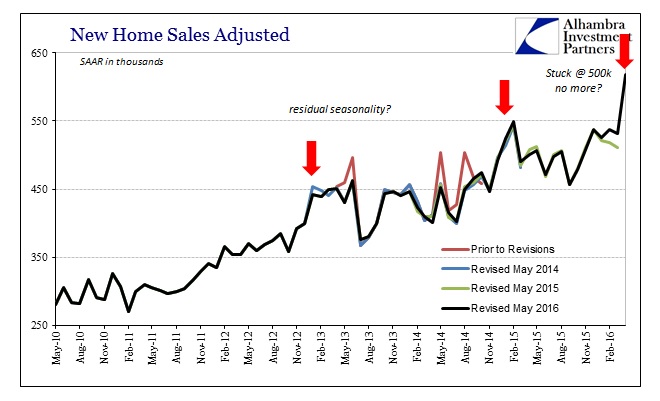

These are not the estimated count of actual new home sale but rather a stochastic process to estimate that number based on other inputs of related factors. That means we have to rely on both the statistics as well as those factors (which are also statistical estimations). Even with the latest benchmark revisions, the seasonally-adjusted SAAR’s for the past few years during the overall economic slowdown period have started to exhibit what others have called in the GDP context “residual seasonality.” In other words, it has become a regular occurrence that new home sales figures jump significantly around year-end (the exception being 2014).

It doesn’t necessarily mean that home sales are not rising, even at regular intervals, only that we might want to be careful before extrapolating an unknown quantity into “without fear the economy is going to grow.” This has been a consistent ritual, as noted yesterday about the uneven trajectory of PMI’s. It seems that the non-recessionary pattern of the slowdown has led to not just overheating extrapolations of dubious data but even perhaps curious exaggerations within the data itself.

Leave A Comment