Stock Predictions

As a continuation of our back-test report series, previously focused on daily trading, recent developments on the utilization of I Know First’s AI-based forecasting signals for less frequent systematic trading are presented in this article. These are highly performing and scalable strategies, average holding period of 4.5 to 30 days, that are suitable for mutual fund products and other investment vehicles. Certain constraints were applied to the short positions (total <=15%) and each individual position (<=10%) to take typical requirements of mutual funds and alike into account.

Short-term oriented strategy

Model: short-term

Avg. holding period: 4.5 days

Type: Long/Short (Short<=15%), max 10% per position

I Know First’s short-term signals are applied with a “consistency” trigger in the 5-day forecast. The portfolio is dynamically adjusted to the daily updated forecasts (max holding period of 5 days), with focus on shorter time predictions as time elapses.

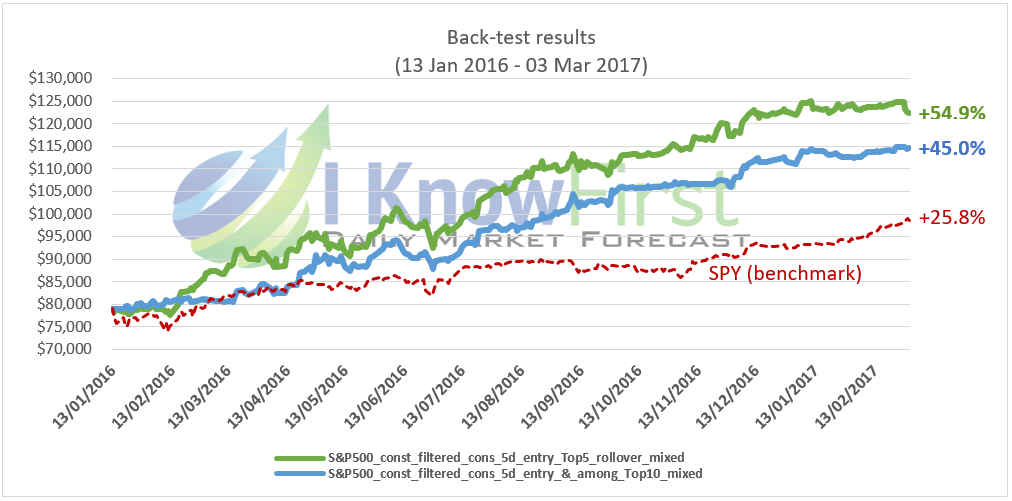

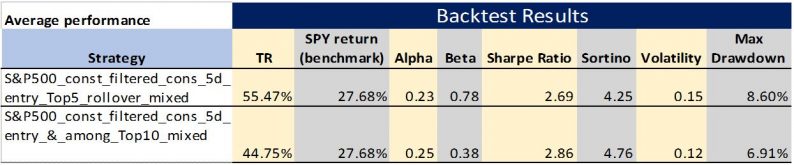

Below two variations are presented, with differentiation in the signal strength for the final trade qualification. Since the constructed portfolios are adjusted with respect to daily updated forecasts and the average holding period per position is around 4.5 trading days, the exact performance numbers depend on the starting dates. Therefore, average performance results are presented in the table below, with starting dates lying in the period between 12/01/2016 – 25/01/2016.

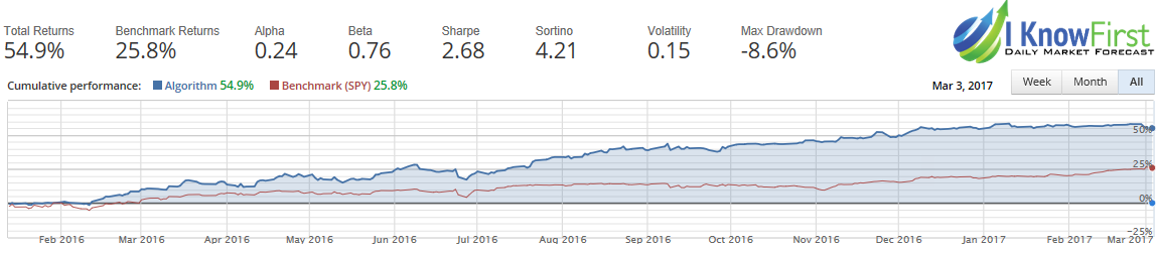

Both of the strategies are significantly outperforming the benchmark (SPY) on the risk-adjusted basis, with Sharpe Ratios above 2.5, and generate high alphas of 0.23 and 0.25, respectively. In the charts below the equity lines can be seen for the starting date 13/01/2016, assuming $ 80,000 of initial capital.

S&P500_const_filtered_cons_5d_entry_Top5_rollover_mixed

S&P500_const_filtered_cons_5d_entry_&_among_Top10_mixed

Leave A Comment