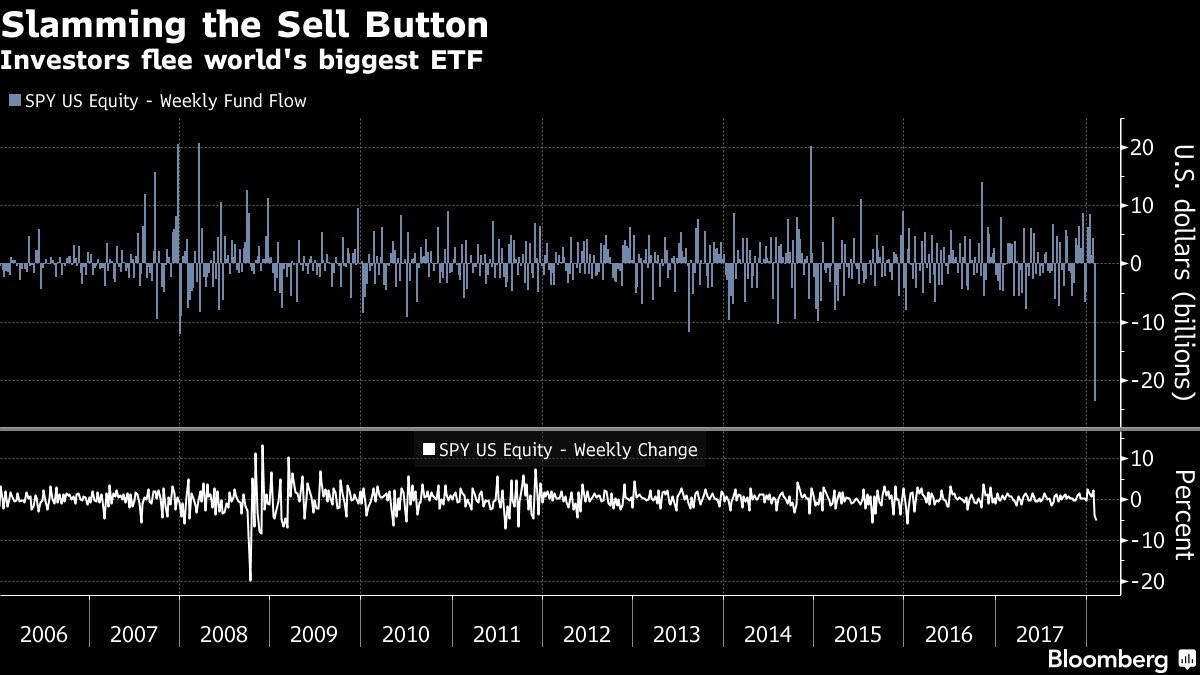

Record ETF Selling Last Week

As you can see from the top chart below, there was record S&P 500 ETF selling last week. Obviously, that’s an incomplete statistic because total ETF holding are much larger now than in 2008 during the financial crisis. The bottom chart tells the whole story as the percentage of total selling was much less than in late 2008. The selling was similar to the corrections in the summer of 2015 and the winter of 2016.

It’s important to point out that if you are trying to follow a passive strategy, you shouldn’t ever sell unless you need the money. I’m not saying that a passive strategy is better than an active strategy. That depends on how much skill you have. I’m saying that if you decide to be a passive investor, you shouldn’t be selling during corrections. That will be disastrous for your returns. If you are squeamish about losing money, you should adjust your diversification so that you are taking less risk. The best change to make would be to invest the new money you save into bonds, rather than selling your stocks. You lower the percentage of risky assets without selling them to avoid timing the market.

Stocks Rebound On Monday

Even though the 10 year bond yield remained at a 4 year high at 2.8548%, stocks rallied. This is consistent with my thesis that the higher yields would cause a volatility shock and maybe multiple compression, but not a bear market because earnings are growing too quickly. The short volatility trade has been great in the past two days as the SVXY is up 18% and the XIV is up 5%. The XIV was probably up less because it’s being closed by Credit Suisse. The VIX was down 9.6% to $26.27.

The S&P 500 was up 1.39% and the Dow was up 2.09%. It was a broad based rally as every sector was up. The materials and technology sectors did the best as they were up 2.09% and 1.79% respectively. Apple and Amazon had huge days as they were up 4.03% and 3.48%. Amazon was one of the stocks which got caught up in the selloff even though it had a great quarter. The stock was down 7.67% at the closing low even though it blew past earnings estimates. The stock still has a triple digit PE multiple, but that might change as AWS continues to grow. The company recently shuffled the deck to improve profitability as it fired a few hundred employees at its Seattle headquarters while hiring heavily in the Alexa and AWS business units.

Leave A Comment