Thoughts

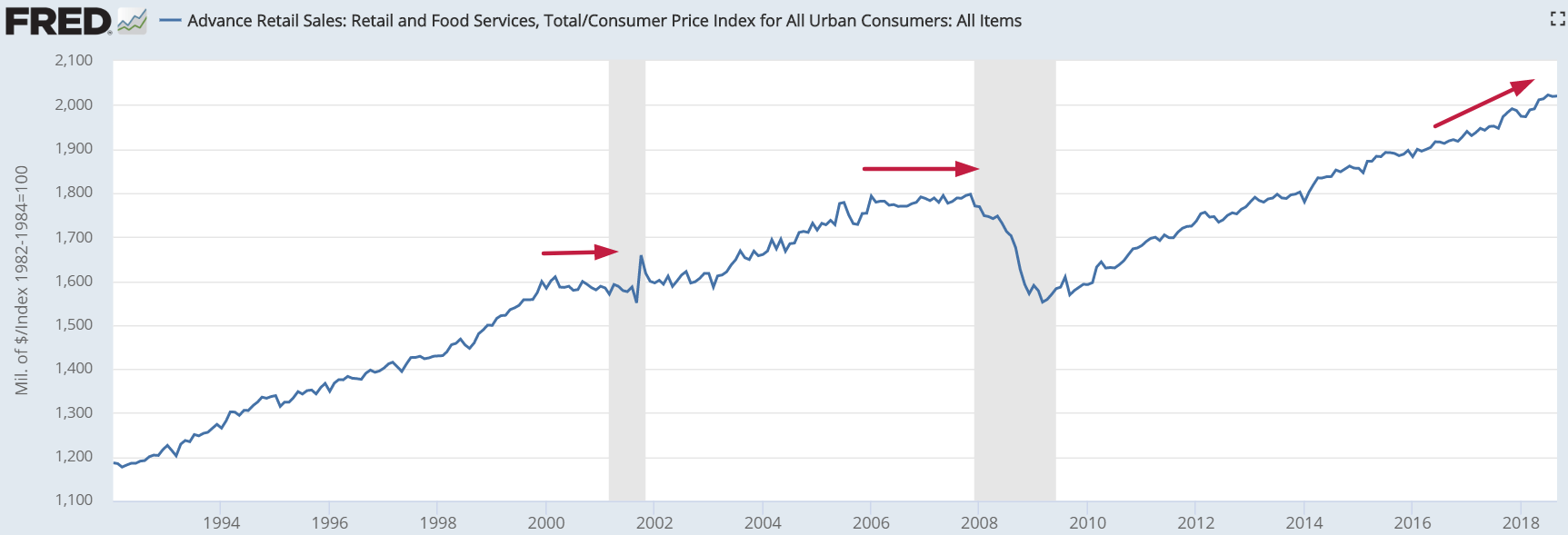

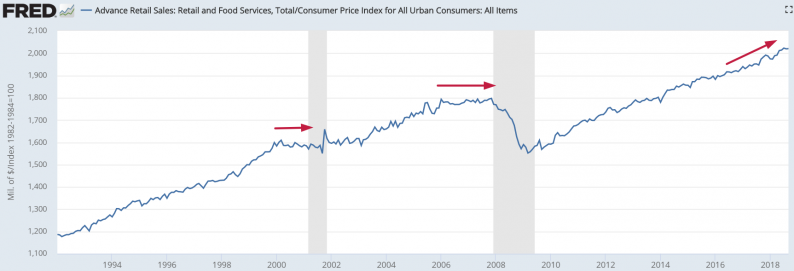

1 am: Inflation-adjusted Retail Sales are still trending higher. A medium-long term bullish sign for the stock market and economy.

Yesterday’s reading for inflation-adjusted Retail Sales went up a little. However, the key point is that inflation-adjusted Retail Sales are still trending higher.

This is a medium-long term bullish sign for the stock market because inflation-adjusted Retail Sales typically trend sideways before an equities bear market or economic recession begins.

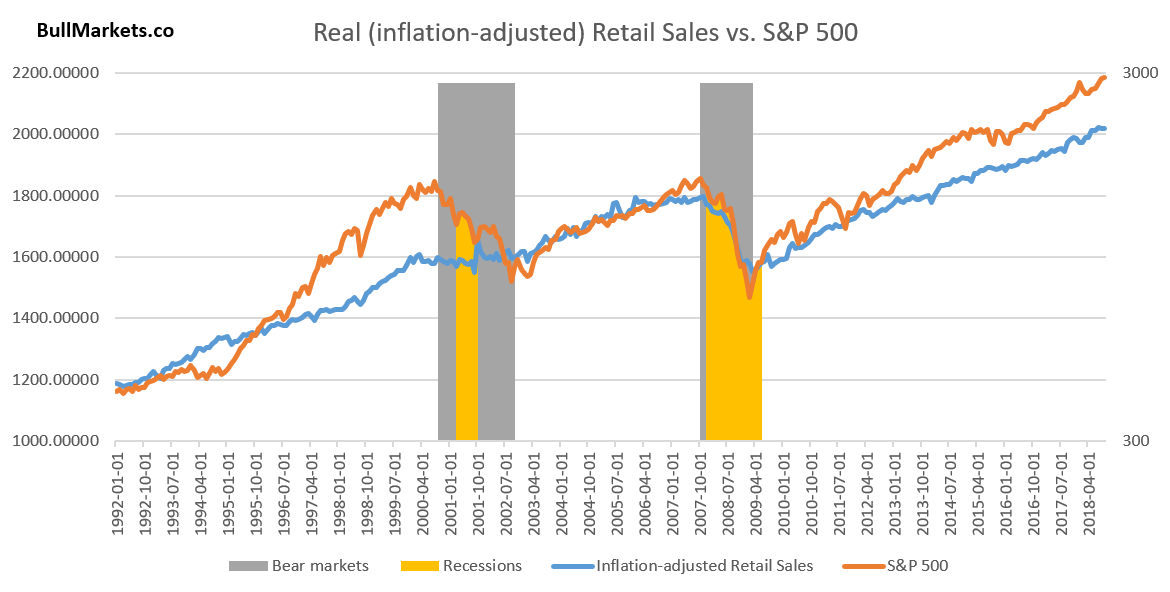

This chart demonstrates the positive correlation between the S&P 500 and Retail Sales.

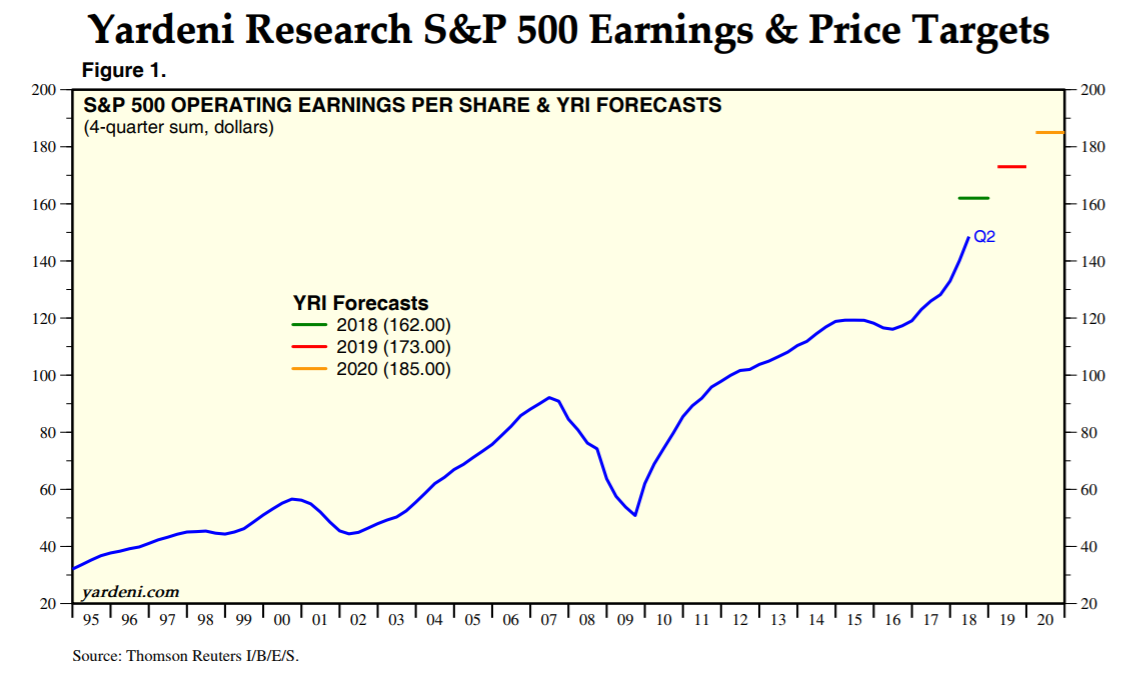

1 am: Ed Yardeni expects forward earnings to keep growing. A medium-long term bullish sign for the stock market.

The stock market moves in the same direction as the economy in the long run because the stock market moves in the same direction as corporate earnings in the long run (economy drives corporate earnings). Ed Yardeni’s forecasts for the S&P 500’s forward earnings are among the most accurate on Wall Street.

He expects earnings to grow throughout the rest of this year and next year. So even if earnings growth does slow down (which it will, because earnings growth surged in 2018 from the one-time Trump tax cut), this is still a medium-long term bullish factor for the U.S. stock market right now.

*You can see how earnings and the stock market peaked at the same time in the past.

1 am: Delinquency Rate is trending downwards. Medium-long term bullish for the stock market

Leave A Comment