The Bureau of Economic Analysis (BEA) revised upward fourth quarter 2017 Real GDP. The second estimate had been revised lower to 2.50458% (continuously compounded annual rate of change) from the advanced estimate. The third and final calculation raises the quarterly increase to 2.84707%. None of the changes are substantial.

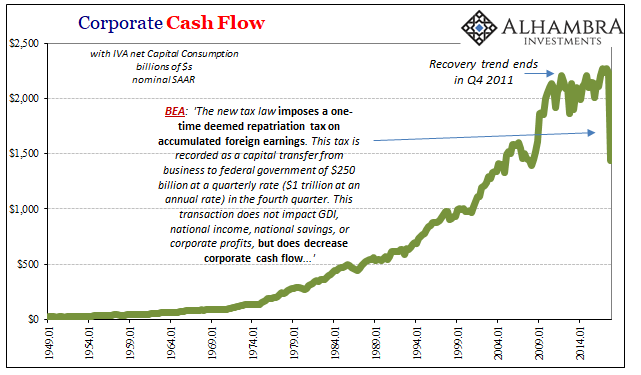

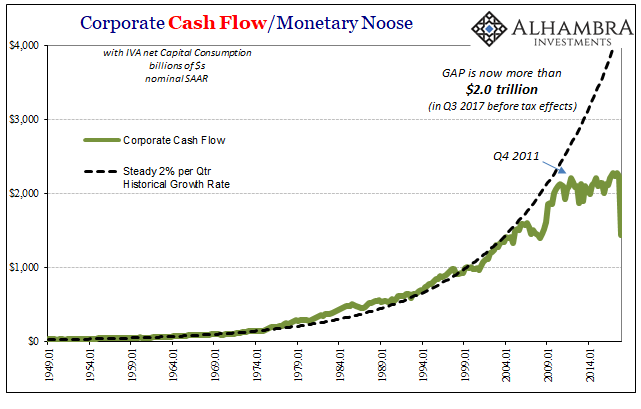

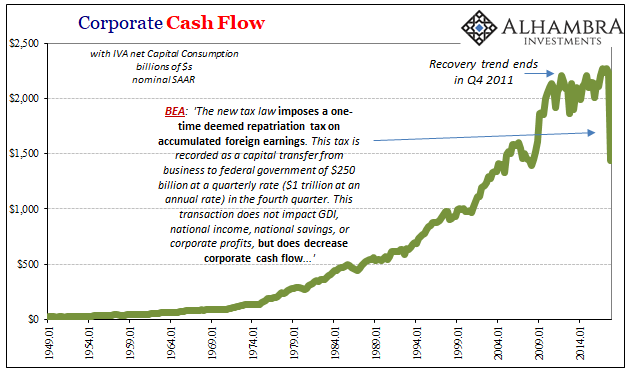

Accompanying these revisions are the BEA’s first assessments for Corporate Profits and Net Cash Flow during the quarter. The latter being one of the more descriptive and illuminating of data points over the past decade, Corporate Net Cash Flow plummeted 36% in Q4. From $2.2 trillion (SAAR) in Q3, the current estimate of $1.4 trillion indicated a radical departure.

Obviously, such a massive reduction isn’t likely to be anything other than a statistical issue or discontinuity. In this case, the tax reform law that was enacted at the end of last year is to blame. From the BEA:

The new tax law imposes a one-time deemed repatriation tax on accumulated foreign earnings. This tax is recorded as a capital transfer from business to federal government of $250 billion at a quarterly rate ($1 trillion at an annual rate) in the fourth quarter. This transaction does not impact GDI, national income, national savings, or corporate profits, but does decrease corporate cash flow…

Other parts of the tax law have had varying effects on other profit accounts. The Bonus Depreciation portion causes distortions in those with the lone exception of Corporate Profits w/IVA and CCadj (often called “profits from current production”).

The new tax law provides for full expensing of qualified investments placed in service after September 27, 2017 and before January 1, 2023 and increases the expensing limitation from $500,000 to $1 million. BEA’s estimate of profits from current production is not affected by the change; it reflects economic depreciation based on an estimate of the reduction in the value of fixed capital used in the production process.

Leave A Comment