T2108 Status: 17.1% (1st oversold close after 3 straight days dipping to or below oversold)

T2107 Status: 12.7%

VIX Status: 28.1 (overhead resistance held yet again)

General (Short-term) Trading Call: bullish

Active T2108 periods: Day #1 under 20% (oversold day #1), Day #28 under 30%, Day #44 under 40%, Day #48 below 50%, Day #63 under 60%, Day #404 under 70%

Commentary

I am not surprised that yet another oversold period has arrived; T2108, the percentage of stocks trading below their respective 40-day moving averages (DMAs) dropped to 17.1%. I AM surprised (and disappointed) that the S&P 500 (SPY) never even made it close to overhead 50DMA resistance as I had expected would happen before the next oversold period. The trading action resembles more and more a bear market as sellers persistently overwhelm buyers and crowd out rally attempts. The frequency of oversold periods continue pulling the trading action downward.

The S&P 500 closes at a fresh 2-year low as T2108 drops into oversold conditions.

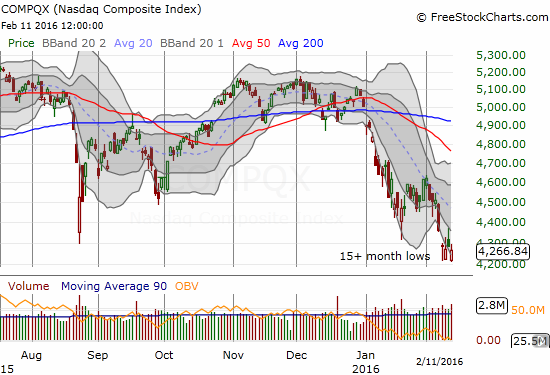

The NASDAQ (QQQ) looks ready to launch a fresh wave of selling as bears weigh heavily.

Once again the volatility index was somehow unable to close with a break of upper resistance from the intraday high in 2012. I would normally consider these failures indicative of underlying bullishness. However sellers have so far been too effective at squashing rally attempts on the S&P 500. Moreover, ProShares Ultra VIX Short-Term Futures (UVXY) still managed to print its highest close since October. As a result, the pre-Fed, anti-volatility trade failed miserably this time around.

U.S. Federal Reserve Chair Janet Yellen did not provide the market with the typical assurances that help drive volatility down. Instead, she mused about the possibilities of negative interest rates, insisted the Fed is still ready to hike rates this year, and did not yield to the market’s clear expectations that rate hikes are completely off the table for 2016. Still, I decided to reload one more time on UVXY put options and added to shares on ProShares Short VIX Short-Term Futures (SVXY) given the start of oversold trading conditions. I am waiting on the next round of call options on ProShares Ultra S&P500 (SSO).

Leave A Comment