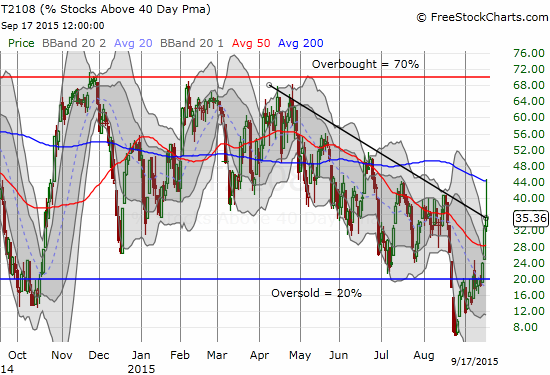

T2108 Status: 35.4%

T2107 Status: 25.7%

VIX Status: 21.1

General (Short-term) Trading Call: Bullish

Active T2108 periods: Day #3 over 20%, Day #2 over 30% (overperiod), Day #22 under 40%, Day #83 under 50%, Day #100 under 60%, Day #298 under 70%

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

SDS (ProShares UltraShort S&P500)

U.S. Dollar Index (volatility index)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

Commentary

Newsflash. Fed leaves rates unchanged. Just as Fed Futures have predicted for many, many weeks now despite punditry out there. $SPY $TLT

— Duru A (@DrDuru) Sep. 17 at 09:02 PM

The much anticipated Fedageddon, the September 17th decision on monetary policy from the Federal Reserve, was fundamentally anti-climactic. The market’s reaction did not turn the bullish thesis on its head, but it did create some very important technical setups.

T2108 surged as high as 44.8% before settling for a 35.4% close. I redrew the downtrend line in the chart below to match closes and emphasize how T2108 retreated from an extremely bullish breakout.

If T2108 quickly follows through on this potential breakout from its downtrend, it will be time to count down to OVERBOUGHT conditions.

The S&P 500 (SPY) followed the same pattern but it closed DOWN on the day. The negative close planted the S&P 500 right on top of former resistance now support from the highs formed during the oversold periods. The drop looks bearish but the better performance from T2108 forms a kind of bullish divergence. Moreover, the lower part of the former wedge is still sitting below ready to provide support.

The S&P 500 could not maintain its bullish breakout. The rising wedge still supports an eventually bullish follow-through.

Note VERY well that a Bollinger Band (BB) squeeze is starting to form on the S&P 500. The stakes are very high for the resolution of this squeeze. I am still leaning toward a retest of 50DMA resistance and then the 200DMA in coming weeks (or less).

Leave A Comment