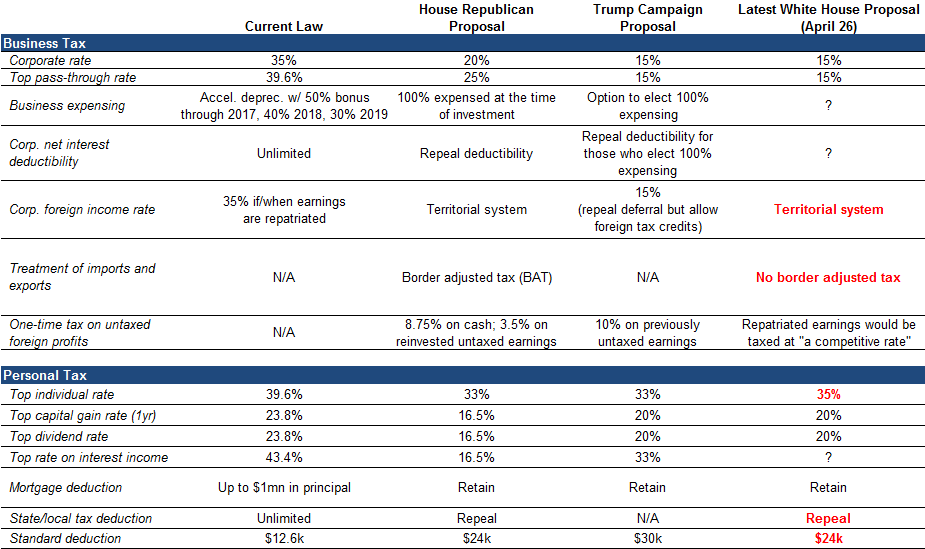

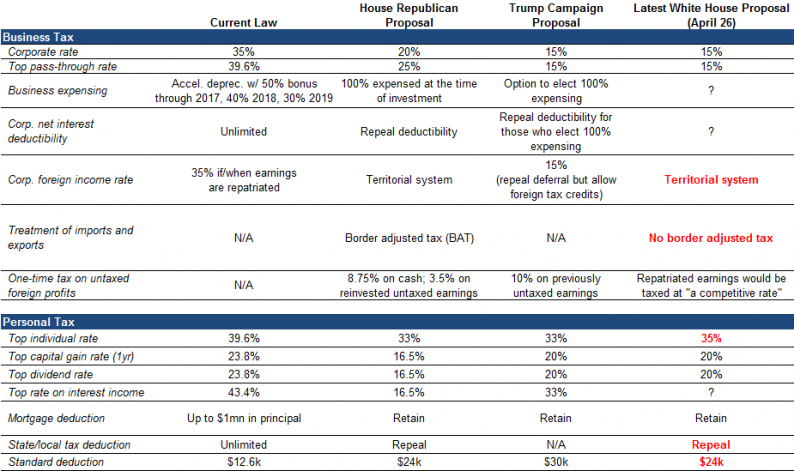

Last week President Trump announced his “tax plan” which discussed lowering the corporate tax rate, closing tax loopholes, reducing individual income tax brackets and increasing standard deductions. That table below, via Goldman Sachs, shows the comparison between current law and the various proposals.

President Trump campaigned on lowering taxes as a means by which economic growth could be jump started, and with Q1’s economic growth coming in at a meager 0.7% annualized, it would certainly seem to be needed.

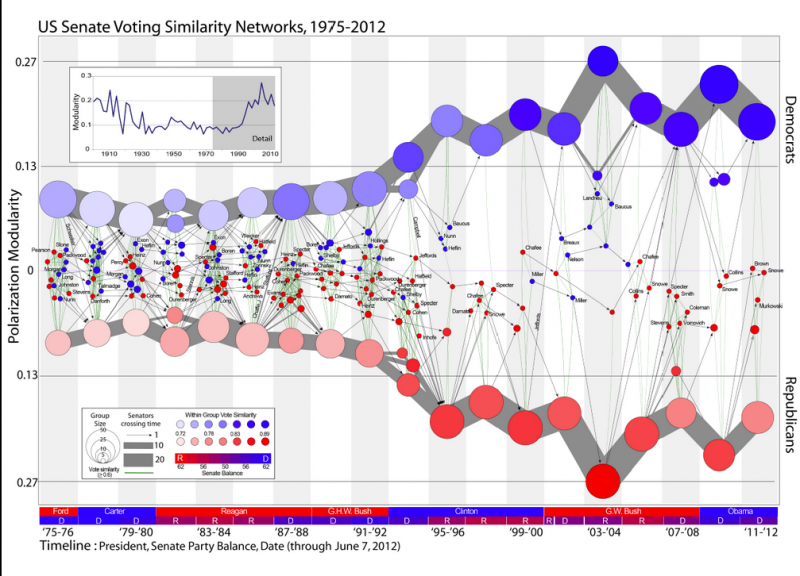

The issue of tax reform is not going to be an easy one. With such a deeply partisan government the probability of passing tax reform as currently proposed is extremely slim. Furthermore, while I do expect that some version of tax reform will eventually get passed, it will likely take much longer than most expect. The chart below shows the current chasm leading to the difficulty of getting anything accomplished in Washington.

But the question I want to address today is simply this:

“Do tax reductions lead to higher economic growth, employment and incomes over the long-term as promised?”

This is after all what is being promised. On Sunday morning, speaking to NBC’s Meet the Press, VP Mike Pence confirmed just that as he was confident that eventually, the deficit would decline as it would be overcome by economic “growth” thanks to the tax cuts it will fund.

Simple. Right?

Maybe not. The reason is that a tax-rate reduction is quickly absorbed into the economy. Let’s look at the following simple example:

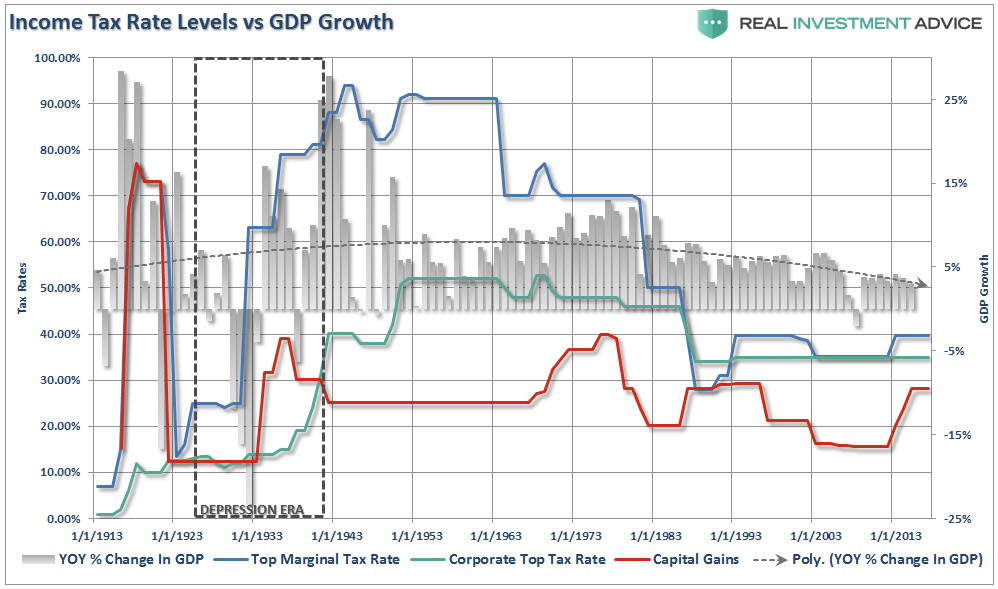

As shown in the chart below, changes to tax rates have a very limited impact on economic growth over the longer term.

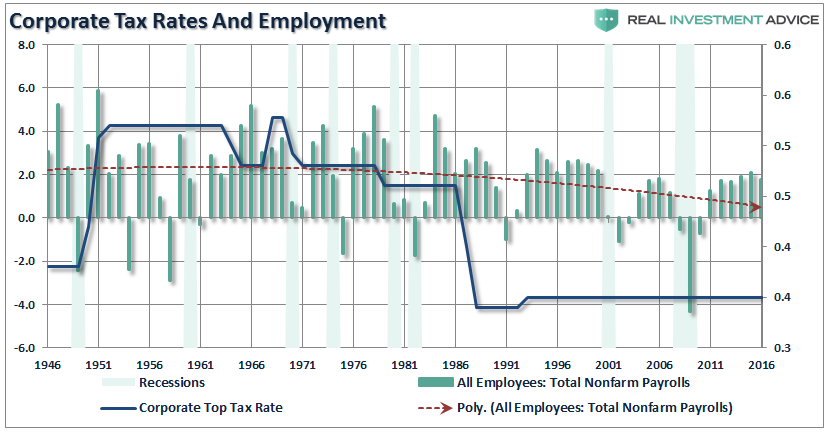

Furthermore, it is believed that tax cuts will lead to a boom in employment. The chart below shows the corporate tax rate versus employment back to 1946. Corporate tax levels create employment change at the margin. If you look at the chart you will notice that when corporate tax rates are reduced employment did marginally increase but only for a short period of time.

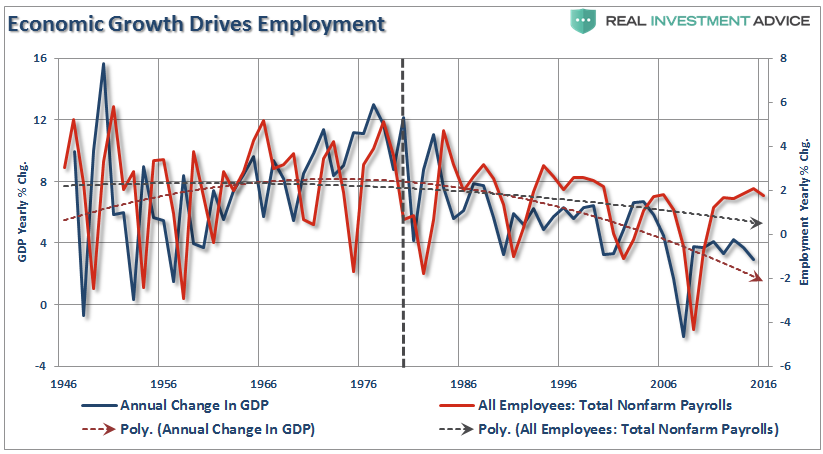

What drives employment is sustainable economic growth that leads to higher wages, increased aggregate demand and higher rates of production. In other words, employment adjusts over time to respond to the strength and direction of the economy rather than the movements in tax rates. The chart below shows economic growth versus employment.

Do not misunderstand me. Tax rates CAN make a difference in the short run particularly when coming out of a recession as it frees up capital for productive investment at a time when recovering economic growth and pent-up demand require it.

Leave A Comment