The month of March marks the beginning of Spring. Interestingly, given one of the warmest winters on record, spring flowers have already been in full bloom. However, for investors, it has been a different story as volatile and declining markets have frozen many to inaction.

Important Note: Speaking of weather, last year, the BEA adjusted the “seasonal adjustment” factors to compensate for the cold winter weather over the last couple of years that suppressed first quarter economic growth rates. (The irony here is that they adjusted adjustments for cold weather that generally occurs during winter.) However, the problem with “tinkering” with the numbers comes when you have an exceptionally warm winter. The new adjustment factors, which boosted Q1 economic growth during the last two years will now create a large over-estimation of activity for the first quarter of this year. This anomaly will boost the “bullish hope” as the onset of a recession is delayed until those over-estimations are revised away over the course of the next year.

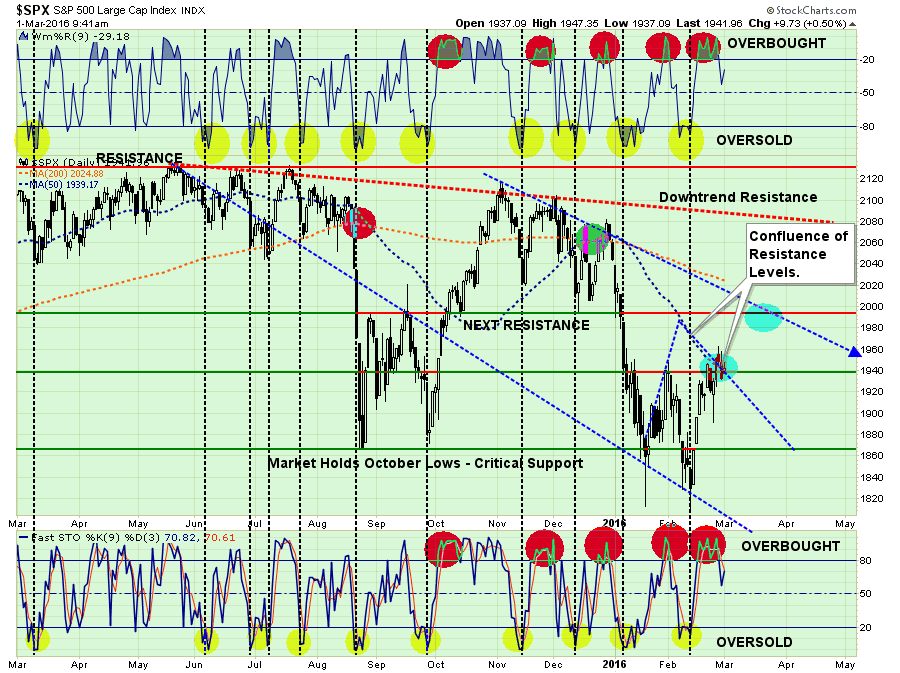

Currently, many of the bearish trends that existed going into February have persisted, and in many worsened, over the last month. As I wrote at the beginning of last month:

“Those two factors [end of January rebalancing and BOJ negative rate announcement] pushed the markets higher on Friday, and as shown below, broke the markets out of the recent consolidation near critical support.That was the good news.”

(Chart updated through today’s open)

The bad news comes from the overbought / oversold indicators again as we head into March. To wit:

“The oversold condition that once existed has been completely exhausted due to the gyrations in the markets over the last couple of weeks. This leaves little ability for a significant rally from this point which makes a push above overhead resistance unlikely. Just as an oversold condition provides the necessary ‘fuel’ for an advance, the opposite is also true.”

Leave A Comment