As you know, we’re wary of the US stock market at current valuations.

But we like to keep an open mind. Which is why we persuaded former hedge fund manager and editor of Mega Trends Investing Teeka Tiwari to share his controversial thesis with Diary of a Rogue Economist readers.

Even with the market near all-time highs, Teeka says the S&P 500 is about to launch a brand-new leg skyward…. and will keep pushing higher for another 14 years.

The Best Long-Term Stock Market Indicator I’ve Found…

By Teeka Tiwari, Editor, Mega Trends Investing

If history is any guide, the US stock market is going to begin pushing higher in a few months… and will continue for another 14 years.

An extraordinary amount of wealth will be created. We will see stock market returns at least seven times higher than what we’ve seen since 2000.

How do I know this?

I have an indicator that is so reliable it has foretold market cycles – including booms and busts – decades in advance. It’s predicted every secular bull and bear market since 1920.

And it’s telling us right now that we are on the cusp of a period of massive wealth creation.

A New Secular Bull Market

First, I need to make sure you understand the definition of a “secular” market.

It is a long-term “one-way” directional move in the stock market that lasts between 12 and 20 years. Since 1900, we have had seven of these – alternating secular bull and bear markets.

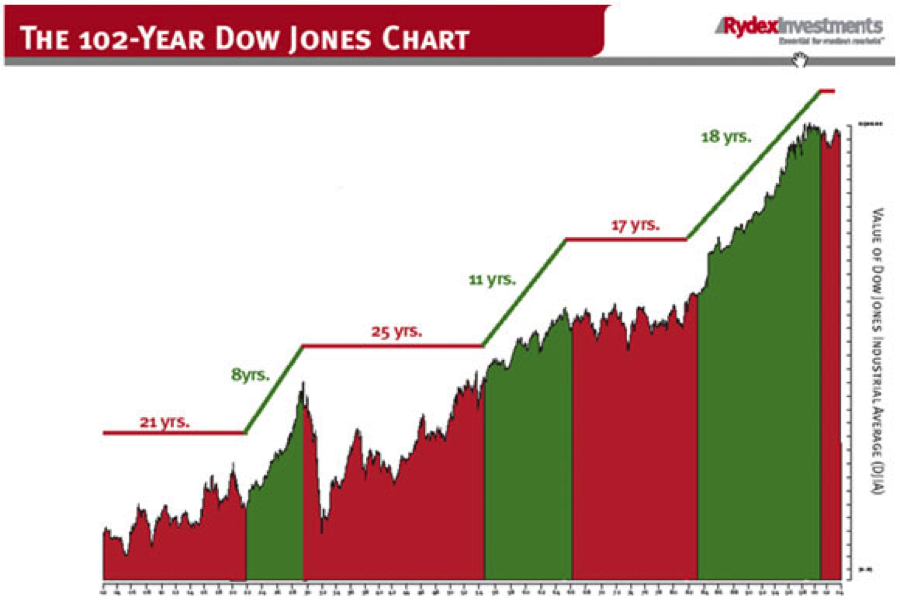

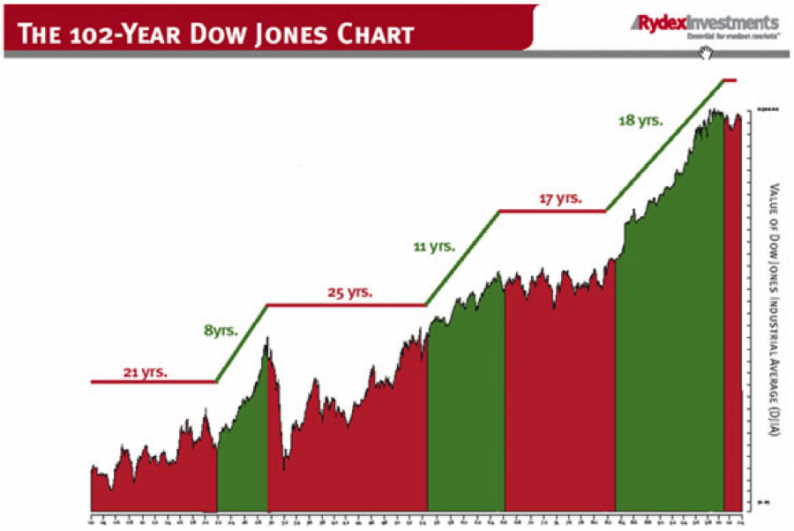

This 102-year chart shows what these secular markets look like…

The red portions are secular bear markets – when stocks trade sideways or down for an extended period. The green areas show secular bull market periods – when stock prices rise.

But here’s the thing about “secular” markets – within them, we also have shorter market cycles, called “cyclical” markets. This means we could be in a long-term down market (a secular bear market) but enjoy a shorter-term up market (a cyclical bull market).

Leave A Comment