Despite many promises, there has been no sustainable economic recovery. The United States, and the developed world for that matter, have made repetitive attempts over the last 16 years to return economic growth to the pace of years long past. These nations are stuck in a cycle in which hopes for economic “escape velocity” get crushed by economic recession and asset price collapse. Following each failure is an increasingly anemic pattern of economic growth accompanied by rising mountains of debt, which ultimately lead to another failure. The perpetual excuse from the central bankers is that not enough was done to foster “lift-off”. In their view, lower interest rates, more fiscal spending and additional quantitative easing will eventually provide the needed spark that will cause the economic engine to fire on all cylinders. In the profound words of Mark Twain, “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

What follows in this article is evidence that current economic policy is not simply flawed in its logic and application but actually destructive. As should be evident to all by now, these experimental monetary and fiscal policies provide short term economic relief but only serve to exaggerate the problems they claim to solve. The elegant Virtuous Cycle that propelled western economies to prosperity has been quietly dismantled and replaced with an unproductive imitation. This new, Un-Virtuous Cycle euthanizes discipline and prudence in exchange for the immediate gratification of debt-fueled consumption.

The Virtuous Cycle

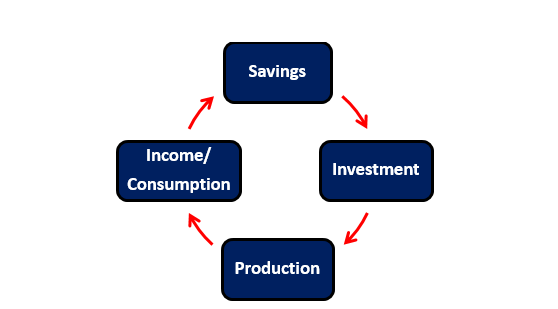

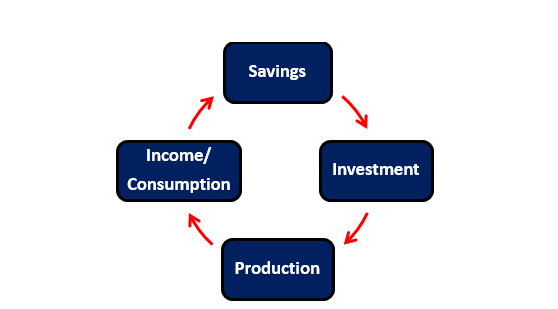

One of the primary differentiating characteristics between rich and poor countries is the presence or absence of physical capital in the form of abundant sophisticated machinery and equipment. These productive assets are accumulated through savings (individual or institutional) which is converted to investment in physical capital. In the natural order, there is a sequence of events properly characterized as The Virtuous Cycle (illustrated below). It is an identity associated with sustainable productive output and growth.

Saving, or simply the discipline of consuming less than one earns, is a prerequisite for capital accumulation and the chief requirement in the Virtuous Cycle. The amount of saving determines how much investment will take place. Investment in new property, plant and equipment – better tools – fuels new and improved forms of production and leads to increased productivity and enhanced income. Higher incomes increase consumption and produce higher levels of savings, so economic prosperity continually grows. This cycle enables us to produce things of greater complexity than we otherwise could, and thus advance productivity, income and prosperity.

It is logical therefore that government and central bank policies should focus on promoting a healthy savings rate. However, over the last several decades we have seen the exact opposite. Central bank policy dismembers the Virtuous Cycle by punishing savers.

Two Primary Factors of Economic Growth

Leave A Comment