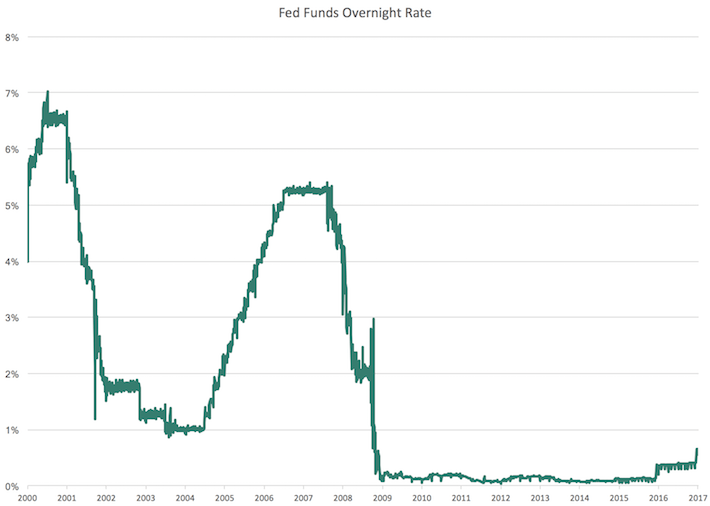

On December 14, the Federal Reserve announced that they were hiking the Fed Funds rate by 0.25%. This is the rate that financial institutions lend money to each other overnight and has a trickle-down effect other interest rates in the domestic economy.

This increase is indicative of a larger trend – it comes after an equal-sized interest rate increase in December 2015. Further, the Federal Reserve indicated in the announcement to expect 3 additional hikes over the next twelve months.

If each of the 3 hikes in 2017 will be of the same magnitude, then the year will finish at a 1.5% Fed Funds rate. This presents a dramatic change to our interest rate environment given that short-term rates have been held near zero since December of 2008 to provide economic stimulus.

Investors should make themselves aware of the effects that these rate increases may have on their portfolio, as interest rates have a large effect on the price of real assets.

This article will discuss the effects of rising interest rates on dividend stocks.

Why Raise Interest Rates

As investors, it is important to understand the dynamics behind these interest rate increases. It’s beneficial to know not just when interest rates are increasing, but why.

Interest rate increases are a method to provide future economic stimulus. Note the key word future. High interest rates are not actually beneficial to the economy in a direct sense, since they increase the cost of borrowing for companies and individuals. This reduces business investment and personal consumption.

Rather, the advantage of high interest rates is that they allow for interest rates to be lowered at some point in the future. The act of lowering interest rates spurs economic growth, which is why raising interest rates is like ‘banking away’ future economic stimulus.

The 2008-2009 financial crisis provides a prime example of using interest rate cuts for economic stimulus. The Federal Reserve reduced interest rates to rock-bottom levels, where they have remained ever since.

Source: U.S. Federal Reserve

Given the current signs of strength in the U.S. economy, the Federal Reserve is hiking rates to make sure they will have economic stimulus for the next (inevitable) recession.

The Relationship Between Interest Rates and Dividend Stocks

This article will discuss the relationship between interest rates and dividend stocks in two different regards: at the security level and at the business level.

First, the business level. Generally speaking, high interest rates are bad for most companies because it increases the cost of borrowing. Companies with more debt will understandably be effected more than companies with low debt, all else being equal.

That’s why it’s important to monitor debt-related financial metrics when researching potential investments.

There are certain companies within particular industries that will actually benefit from increasing interest rates. These will be discussed in more detail later in this article.

Next I will consider the effect of rising interest rates on dividend stocks at the security level.

The most noticeable effect of interest rates is their relationship with the market’s price-to-earnings ratio. These two variables have an inverse relationship – meaning that as interest rates increase, the market’s price-to-earnings ratio (and price) will decrease.

Of all securities, rising interest rates will hurt bonds the most. This is because all of a bond’s investment returns come from interest payments and rising interest rates mean that more attractive fixed income opportunities (as measured by yield to maturity) will arise.

Leave A Comment