Inflation has been trending lower this year, but the Federal Reserve still appears on track to hike rates again before the year is out.

Fed funds futures this morning are pricing in an 82% probability that the central bank will lift its target rate to a 1.25%-to-1.50% range from the current 1.0%-to-1.25%, based on CME data. A quarter-point rise would be a relatively trivial change. But with inflation holding well below the Fed’s 2% target lately, plans for another hike have become a controversial topic.

Yesterday’s release of minutes from the latest policy meeting highlights the Fed’s internal debate on how to interpret the soft inflation numbers.

On balance, participants continued to forecast that PCE price inflation would stabilize around the Committee’s 2 percent objective over the medium term. However, several noted that in preparing their projections for this meeting, they had taken on board the likelihood that convergence to the Committee’s symmetric 2 percent inflation objective might take somewhat longer than they anticipated earlier.

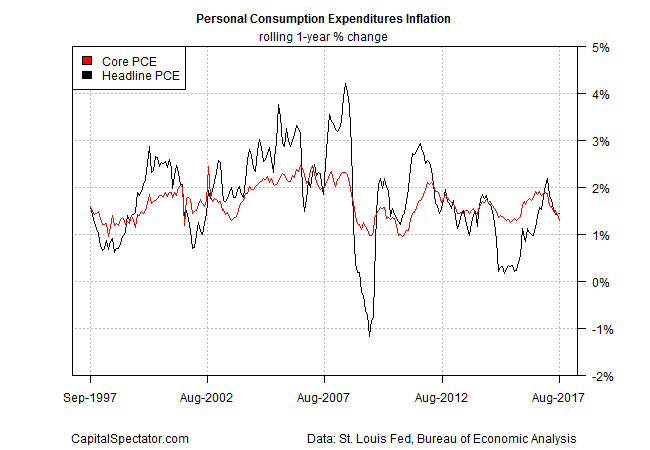

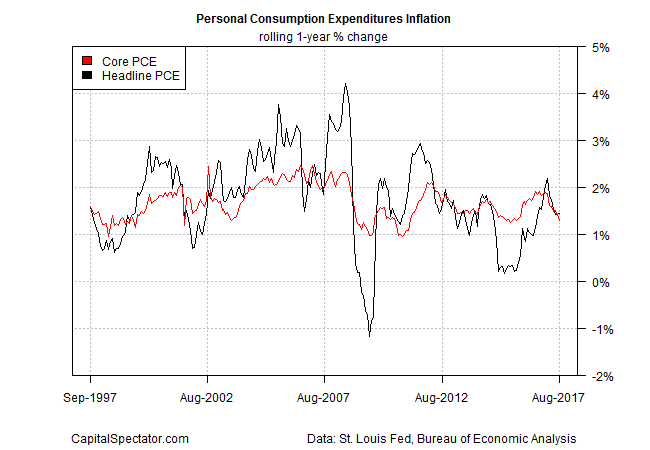

Recent history certainly leaves the doves with ammunition for promoting a go-slow approach to rate hikes. Core inflation based on personal consumption expenditures, which is on the Fed’s short list for key measure of pricing pressure, fell to a 1.3% year-over-year pace in August – the softest gain in a year-and-a-half.

But if the downside bias in core PCE is a reason for delaying rate hikes, at least one Fed official isn’t drinking that Kool-Aid. San Francisco Federal Reserve Bank President John Williams yesterday said he anticipates another round of tighter policy this year and three more hikes in 2018.

For analysts who argue that the economy is strong enough to warrant higher rates and inflation will soon heat up, Exhibit A is the recent increase in wage growth. The annual change for average hourly earnings for workers in the private sector ticked up to 2.9% in September – the highest since 2009. By some accounts, this is a sign that soft inflation is set to rebound in the months ahead.

Leave A Comment