Following up from yesterday’s nod toward monetary policy irrationality, the “relevant” markets today continue to profess their concurrence with it all categorized in that manner. I’m not just critiquing the readings of economists at the Fed and their conditional responses, I’m stating unequivocally that the entire affair, and all in it, has been reduced to pure farce. That starts squarely with the idea that the Federal Reserve, the nation’s deputized monetary agent, has any idea, let alone control, about money and money markets; dollar or “dollar.”

Trading today only furthers that thought as everyone, or at least the “right” people, now perceives December 17 as the final “liftoff” and “exit.” How I ended yesterday seems quite appropriate to open commentary today:

And so it is in that context that all this makes perfect sense; the Federal Reserve will target a money rate that nobody uses in order to project a story in which nobody believes so that economists can call this stunted, decrepit recovery a full one.

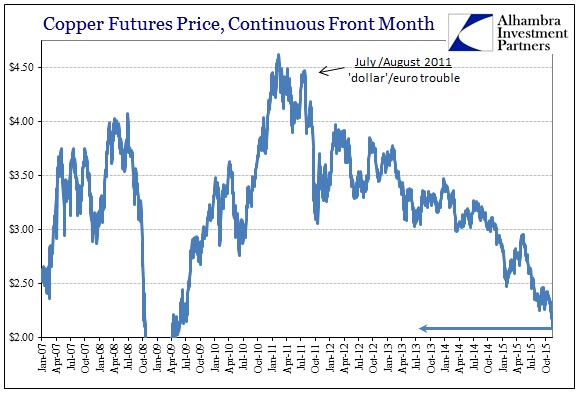

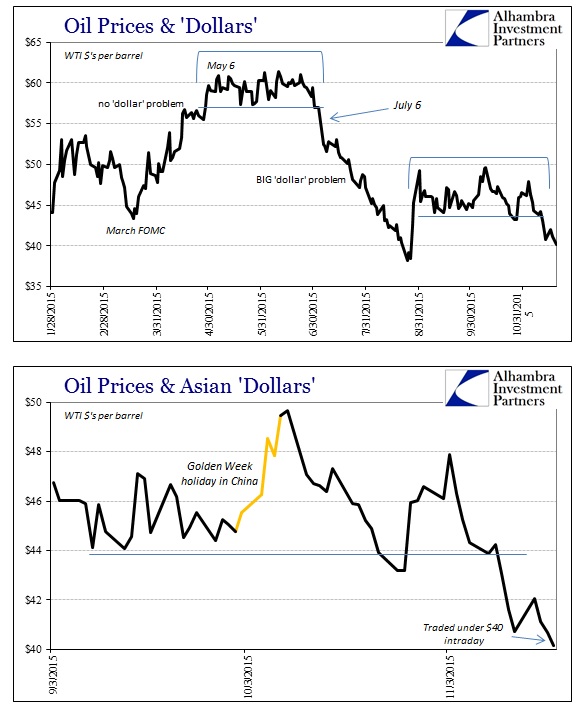

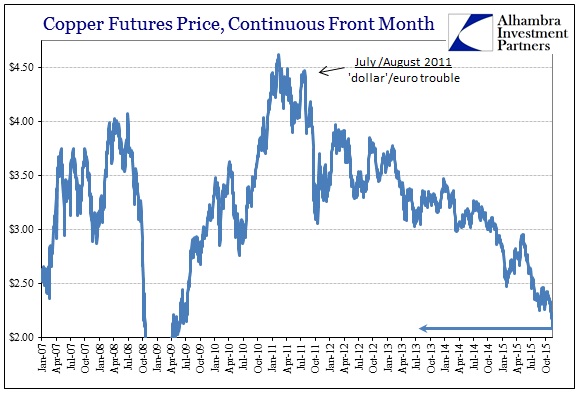

That is no interpretation on any account. Start with oil and copper, among other commodities. If the federal funds rate’s only job is to project economic confidence, copper trading below $2.08 again today and WTI trading below $40 again today grabs nothing but failure in that regard. Small wonder, too, given that the fundamentals of each are simply atrocious, having been so for now more than a year. This cannot be “transitory” factors, as true markets, where prices actually clear actual material (or don’t, as in US crude), are wrestling with exactly the same negativity right now as when the same FOMC story was told the first time.

Oil didn’t believe it then and doesn’t believe it now; it can’t, there is simply too much black gold sitting around demanding someone actually take a look at demand. The media remains full of commentary about gluts and OPEC supply without so much as a peep about even the possibility that demand not only surrendered late last year but hasn’t even started an actual retrace since. Instead, given domestic production, it quite easily appears as if oil demand is following the path set out by the “dollar” down, up and back down again.

Leave A Comment