After a sharp decline in the stock market last week, investors were once again awakened to the reality that stocks are called risk assets for a reason… sometimes they go down. The reason why stock investors have been well compensated over the years, is because they have to put up with these types of volatile events from time to time. Nonetheless, I know the financial media will be quick to dwell on all the negative aspects of last week’s action. However lets take a look at the good news.

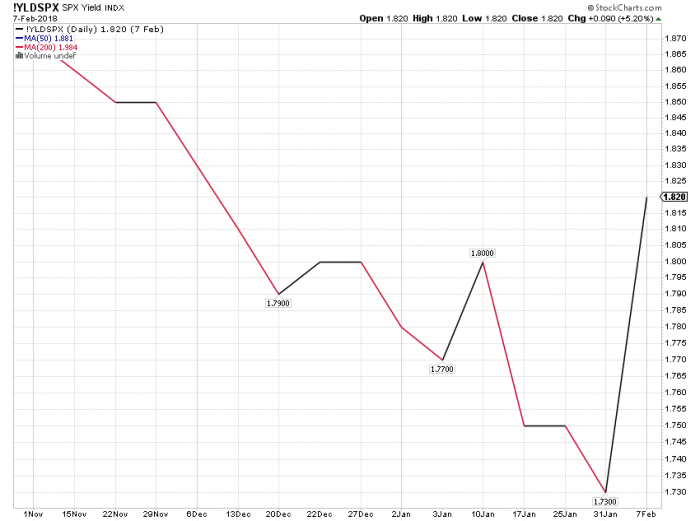

Dividend yields have an inverted relationship to price. As the price of a stock or index (S&P 500) rises, the amount of the dividend (in percentage terms) decreases. And vice versa.

The chart above is the dividend yield on the S&P 500 index. We hit a low of 1.73% as the market topped out in January. After the decline, the dividend yield has increased to 1.82, a 5% increase.

2.Valuations have gotten cheaper

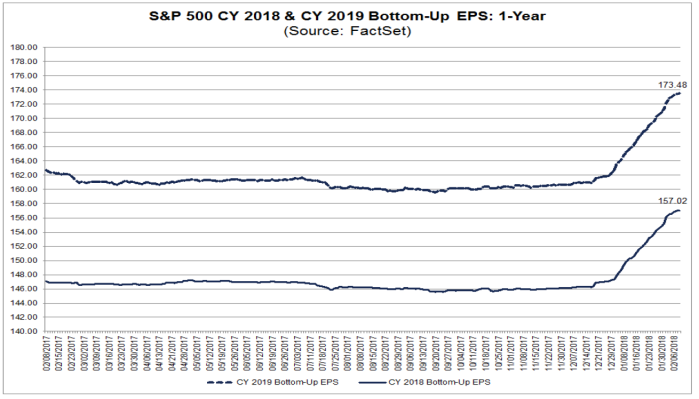

Earnings Per Share (EPS) projections for the S&P 500 companies in 2018 and 2019 have risen sharply in the last two months. The 2018 estimates were for $146 per share in December and are now $157.02 per share. An increase of about 7.5%. The 2018 earnings growth estimates are nearing 20%.

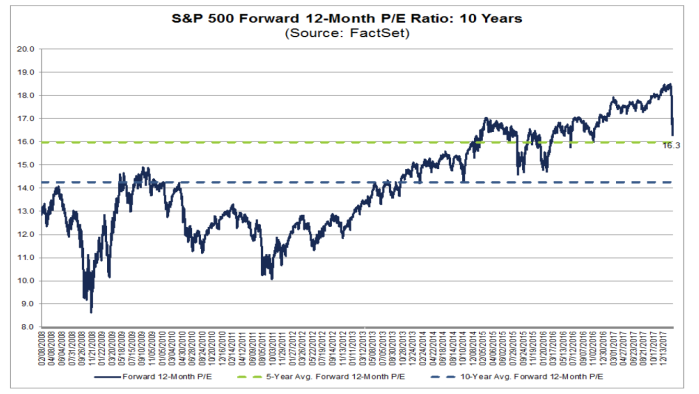

So the increase in the earnings estimates coupled with the decline in the price of the index has culminated in a decrease in the valuation investors are paying for those earnings. Before the decline investors were paying almost 19x 2018 earnings. Now investors paying 16.3x for 2018 earnings, which is closer to the historical average. Especially given the low inflation, low interest rate environment we are in.

Investors are paying 16.3x forward earnings when earnings growth is projected to be close to 20% for the year. And interest rates are still below 3%, at least for now. That’s a pretty enticing offer.

Leave A Comment