I thought the following quote from Janet Yellen’s Q&A at the University Of Michigan this week was interesting regarding the lessons I thought were learned from the financial crisis.

“First, we supervise banking organizations and some other financial enterprises to make sure that they operate in a safe and sound fashion. Second, we monitor potential threats to financial stability. We certainly don’t want to have another financial crisis and we want to redress threats in the environment that could lead to one. We had a system in which banking organizations were not monitoring and controlling risk appropriately. They had too much capital and were overleveraged.”

Silly me.

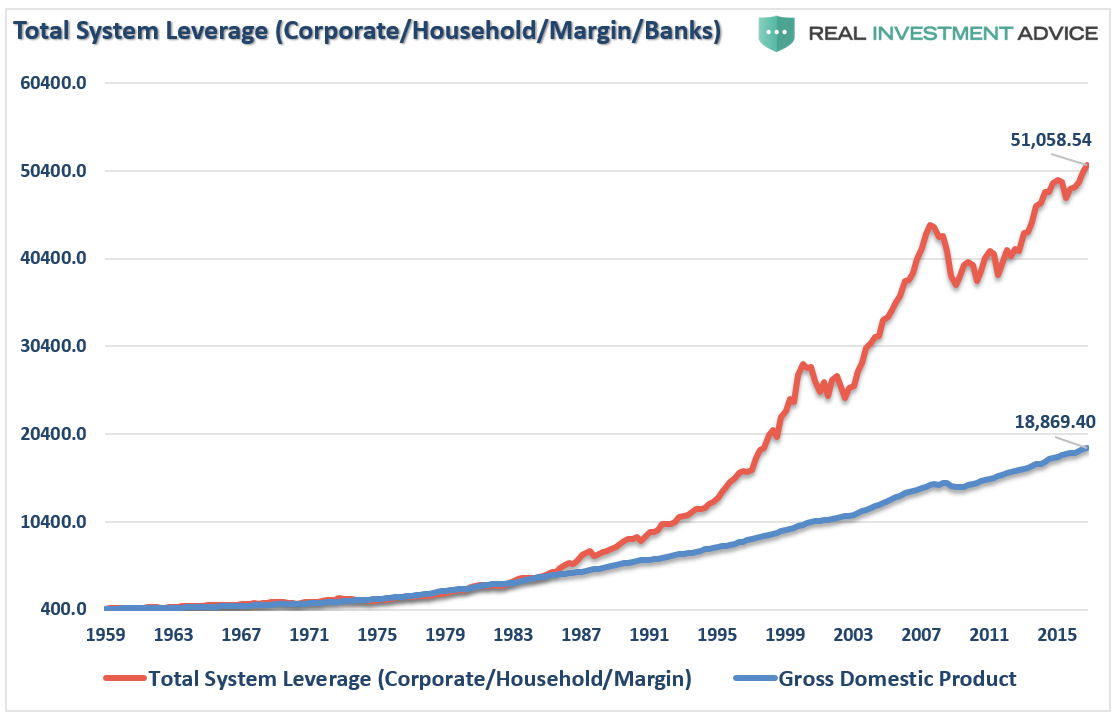

While talk is cheap, the reality is the Federal Reserve fostered another surge in leverage by promoting and maintaining “accommodative” policies for far too long. The chart below is the aggregate of corporate, consumer, margin and banking debt in billions. I have excluded governmental debt so we can focus on the leverage in the economy. I have added GDP for comparative purposes.

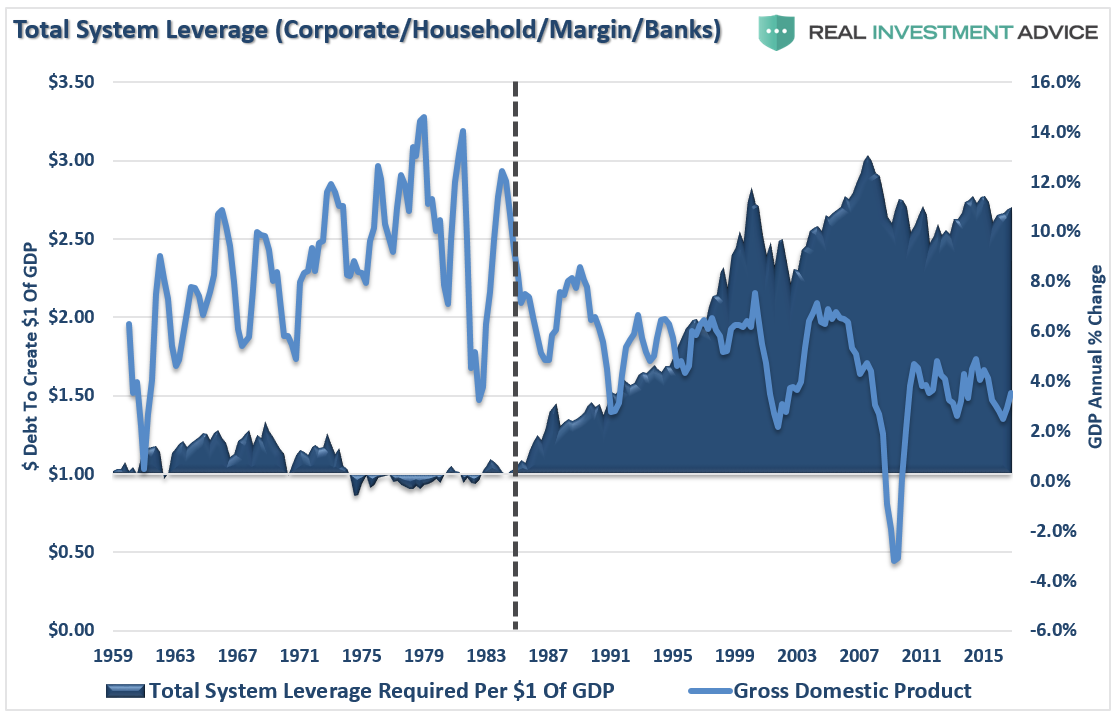

It is worth noting that from 1959 to 1983, it required roughly $1 of debt to create $1 of economic activity. However, as I have discussed previously, the deregulation of the financial sector, combined with falling interest rates, led to a debt explosion. As shown below this debt explosion, which allowed for an excessive standard of living, has led to the long-term deterioration in economic growth rates.

If we add governmental debt, student loan debt, and entitlements into the equation, the problem gets far worse.

However, the point I want to address here is the level of debt in the system which has once again reached new records since the financial crisis.

What could possibly go wrong this time?

There is an inherent belief that corporate and bank balance sheets are in much better shape today than they were in 2007. While I will not argue that banks are indeed on better footing, the repeal of FASB Rule 157 allowed banks to “mark assets to fantasy,” which vastly improved their balance sheet health.

The question that should be asked of Ms. Yellen is simply:

“After trillions in various bailouts of the financial system, and claims the ‘health’ of the financial system is good, why does FASB Rule 157 still remain repealed?”

The answer is simple. The “health” of the financial system may not be as strong as advertised.

But I digress.

As debt levels increase, the servicing of that debt diverts capital from productive investment. Furthermore, the use of debt as it relates to “current” consumption, which is 70% of economic growth, is “future” consumption denied.

Leave A Comment