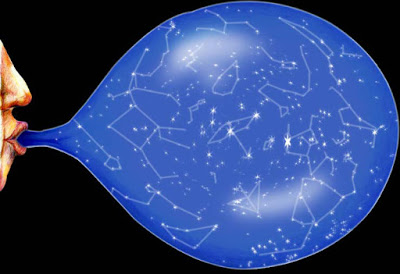

Inflation Over Estimated?

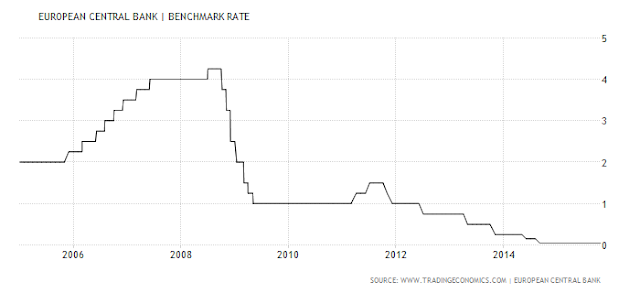

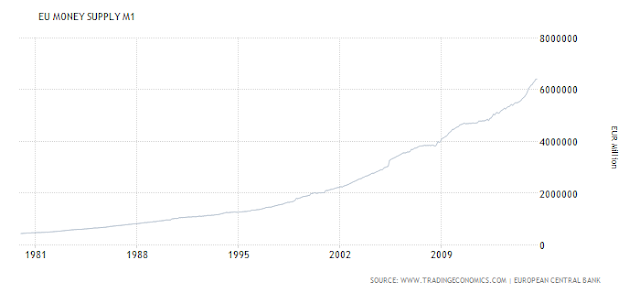

I was watching a little of the ECB press conference after their policy meeting and a reporter asked why inflation is such a bad thing for Europe and European consumers. Mario Draghi gave a canned response, but the real interesting moment came when an individual sitting to his left on the ECB panel opened his mike up and wanted to speak about inflation. I thought this was a little odd, and it became stranger by the moment. He really went out of his way to point out some obscure economic study that showed that US inflation was overestimated, and that actually US inflation was actually negative according to this recent study.

Central Bankers & Research Objectivity

The first question is what does US Inflation have to do with the ECB`s decision to add more stimulus to the European economy, and what does it have to do with European inflation?

I guess the inference is that even in the US where the economy is the relative strongest house on the block so to speak, that there is even underlying deflation in the world`s strongest performing economy.

But is sure seemed to point out that Central Bankers are not objective data driven, independent academics seeking the truth regarding economics, but rather have a goal ahead of time, and look for any type of data to support said agenda.

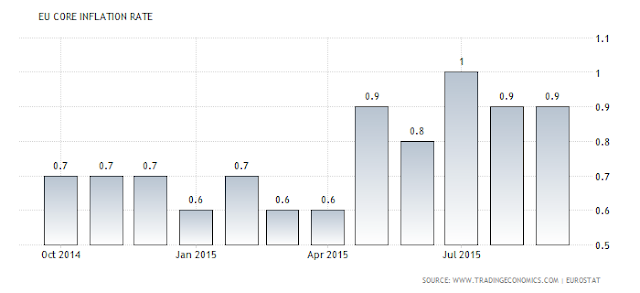

Most of the studies actually show that inflation is under reported and this is the first time I have come across someone citing the opposite conclusion regarding inflation reporting.

Gas Savings Eaten Up Fast by Increasing Healthcare, Food & Housing Expenses

This is rather intuitive as well, energy and commodities have collapsed due to the oversupply of these markets, but really that is the one area which makes the overall inflation numbers appear lower than most feel in their everyday living experiences.

For example, the cost of renting or home ownership has been rising steadily the past 16 months, and will continue to do so over the projected near term future. Healthcare costs continue to rise each year despite a nationalized healthcare plan. Even those lucky enough to have great company backed healthcare plans are paying higher deductibles and more out of pocket health expenses each year. Education and tuition costs continue to rise above the average rate of inflation. Entertainment expenses from movies, eating out, cable and internet fees, mobile phone plans, gym memberships, and travel accommodations are all experiencing inflationary pressures. Automobile prices sure aren`t deflationary as anyone who has purchased a new car recently realizes. Shoot even HOA fees are rising year after year! And those pesky real estate taxes sure seem to go up well above the stated rate of 2% inflation that is the Fed`s desired target rate. Ironic isn`t it that if inflation could only hit that 2% mark they would be raising interest rates in a heartbeat. Like when it was well over 2% 16 months ago, and the Federal Reserve not only wasn`t raising rates, but was still buying bonds each month via QE 3?

Leave A Comment