In February 2000, the FOMC quietly switched from the CPI to the PCE Deflator as its standard for inflation measurement. There were various technical reasons for doing so, including the CPI’s employment of a geometric mean basis (which was in 2015 finally altered to a Constant Elasticity of Substitution formula). But it was one phrase that in hindsight did the Fed no favors, as it explicitly cited the expected fruits of the PCE Deflator’s methodology which would “avoid some of the upward bias associated with the fixed-weight nature of the CPI.”

I am not a conspiracy theorist by any means, but there are times when you have to shake your head as these economists lack even a modicum of self-awareness. The central bank has been given a legal mandate for price stability, so the average American might wonder why that central bank is allowed to choose the measure most inherently stable (and low). At the very least, it seems like a conflict of interest, one among so many.

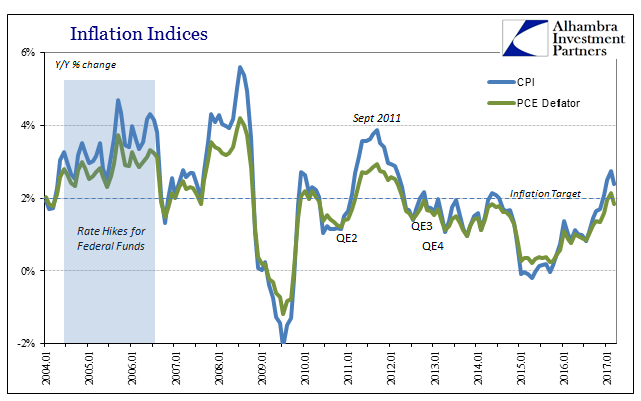

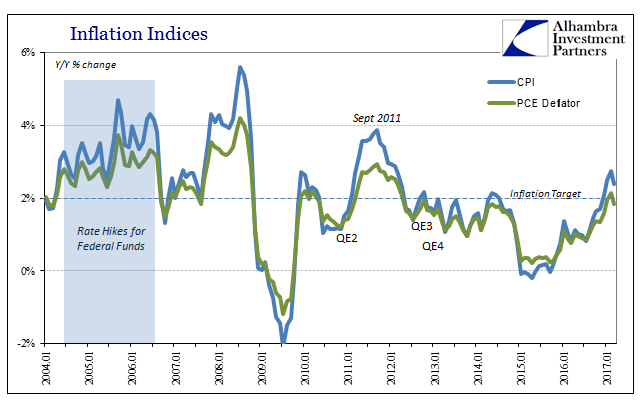

In that regard, the last five years have been almost fitting. The PCE Deflator has, as expected, avoided the higher beta tendencies of the CPI and in both directions. For that, it has remained stable, alright, but stable below target no matter what the Fed does with its own balance sheet. I hope the irony is not lost on them, especially as it was oil prices that “achieved” what they could not despite considerable expenditure on their part.

For the first time in 58 months, the Deflator measured above 2% inflation for February 2017. It was heralded as a triumph of burgeoning improvement by the media, but for all the wrong reasons. To start with, the calculated inflation rate was barely above 2% despite what was an average 80% increase in oil prices during that month. That immediately proposed the anchor for the index remained quite a bit less than target still. Thus, without further oil price acceleration there would be nothing keeping the rate even near the mandate.

Leave A Comment