Photo Credit: Mike Mozart

General Mills, Inc. (GIS) Consumer Staples – Food Products | Reports December 17, Before Market Opens

Key Takeaways

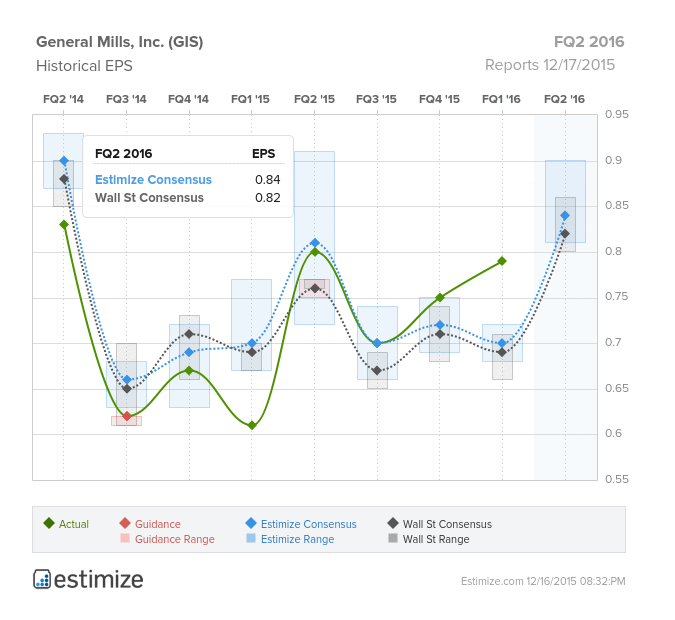

General Mills is a leading multinational manufacturer and marketer of consumer goods set to report FQ2 2016 earnings December 17. Best known for it’s wide array of cereal, General Mills’ portfolio also includes, Progresso Soup, Chex Mix and Totino Pizza rolls, amongst many other recognizable brands. After beating estimates and surprising investors in FQ1 2016, it is widely expected that the processed food company will continue to deliver positive earnings growth. For the second fiscal quarter 2016, the Estimize consensus calls for revenue of $4.596 billion and EPS of $0.82, significantly higher than Wall Street’s estimate of $4.596 billion in revenue. Compared to the prior quarter this represents an increase in revenue and EPS of 9.22% and 6.33% respectively. Amid a weak food industry and a shift in consumer preferences toward healthier options, General Mills has made strides to maintain the performance of its current products while also driving growth in organic and natural offerings.

Like many of its peers, General Mills continues to shift its offerings to better align with consumer trends that have shaped the current market. Despite natural and organic food representing a small portion of its revenue, General Mills is in fact the third largest organic manufacturer in the United States today. Their recent announcement to reduce sodium by 20% supports the long-term efforts of promoting health and nutrition. While General Mills is playing catch up to health trends, its product diversification, financial stability and extensive distribution network will ensure it can evolve and remain relevant. Amongst other things, General Mills has made sound cost cutting moves to strategically position itself to expand health initiatives. Given the company’s strengths, shareholders should continue to view General Mills as a reliable investment going into its recent earnings report.

Leave A Comment