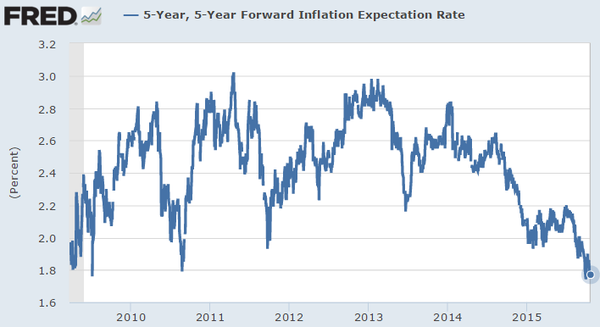

Futures-implied probability of a 2015 rate hike in the United States remains below 40%. Some market participants have all but dismissed this possibility as they look at weak global growth as well as soft inflation and inflation expectations in the US. Some have even suggested that the next policy move by the Fed should be a rate cut into negative territory.

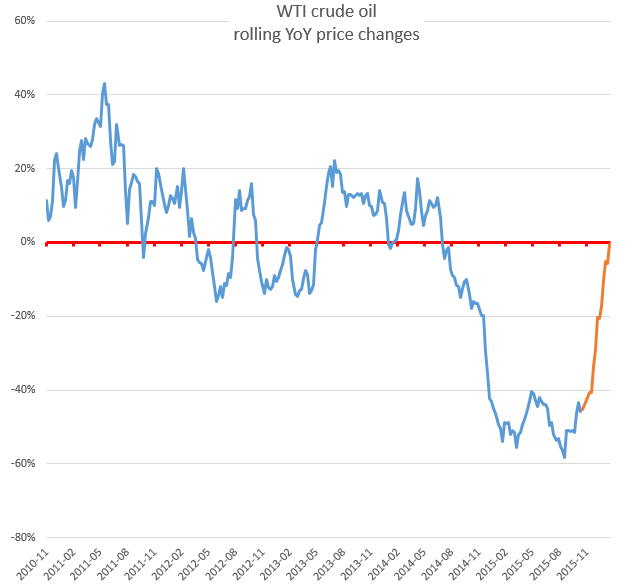

However global growth and US inflation expectations may not necessarily the main focus at the Fed. For example, numerous economists continue viewing the energy market crash as having only a transient impact in inflation. The logic here is that if we freeze crude oil prices at current levels (below $45/bbl), by early 2016 the year-on-year change will be around zero.

And a number of energy analysts expect crude oil prices to begin gradually rising going forward. To many forecasters this would imply that crude oil price weakness will no longer have such a severe impact on the rate of inflation.

Of course some would say that low fuel prices have not yet fully made their way through the economy – suggesting that the disinflationary pressures will persist for some time. Similarly some argue that the full effects of the dollar rally in the first half of 2015 are yet to be fully felt.

Nevertheless many economists view the headline inflation approaching the core measures by early 2016, with the core CPI turning higher as well. Moreover, a slew of recent US economic reports suggests that while the US economy probably slowed in the second half due to dollar strength and weakness abroad, the effect may be transient.

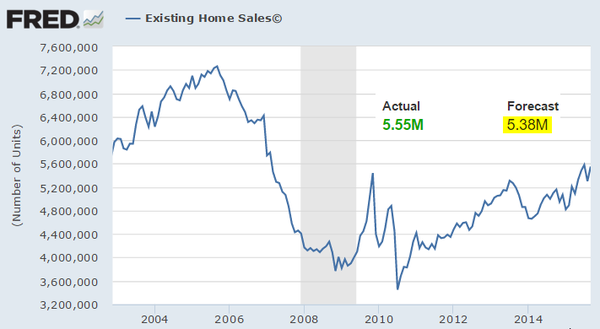

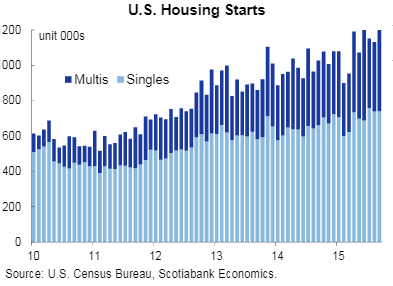

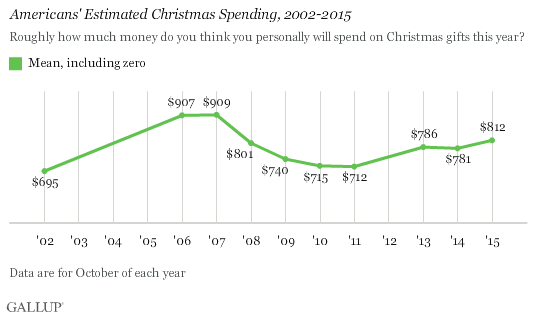

The housing market for example continues to recover and consumer sentiment and spending does not seem to be impacted by the recent market volatility.

Leave A Comment