The food and beverage industry enjoys several qualities that make it a good source of dividend growth stocks.

First, is the simple reality that everyone has to eat and drink. The strongest food and beverage companies capitalize on this, through steady demand and pricing power.

Their incredible stability lets them pay dividends, and increase their payouts each year. This article will discuss the five top dividend stocks in the food and beverage industry, each of which has a long history of dividend growth.

Three of the five stocks on this list are Dividend Aristocrats, a group of 51 companies in the S&P 500 Index with 25+ consecutive years of dividend increases.

The other two stocks on this list are Dividend Achievers, which have recorded 10+ consecutive years of dividend increases.

Food and beverage companies are also well-equipped to continue raising dividends each year, even if another recession hits.

All five are best-in-class food and beverage stocks, with strong brands and reliable dividend payouts.

Food & Beverage Stock #5: General Mills (GIS)

Dividend Yield: 3.4%

General Mills, which has paid a dividend for 117 years. It has increased its dividend for more than 10 years in a row. The current yield of 3.4% is well above the 2% average yield for the S&P 500.

The combination of over 100 years and a 3%+ dividend yield, places General Mills on Sure Dividend’s list of blue-chip stocks.

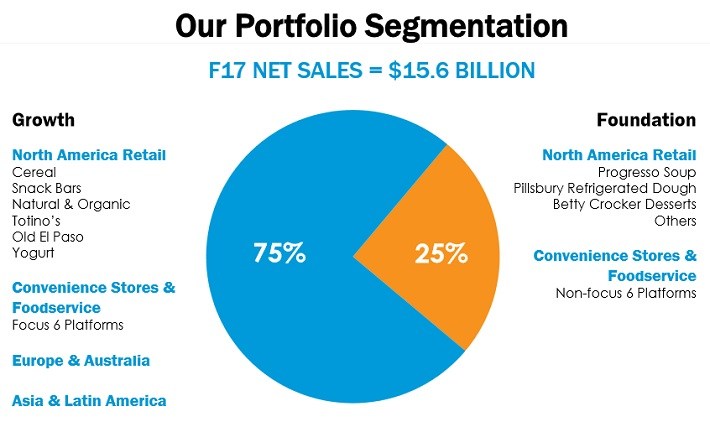

General Mills generates over $15 billion in sales. Its core brands lead their respective categories, especially when it comes to cereal. General Mills possesses the #2 market share in cereal, with 3 of the top 5 cereal brands in the U.S.

Source: Investor Day Presentation, page 9

Changing consumer behavior is one of the constant themes in the food and beverage industry today. Consumer spending is shifting from packaged, shelf-stable goods, toward for fresher alternatives such as natural foods, and organics.

Snacks are still growing, but at the expense of items like cereal. General Mills’ net sales fell by 6% in fiscal 2017. Some of this was due to the strong U.S. dollar. But, even after excluding currency, sales declined by 4% for the year. Organic sales declined 5% in the core North America retail segment.

These changes in consumer appetites prompted General Mills to switch focus. It is steering investment to its highest perceived growth opportunities, which include snack bars, Haagen-Dazs, and Old El Paso. Haagen-Dazs is a top performer, particularly in the emerging markets.

Source: Investor Day Presentation, page 16

General Mills management expects mid-single digit growth from Haagen-Dazs over the next three years.

Growth in these products will help offset weakness in cereal. Earnings will also increase from cost cuts. Cost reductions drove a 6% adjusted earnings-per-share increase in fiscal 2017.

In fiscal 2018, net sales are expected to decline 1%-2%, but adjusted earnings-per-share are expected to rise 1%-2%.

The stock appears to be slightly undervalued. General Mills had adjusted earnings-per-share of $3.08 in fiscal 2017. This means the stock has a price-to-earnings ratio of 18.7.

The stock trades at more than a 20% discount to the S&P 500 Index valuation. The stock might be cheap, given its brand strength and earnings growth potential.

Food & Beverage Stock #4: The Coca-Cola Company (KO)

Dividend Yield: 3.3%

Coca-Cola has one of the longest streaks of dividend increases in the entire stock market. It has increased its dividend for 55 years in a row. Not only is Coca-Cola a Dividend Aristocrat, but it is also a Dividend King. The Dividend Kings are a small group of just 19 stocks, with 50+ consecutive years of dividend increases.

Leave A Comment