Video Length: 00:05:30

I happened to tune into CNBC while grabbing a bite to eat and CNBC welcomed Adam Longson, Morgan Stanley Head of Energy Commodity Research. Adam`s analysis of the oil market is so bad on so many levels that I hardly know where to start. But if this is what traders at Morgan Stanley are basing their trades on then no wonder Morgan Stanley`s stock has been getting killed, and talent is leaving this firm like rats on a sinking ship. The analysis is so bad, but what can you expect from a CPA, yes this guy is a licensed CPA, that I have a mind to short Morgan Stanley`s stock. If this kind of analysis and talent is representative of what the best and brightest at Morgan Stanley are up to these days ( I thought they were about sales revolving around money management like the old Merrill Lynch model) but whatever, then their earning`s report is going to be really bad. In fairness to Adam he is also a Chartered Financial Analyst besides being an accountant (that just sounds funny) but in looking at his resume a) it is no wonder he put this crap out b) he is way over his head as an energy research analyst.

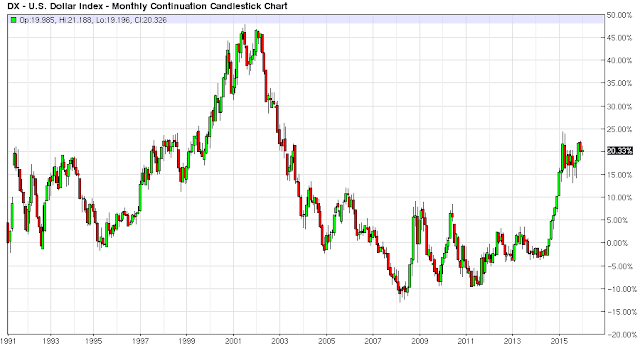

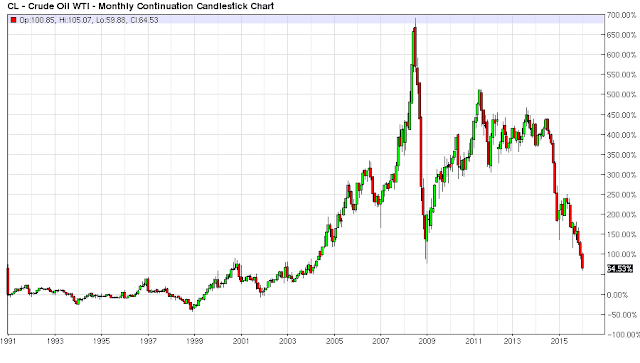

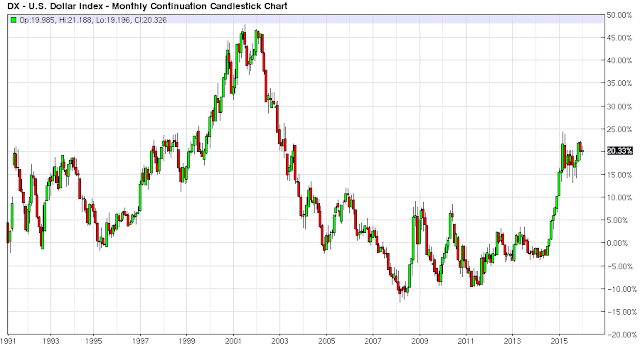

I refuse to do his job for him, so I am not going to show him why he is incorrect in his analysis. He just isn`t that experienced in trading or analyzing what drives the oil markets. It just goes to show how bad talent levels are at many investment banks these days. All the good talent works for hedge funds these days, or has gone out on their own as individual traders trading their own money with much less headaches. This analysis is so flawed, and just plain wrong that it is a fire able offense in my book. Moreover, if no one at MS realizes why and how this is just flawed analysis, then that is a serious problem at Morgan Stanley. This has nothing to do with where the price of oil is going, it very well could go to $20 a barrel, but it sure the hell will not be because of a strong dollar. I will post two charts and let the reader and Adam figure out why his analysis is so flawed. He might want to start with that “Food Analogy” and ask why that is a flawed analogy between the comparisons he is trying to make with the oil market. This comes down to a basic understanding of logical differences. The funny thing is that I am sure Adam worked on this Food Analogy, as these are great in the analyst community for selling crap to clients, but no one at MS called him out on the fallacy inherent in his analogy. The bottom line is given this oil analysis Adam Longson has no business being an energy analyst.

Leave A Comment